EUROPE MARKETS: Europe Stocks Stumble As Weak Oil Prices, Trade Worries Weigh On Investors

June 12 2019 - 8:58AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Axel Springer, Dassault Systemes, oil names active

European stocks fell Wednesday, tracking losses across global

markets as oil prices fell and investors were filled with fresh

uncertainty over a potential trade deal between the U.S. and

China.

How are markets performing?

The Stoxx 600 fell 0.5% to 378.74, after a 0.9% gain on

Tuesday.

In Germany, the DAX fell 0.6% to 12,086.16, after a 1.3% climb

Tuesday.

The U.K.'s FTSE 100 dropped 0.7% to 7,340, on the heels of a

0.5% gain.

Elsewhere, France's CAC 40 fell 0.7%, nearly reversing a 0.8%

gain Tuesday, while Italy's FTSE MIB dropped 0.7%, from a 0.9% gain

the prior session.

The pound was flat at $1.2737, while the euro slipped 0.1% to $1.132.

What's moving the markets?

Renewed concerns over a U.S.-China trade deal damped enthusiasm

for global equities after the Dow Jones Industrial Average broke a

6-session winning streak. Trade-deal optimism had been building

ahead of a Group of 20 meeting at the end of the month, but U.S.

President Donald Trump admitted Tuesday he was "holding up" a deal

(http://www.marketwatch.com/story/trump-i-have-no-interest-in-trade-deal-until-china-reverses-its-stance-2019-06-11)

between the countries.

Oil was the biggest losing sector in Europe, as heavily weighed

companies tracked sharp falls in U.S. and Brent crude prices , down

over 2% each

(http://www.marketwatch.com/story/crude-prices-slide-on-signs-of-rising-us-inventories-2019-06-12).

That was after a report showing higher U.S. inventories and ahead

of a key government report on supplies data due later. Total SA

(FP.FR) fell nearly 2%, while BP PLC (BP.LN) (BP.LN)

As well, investors were watching unrest in Hong Kong where

thousands of protesters surrounded government headquarters on

Wednesday, forcing the delay of a legislative session

(http://www.marketwatch.com/story/renewed-protests-in-hong-kong-as-government-debates-extradition-bill-2019-06-11)

to vote on a bill that would allow criminal suspects in Hong Kong

to be sent for trial in mainland China. Police opened up with tear

gas and water cannons to try to disperse those protesters, and Hong

Kong stocks tumbled amid the unrest.

Which stocks are active?

Axel Springer (SPR.XE) surged 11%, making for a top gainer in

the Stoxx Europe 600 index, after private equity group KKR (KKR)

announced a $7.7 billion takeover offer

(http://www.marketwatch.com/story/kkr-to-buy-axel-springer-for-68-billion-euros-2019-06-12)

for the German media group.

Dassault Systemes SA (DSY.FR) shares fell 1.6% after announcing

a deal to buy U.S. health care software group Medidata Solutions

Inc. (MDSO) in a $5.8 billion deal

(http://www.marketwatch.com/story/dassault-offers-to-buy-medidata-in-58-billion-deal-2019-06-12).

Shares of Spanish retail group Inditex SA (ITX.MC) fell 1% after

posting a better-than-expected net profit rise, but sales that came

in below expectations

(http://www.marketwatch.com/story/inditex-profit-sales-rise-2019-06-12).

Banks were also under pressure across the board, with HSBC

Holdings PLC (HSBA.LN) (HSBA.LN) dropping 1% and Banco Santander SA

(SAN.MC) fell 1%.

(END) Dow Jones Newswires

June 12, 2019 08:43 ET (12:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

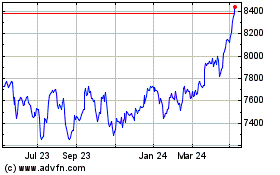

FTSE 100

Index Chart

From Apr 2024 to May 2024

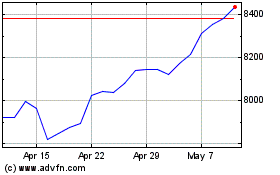

FTSE 100

Index Chart

From May 2023 to May 2024