We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Each month, the United States Department of Labor released a report called the Nonfarm Payroll. This fundamental indicator (the term for a report or release) measures the change in employment in the United States for the previous month, excluding the farming sector.

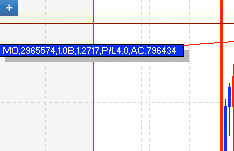

For the release in this example, the figures came in above expectations of economists. As a result the Dollar strengthened that day as the data suggested that the labour sector of the US economy was doing better than expected.

As you can see, following the report’s release, there was a huge surge as price moved downward from around 1.2770 to 1.2680, a move of 90 points, or ‘pips’ in forex lingo. There aren’t any other candles in the surrounding time period where price moves as much as the 30 minutes after the release of the Nonfarm Employment data.

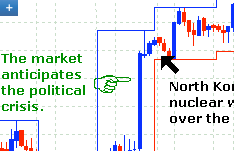

This chart shows the reaction of the currency market to a geopolitical crisis. In this crisis, North Korea detonated a nuclear weapon in a test of their nuclear capabilities. How a particular currency will respond to geopolitical dangers depends on many factors. Here, the Japanese Yen suffers because it is a neighbour of North Korea and because the two countries have tense relations they are opposed to each other militarily. Obviously, any attack by North Korea on Japan would damage the Japanese economy. When traders got wind of these developments on, they sold the Yen and bought the Dollar. The price changed around 100 pips, meaning the amount of Yen you needed to get one Dollar went up from 117.90 to 118.90. Or, in other words it now cost one more Yen to buy a US Dollar.

North Korea’s nuclear test is a political event that has an effect on the foreign currency market

Since a nuclear test by North Korea is very Yen negative, the Dollar would do better since it’s the opposite currency in this particular pair. The Yen’s weakness withstanding, the Dollar would have still gained on this geopolitical event because it is considered a ‘safe haven’ currency. During times of danger, investors will move their money out of riskier investments and put them into more stable ones. The US attracts those investors that want to park their money in a safer economy.

During times of international conflict, investors are wary of risk so move their money to safe haven currencies, impacting their values on the Forex market

The US’s ‘safe haven’ status doesn’t always work in times of danger in the world. If there is a geopolitical event that directly affects the United States, such as a terrorist attack, or something less immediate, such as military posturing against a state like Iran investors might sell the Dollar. Traders would be worried that the threats might come to action and there would be a war between the two countries. A war with Iran weakens the Dollar because the US economy is so tied to the oil market, of which a large proportion travels through the Persian Gulf. A military engagement against Iran would disrupt oil deliveries and cause hardship for the American economy in other ways. So, as we mentioned before, there are many factors to consider during a political crisis to see what effect it will have on a particular currency.

.png)

Support: 1-888-992-3836 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions