Total revenue of $95.9 million increases 34%

year-over-year

License revenue of $51.3 million increases 33%

year-over-year

GAAP operating income of $13.6 million and

non-GAAP operating income of $25.5 million

Record net cash provided by operating

activities of $45.9 million increases 39% year-over-year

CyberArk, (NASDAQ: CYBR), the global leader in privileged

access security, today announced strong financial results for

the first quarter ended March 31, 2019.

“We were pleased to deliver results ahead of all guided metrics

as well as record cash flow from operations,” said Udi Mokady,

CyberArk Chairman and CEO. “Our results demonstrate that Privileged

Access Security is the foundation of comprehensive cybersecurity

programs. As the leader in the market, organizations of all sizes

and industries are turning to CyberArk as a trusted advisor to

secure digital transformation and cloud migration strategies. As we

look at the remainder of 2019 and beyond, we are committed to

delivering sustainable growth, strong profitability and continual

innovation to secure privileged access across on-premises, hybrid

and cloud environments.”

Financial Highlights for the First Quarter Ended March 31,

2019

Revenue:

- Total revenue was $95.9 million, up 34%

compared with the first quarter of 2018.

- License revenue was $51.3 million, up

33% compared with the first quarter of 2018.

- Maintenance and professional services

revenue was $44.7 million, up 34% compared with the first quarter

of 2018.

Operating Income:

- GAAP operating income was $13.6

million, compared to $4.0 million in the first quarter of 2018.

Non-GAAP operating income was $25.5 million, compared to $12.6

million in the first quarter of 2018.

Net Income:

- GAAP net income was $13.7 million, or

$0.36 per diluted share, compared to GAAP net income of $6.4

million, or $0.18 per diluted share, in the first quarter of 2018.

Non-GAAP net income was $21.5 million, or $0.56 per diluted share,

compared to $11.8 million, or $0.32 per diluted share, in the first

quarter of 2018.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP gross margin, operating income

and net income for the three months ended March 31, 2019 and 2018.

An explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

Balance Sheet and Net Cash Provided by

Operating Activities:

- As of March 31, 2019, CyberArk had

$509.7 million in cash, cash equivalents, marketable securities and

short-term deposits. This compares with $344.2 million in cash,

cash equivalents, marketable securities and short-term deposits as

of March 31, 2018 and $451.2 million as of December 31, 2018.

- As of March 31, 2019, total deferred

revenue was $171.1 million, a 43% increase from $119.5 million at

March 31, 2018.

- During the first quarter of 2019, the

Company generated $45.9 million in net cash provided by operating

activities, a 39% increase compared to $33.1 million in the first

quarter of 2018.

Business Outlook

Based on information available as of May 14, 2019, CyberArk is

issuing guidance as indicated below:

Second Quarter 2019:

- Total revenue between $96.0 million and

$98.0 million, representing 24% to 26% year-over-year growth.

- Non-GAAP operating income between $22.0

million and $23.5 million.

- Non-GAAP net income per share between

of $0.45 and $0.48 per diluted share.

- Assumes 39.1 million weighted average

diluted shares.

Full Year 2019:

- Total revenue between $415.0 million

and $419.0 million, representing 21% to 22% year-over-year

growth.

- Non-GAAP operating income between

$100.5 million and $103.5 million.

- Non-GAAP net income per share between

$2.10 and $2.16 per diluted share.

- Assumes 38.9 million weighted average

diluted shares.

Conference Call Information

CyberArk will host a conference call today, Tuesday, May 14,

2019 at 8:30 a.m. Eastern Time (ET) to discuss the company’s first

quarter financial results and its business outlook. To access this

call, dial +1 877-823-7693 (U.S.) or +1 647-689-4543

(international). The conference ID is 5885529. Additionally, a live

webcast of the conference call will be available via the “Investor

Relations” section of the company’s website at

www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 800-585-8367 (U.S.) or +1 416-621-4642

(international). The replay pass code is 5885529. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in privileged

access security, a critical layer of IT security to protect data,

infrastructure and assets across the enterprise, in the cloud and

throughout the DevOps pipeline. CyberArk delivers the industry’s

most complete solution to reduce risk created by privileged

credentials and secrets. The company is trusted by the world’s

leading organizations, including more than 50 percent of the

Fortune 500, to protect against external attackers and malicious

insiders. A global company, CyberArk is headquartered in Petach

Tikva, Israel, with U.S. headquarters located in Newton, Mass. The

company also has offices throughout the Americas, EMEA, Asia

Pacific and Japan. To learn more about CyberArk, visit

www.cyberark.com, read the CyberArk blogs or follow on Twitter via

@CyberArk, LinkedIn or Facebook.

Copyright © 2019 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating income and non-GAAP net income is helpful to our

investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to gross profit, operating income or net

income or any other performance measures derived in accordance with

GAAP.

- Non-GAAP gross profit is calculated as

gross profit excluding share-based compensation expense and

amortization of intangible assets related to acquisitions.

