Apple Posts Revenue Growth on Strong AirPod, App Sales

January 28 2020 - 5:05PM

Dow Jones News

By Tripp Mickle

Apple Inc. posted record revenue and a return to profit growth

in its latest quarter behind strong sales of iPhones, apps and its

AirPod wireless earbuds.

The tech giant reported revenue rose in the December quarter to

$91.82 billion from $84.31 billion, driven by blossoming sales of

devices and services connected to the iPhone such as smartwatches

and streaming-TV subscriptions. Sales of iPhones, which account for

more than half of its revenue, rose to $55.96 billion from $51.98

billion.

Net income rose to $22.24 billion from $19.97 billion, its first

quarterly profit increase in more than a year and a record. The

company said per-share earnings in the latest quarter were $4.99.

Analysts surveyed by FactSet expected earnings of $4.54 a

share.

Apple said it expects revenue in the current period between $63

billion and $67K billion. Analysts projected revenue of $62.41

billion, according to FactSet.

Shares of Apple, which have more than doubled over the past

year, rose 3% in after-hours trading.

The results marked a return to form for Apple, which for the

first time last year failed to report a quarterly revenue record

since the iPhone's 2007 release. A year ago, it slashed its

guidance for the first time in more than 15 years. An iPhone sales

slump and an economic downturn in China led to its first decline in

fiscal year revenue since 2016.

The company sought to snap out of a slowdown in its smartphone

business by introducing new services and accessories that would

appeal to owners of the 900 million iPhones world-wide.

The growth in both those businesses has energized investors and

helped the company's stock to one of the biggest one-year rallies

in history. Apple has added more than $725 billion to its value,

well above the value of Facebook Inc.

"This is continued evidence that services can transform the

company," said Mark Stoeckle, chief executive of Adams Funds, a

Baltimore-based investment firm with $2.5 billion under management

that counts Apple among its largest holdings.

"[Apple CEO] Tim Cook has brought out products that have not

only added to revenue and earnings but done so within an ecosystem

where that cash cow -- the iPhone business -- has been the

beneficiary," Mr. Stoeckle said.

(END) Dow Jones Newswires

January 28, 2020 16:50 ET (21:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

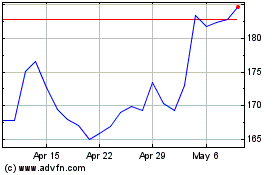

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

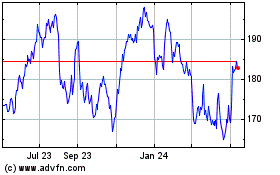

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024