Strong U.S. Retail Sales Growth Buoys Dollar

June 14 2019 - 5:33AM

RTTF2

The U.S. dollar was notably higher against its major opponents

in the European session on Friday, as a data showed that nation's

retail sales growth improved in May, reducing some of fears about a

slowdown in economic growth.

Data from the Commerce Department showed that retail sales

climbed by 0.5 percent in May after rising by an upwardly revised

0.3 percent in April.

Economists had expected retail sales to increase by 0.6 percent

compared to the 0.2 percent drop originally reported for the

previous month.

Excluding a rebound in sales by motor vehicle and parts dealers,

retail sales still rose by 0.5 percent in May, matching the

upwardly revised increase in April.

Ex-auto sales had been expected to rise by 0.3 percent compared

to the 0.1 percent uptick originally reported for the previous

month.

Investors await a two-day policy meeting by the Federal Reserve

next week, which warp up with a decision on Wednesday.

The press conference by Fed Chair Jerome Powell is likely to

grab attention for clues about rate cut amid slowing global growth

due to rising trade tensions with China.

The currency was steady against its major counterparts in the

Asian session.

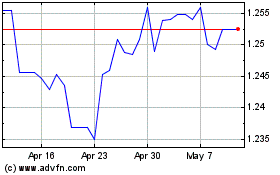

The greenback advanced to 1.2624 against the pound, its biggest

since June 3. The greenback may test resistance around the 1.24

level, if it rises again.

The greenback that ended Thursday's trading at 1.1276 against

the euro spiked up to an 8-day high of 1.1240. The currency is seen

finding resistance around the 1.10 region.

Data from Destatis showed that Germany's wholesale price

inflation slowed in May after accelerating in April.

Wholesale prices advanced 1.6 percent year-on-year in May,

slower than the April's 2.1 percent increase. Having dropped to a

session's low of 108.16 against the yen at 3:30 am ET, the

greenback reversed direction and rose to 108.45. The greenback is

poised to find resistance around the 111.00 region.

Final data from the Ministry of Economy, Trade and Industry

showed that Japan's industrial production grew moderately in April,

as initially estimated.

Industrial production rose 0.6 percent month-on-month in April,

in line with estimate, reversing a 0.6 percent fall in March.

The U.S. currency firmed to an 11-day high of 0.9979 against the

franc, up from Thursday's closing value of 0.9938. The greenback is

likely to find resistance around the 1.01 region.

The greenback appreciated to a 2-week high of 0.6513 against the

kiwi and a 3-week high of 0.6884 against the aussie, compared to

yesterday's closing values of 0.6567 and 0.6915, respectively. On

the upside, 0.64 and 0.67 are likely seen as the next resistance

levels for the greenback against the kiwi and the aussie,

respectively.

The American unit reached as high as 1.3355 against the loonie,

setting a weekly high. At yesterday's close, the pair was worth

1.3326. Should the greenback rises further, 1.35 is likely seen as

its next resistance level.

The University of Michigan's preliminary consumer sentiment

index for June is set for release shortly.

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024