- Non-GAAP operating income is calculated

as operating income excluding share-based compensation expense,

acquisition related expenses and amortization of intangible assets

related to acquisitions.

- Non-GAAP net income is calculated as

net income excluding share-based compensation expense, acquisition

related expenses, amortization of intangible assets related to

acquisitions and the tax effect of the non-GAAP adjustments.

The Company believes that providing non-GAAP financial measures

that exclude share-based compensation, acquisition related

expenses, amortization of intangible assets related to acquisitions

and the tax effect of the non-GAAP adjustments allows for more

meaningful comparisons of its period to period operating results.

Share-based compensation expense has been and will continue to be

for the foreseeable future, a significant recurring expense in the

Company’s business and an important part of the compensation

provided to its employees. Share based compensation expense has

varying available valuation methodologies, subjective assumptions

and a variety of equity instruments that can impact a company’s

non-cash expense. The Company believes that expenses related to its

acquisitions, amortization of intangible assets related to

acquisitions and the tax effect of the non-GAAP adjustments do not

reflect the performance of its core business and impact

period-to-period comparability.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to acquisitions

and the tax effect of the non-GAAP adjustments. A reconciliation of

the non-GAAP financial measures guidance to the corresponding GAAP

measures is not available on a forward-looking basis due to the

uncertainty regarding, and the potential variability and

significance of, the amounts of share-based compensation expense,

amortization of intangible assets related to acquisitions, and the

non-recurring expenses that are excluded from the guidance.

Accordingly, a reconciliation of the non-GAAP financial measures

guidance to the corresponding GAAP measures for future periods is

not available without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, performance or achievements to differ significantly

from the results, performance or achievements expressed or implied

by such forward-looking statements. Important factors that could

cause or contribute to such differences include risks relating to:

changes in the rapidly evolving cyber threat landscape; failure to

effectively manage growth; potential near-term declines in our

operating and net profit margins and our revenue growth rate; real

or perceived shortcomings, defects or vulnerabilities in the

Company’s solutions or internal network system, or the failure of

the Company’s customers or channel partners to correctly implement

the Company’s solutions; fluctuations in quarterly results of

operations; the inability to acquire new customers or sell

additional products and services to existing customers; competition

from a wide variety of IT security vendors; the Company’s ability

to successfully integrate recent and or future acquisitions; and

other factors discussed under the heading “Risk Factors” in the

Company’s most recent annual report on Form 20-F filed with the

Securities and Exchange Commission. Forward-looking statements in

this release are made pursuant to the safe harbor provisions

contained in the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are made only as of the date

hereof, and the Company undertakes no obligation to update or

revise the forward-looking statements, whether as a result of new

information, future events or otherwise.

CYBERARK SOFTWARE

LTD.Consolidated Statements of OperationsU.S. dollars

in thousands (except per share data)(Unaudited)

Three Months Ended March 31, 2018

2019 Revenues: License $ 38,494 $ 51,284 Maintenance

and professional services 33,289 44,651 Total

revenues 71,783 95,935 Cost of revenues: License 2,397 2,588

Maintenance and professional services 8,891 10,979

Total cost of revenues 11,288 13,567 Gross profit

60,495 82,368 Operating expenses: Research and

development 12,984 16,331 Sales and marketing 34,582 41,505 General

and administrative 8,899 10,905 Total operating

expenses 56,465 68,741 Operating income 4,030 13,627

Financial income, net 1,841 1,421

Income before taxes on income 5,871 15,048 Tax benefit

(taxes on income) 550 (1,371) Net income $

6,421 $ 13,677 Basic net income per ordinary share $

0.18 $ 0.37 Diluted net income per ordinary share $ 0.18 $ 0.36

Shares used in computing net income per ordinary shares,

basic 35,454,102 37,046,472 Shares used in computing

net income per ordinary shares, diluted 36,464,230

38,440,461

Share-based Compensation

Expense: Three Months Ended March 31,

2018 2019 Cost of revenues $ 655 $ 957

Research and development 1,504 2,307 Sales and marketing 2,417

3,685 General and administrative 2,347 3,303

Total share-based compensation expense $ 6,923 $ 10,252

CYBERARK SOFTWARE

LTD.Consolidated Balance SheetsU.S. dollars in

thousands(Unaudited)

December 31, March 31, 2018 2019

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 260,636 $ 301,902 Short-term bank deposits 106,399

109,285 Marketable securities 59,948 55,161 Trade receivables

48,431 34,517 Prepaid expenses and other current assets

6,349 9,800 Total current assets 481,763

510,665 LONG-TERM ASSETS: Property and equipment, net

15,120 15,325 Intangible assets, net 14,732 13,144 Goodwill 82,400

82,400 Marketable securities 24,261 43,376 Other long-term assets

31,863 59,341 Deferred tax asset 23,481 24,618

Total long-term assets 191,857 238,204

TOTAL ASSETS $ 673,620 $ 748,869

LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Trade payables

$ 4,924 $ 4,893 Employees and payroll accruals 32,853 25,898

Accrued expenses and other current liabilities 13,271 17,798

Deferred revenues 92,375 104,506 Total current

liabilities 143,423 153,095 LONG-TERM

LIABILITIES: Deferred revenues 57,159 66,565 Other long-term

liabilities 6,268 27,113 Total long-term

liabilities 63,427 93,678

TOTAL

LIABILITIES 206,850 246,773 SHAREHOLDERS'

