Canadian Dollar Advances After BoC Holds Rate Steady

September 04 2019 - 6:57AM

RTTF2

The Canadian dollar was higher against its major counterparts in

the European session on Wednesday, after the Bank of Canada kept

its key rate unchanged, while suggesting that the current level of

policy stimulus remained appropriate.

The BoC maintained its benchmark rate at 1.75 percent, as

expected.

The economy is operating close to potential and inflation is on

target, the bank said in its accompanying statement.

But escalating trade conflicts and its impact are taking a toll

on the global and Canadian economies.

"As the Bank works to update its projection in light of incoming

data, Governing Council will pay particular attention to global

developments and their impact on the outlook for Canadian growth

and inflation."

The currency showed mixed trading against its major opponents in

the Asian session. While it rose against the greenback and the yen,

it held steady against the euro. Against the aussie, it

declined.

The loonie climbed to a 5-day high of 1.3268 against the

greenback, from a low of 1.3345 it touched at 6:30 pm ET. Next key

resistance for the loonie is likely seen around the 1.30 level.

After falling to a 5-day low of 1.4692 against the euro at 9:45

am ET, the loonie appreciated to 1.4613 following the decision. The

loonie is seen finding resistance around the 1.44 level.

Data from IHS Markit showed that the euro area private sector

logged a moderate growth in August, though the pace of expansion

improved slightly more than initially estimated.

The final composite output index rose to 51.9 in August from

51.5 in July. The flash score was 51.8. Any reading above 50

indicates expansion in the sector.

The loonie reached as high as 80.07 against the yen, marking a

5-day high. This followed a low of 79.33 seen at 7:45 pm ET. The

loonie is likely to find resistance around the 83.5 level.

The latest survey from Jibun Bank showed that Japan services

sector activity accelerated in August, with a PMI score of

53.3.

That's up from 51.8 in July and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

Having declined to near a 4-week low of 0.9051 against the

aussie at 9:45 am ET, the loonie rebounded to 0.9008. Should the

loonie rises further, 0.88 is seen as its next resistance

level.

Data from the Australian Bureau of Statistics showed that

Australia's gross domestic product gained a seasonally adjusted 0.5

percent on quarter in the second quarter of 2019.

That was in line with expectations and unchanged from the

previous three months following an upward revision from +0.4

percent.

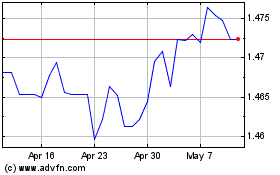

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024