Old Mutual Limited Operational Update for the 3 months ended 31.3.19 (1664A)

May 24 2019 - 8:00AM

UK Regulatory

TIDMOMU

RNS Number : 1664A

Old Mutual Limited

24 May 2019

Old Mutual Limited

Incorporated in the Republic of South Africa

Registration number: 2017/235138/06

ISIN: ZAE000255360

LEI: 213800MON84ZWWPQCN47

JSE Share Code: OMU

NSX Share Code: OMM

MSE Share Code: OMU

ZSE Share Code: OMU

("Old Mutual" or "Company" or "Group")

Ref 25/19

24 May 2019

OPERATING UPDATE FOR THE 3 MONTHS ENDED 31 MARCH 2019

Operating environment

In South Africa, our largest market, the economic environment

remains challenging with low economic growth and rising fuel prices

expected to place further pressure on our customers' disposable

income levels. During the first 3 months of 2019, the JSE delivered

its best first quarter since 2007 with the ALSI rising 7.1%

reflecting the strong performance of resource and industrial

sectors. Whilst equity markets in South Africa are up from December

2018 the absolute levels are still below where they were in the

first quarter last year, placing pressure on earnings.

In Zimbabwe, the equity markets remain volatile, decreasing 17%

since the beginning of the year. Inflation reached 67% at the end

of March 2019, reflecting the increased cost of imports. Our

customers' in this market are impacted by the rising inflation and

the resultant impact thereof on their disposable income levels. On

20 February 2019 the Reserve Bank of Zimbabwe announced that RTGS

had been recognised as an official currency and established an

inter-bank foreign exchange market to allow trading between RTGS

and other currencies. At the end of March 2019, the RTGS was

trading at 3.01 to the USD dollar.

Financial performance

Despite the challenging economic environment the business

continues to attract new business from customers. Life APE sales of

R2,945 million were 4% ahead of prior year largely due to higher

recurring premium SuperFund sales in Old Mutual Corporate.

Gross flows of R39.3 billion were 10% behind prior year due to

lower flows in Wealth and Investments and lower single premium

sales in Old Mutual Corporate. NCCF in the first quarter of 2019

was negative (-R1.1 billion) mainly reflecting lower net flows in

Wealth and Investments.

Funds under Management was up from December 2018 at R1,084

billion in line with equity market returns in South Africa.

Corporate activity

The sale of our business in Latin America completed on 1 April

2019, with gross proceeds of R4.4 billion ($308 million) received.

The associated costs are expected to be approximately $40 million.

We expect to realise an IFRS profit on the disposal of this

business.

We have repurchased shares under the share repurchase programme

announced on 11 March 2019. The price at which shares were

repurchased ranged from 2,222 to 2,313 cents. The shares

repurchased will be cancelled and revert to authorised but unissued

share capital. Following the shares repurchased to date the Group

will have 4,831,264,848 ordinary shares in issue.

Outlook

Our RFO target of GDP + 2% CAGR will become increasingly

challenging to achieve over the three year target period due to

negative RFO growth in 2018. If poor economic conditions persist

during 2019 in our key markets, this will further challenge the

achievement of this target. We remain on track to deliver on our

other medium term targets.

We anticipate making a further operating update ahead of the

publication of our 2019 Interim Results announcement on 2 September

2019.

This update for the 3 months ended 31 March 2019 has not been

audited or reviewed by the Group's auditors.

Sandton

Sponsors

JSE Merrill Lynch South Africa (Pty) Limited

Namibia PSG Wealth Management (Namibia) (Proprietary)

Limited

Zimbabwe Imara Capital Zimbabwe plc

Malawi Stockbrokers Malawi Limited

Enquiries

Investor Relations

Sizwe Ndlovu T: +27 (0)11 217 1163

Head of Investor Relations E: tndlovu6@oldmutual.com

Communications

Tabby Tsengiwe T: +27 (11) 217 1953

Head of Communications M: +27 (0)60 547 4947

E: ttsengiwe@oldmutual.com

Notes to Editors

About Old Mutual Limited

Old Mutual is a premium African financial services group that

offers a broad spectrum of financial solutions to retail and

corporate customers across key markets segments in 14 countries.

Old Mutual's primary operations are in South Africa and the rest of

Africa, and it has a niche business in Asia. With over 170 years of

heritage across sub-Saharan Africa, we are a crucial part of the

communities we serve and broader society on the continent.

For further information on Old Mutual, and its underlying

businesses, please visit the corporate website at

www.oldmutual.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDLLFVLERISFIA

(END) Dow Jones Newswires

May 24, 2019 08:00 ET (12:00 GMT)

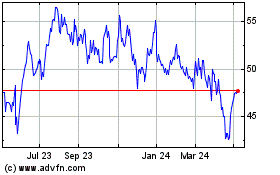

Old Mutual (LSE:OMU)

Historical Stock Chart

From Mar 2024 to Apr 2024

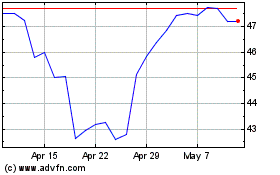

Old Mutual (LSE:OMU)

Historical Stock Chart

From Apr 2023 to Apr 2024