Profit Rises at United Even as 737 MAX Grounding Crimps Extra Flights -- 2nd Update

July 16 2019 - 7:05PM

Dow Jones News

By Doug Cameron

United Airlines Holdings Inc. said it is trimming extra flying

this year because of the grounding of Boeing Co.'s 737 MAX, though

the nation's second-largest carrier by traffic still expects

profits to climb.

Chicago-based United on Tuesday reported forecast-beating

quarterly profit, reflecting strong domestic demand. But it now

expects to only boost flying capacity by up to 4% this year as it

rejiggers schedules to cover the grounding of the MAX.

The MAX grounding has removed dozens of jets from the U.S.

airline fleet as regulators continue their appraisal of proposed

software fixes in the wake of two fatal crashes that government and

industry officials have said could keep the plane out of service

until next year.

United didn't detail the cost of the MAX grounding. The airline

has received 14 of the jets, with another 16 due to arrive by the

end of the year and 28 more in 2020.

The airline said it has agreed to buy 19 used Boeing 737-700

jets that are due to arrive in December, continuing its recent

addition of cheaper, older planes to give it more flexibility to

add flights. The jets are smaller than the 737 MAX 9 model it is

currently unable to use and not intended as substitutes.

Late MAX deliveries are piling up at Boeing facilities for

carriers including United, American Airlines Group Inc. and

Southwest Airlines Co. "We believe the timing of U.S. airlines

catching up to original MAX delivery schedule will likely take

15-18 months," Raymond James analysts wrote in a client note.

Despite the MAX scheduling challenge, United reported

stronger-than-expected earnings for the sixth quarter in a row and

raised its full-year guidance. United's shares rose in after-hours

trading after gaining nearly 3% during Tuesday's regular

session.

Strong domestic demand for flights and fuel prices that are 5%

lower than a year ago are driving industry profits. Delta Air Lines

Inc., which doesn't operate the MAX, last week raised its full-year

profit outlook, helped also by the diminished capacity of

competitors stemming from grounded MAX jets and additional flying

on behalf of alliance partners such as Canada's WestJet.

United reported net profit for the second quarter rose to $1.05

billion from $683 million a year earlier. Earnings per share

climbed to $4.02 from $2.48. Excluding one-off charges, earnings

climbed to $4.21, ahead of the $4.11 consensus among analysts

polled by FactSet. The airline raised the low end of its full-year

per-share profit guidance by 50 cents to $10.50 and maintained the

top end of its range at $12, though costs excluding fuel are now

expected to rise by 0.5% to 1% from a year earlier versus its April

guidance for expenses to remain flat.

Capacity is expected to grow by 3% to 4% this year, down a

percentage point from United's guidance in April, when it cut

planned flying this year by the same amount.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

July 16, 2019 18:50 ET (22:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

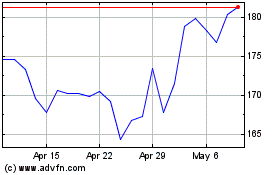

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2024 to May 2024

Boeing (NYSE:BA)

Historical Stock Chart

From May 2023 to May 2024