EQUITY: Ordinary shares of NIS 0.01 par value 95 96 Additional

paid-in capital 303,900 324,457 Accumulated other comprehensive

income (loss) (939) 152 Retained earnings 163,714

177,391 Total shareholders' equity 466,770

502,096

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $

673,620 $ 748,869

CYBERARK SOFTWARE

LTD.Consolidated Statements of Cash FlowsU.S. dollars

in thousands(Unaudited)

Three Months Ended March 31, 2018

2019 Cash flows from operating activities: Net

income $ 6,421 $ 13,677 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 2,194 2,778 Amortization of premium and accretion of

discount on marketable securities, net 101 (10 ) Share-based

compensation 6,923 10,252 Deferred income taxes, net (1,272 )

(1,311 ) Decrease in trade receivables 6,927 13,914 Increase in

prepaid expenses and other current and long-term assets (2,248 )

(5,347 ) Increase in trade payables 3,191 871 Increase in

short-term and long-term deferred revenues 17,760 21,537 Decrease

in employees and payroll accruals (3,003 ) (11,797 )

Increase (decrease) in accrued expenses

and other current and long-term liabilities

(3,922 ) 1,294 Net cash provided by

operating activities 33,072 45,858

Cash flows from investing activities: Proceeds from

(Investment in) short and long term deposits 9,254 (2,913 )

Investment in marketable securities (9,933 ) (35,768 ) Proceeds

from maturities of marketable securities 7,423 21,651 Purchase of

property and equipment (2,502 ) (2,297 ) Payments for business

acquisitions, net of cash acquired (18,488 ) -

Net cash used in investing activities (14,246 )

(19,327 )

Cash flows from financing activities:

Proceeds from withholding tax related to employee stock plans -

4,842 Proceeds from exercise of stock options 1,942

9,918 Net cash provided by financing

activities 1,942 14,760 Increase

in cash, cash equivalents and restricted cash 20,768 41,291

Cash, cash equivalents and restricted cash at the beginning of the

period $ 162,521 $ 261,883 Cash, cash

equivalents and restricted cash at the end of the period $ 183,289

$ 303,174

CYBERARK SOFTWARE

LTD.Reconciliation of GAAP Measures to Non-GAAP

MeasuresU.S. dollars in thousands (except per share

data)(Unaudited) Reconciliation

of Gross Profit to Non-GAAP Gross Profit: Three

Months Ended March 31, 2018 2019

Gross profit $ 60,495 $ 82,368 Plus: Share-based compensation -

Maintenance & professional services 655 957 Amortization of

intangible assets - License 1,230 1,444

Non-GAAP gross profit $ 62,380 $ 84,769

Reconciliation of Operating Income

to Non-GAAP Operating Income: Three Months Ended

March 31, 2018 2019 Operating

income $ 4,030 $ 13,627 Plus: Share-based compensation 6,923 10,252

Amortization of intangible assets - Cost of revenues 1,230 1,444

Amortization of intangible assets - Sales and marketing 198 144

Acquisition related expenses 268 -

Non-GAAP operating income $ 12,649 $ 25,467

Reconciliation of Net Income to Non-GAAP Net Income:

Three Months Ended March 31, 2018

2019 Net income $ 6,421 $ 13,677 Plus:

Share-based compensation 6,923 10,252 Amortization of intangible

assets - Cost of revenues 1,230 1,444 Amortization of intangible

assets - Sales and marketing 198 144 Acquisition related expenses

268 - Taxes on income related to non-GAAP adjustments (3,229

) (4,046 ) Non-GAAP net income $ 11,811 $

21,471 Non-GAAP net income per share Basic $ 0.33

$ 0.58 Diluted $ 0.32 $ 0.56

Weighted average number of shares Basic 35,454,102

37,046,472 Diluted 36,464,230

38,440,461

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190514005465/en/

Investor Contact:Erica SmithCyberArkPhone: +1

617-558-2132ir@cyberark.com

Media Contact:Liz CampbellCyberArkPhone:

+1-617-558-2191press@cyberark.com

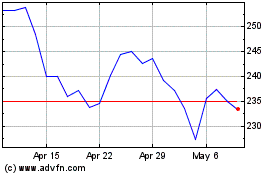

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

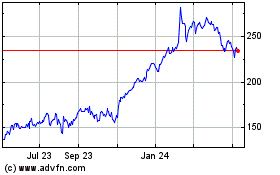

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Apr 2023 to Apr 2024