Euro Firms On Risk Appetite After Trump's Comments

May 14 2019 - 2:13AM

RTTF2

The euro strengthened against its major opponents in the

European session on Tuesday, as sentiment bolstered after U.S.

President Donald Trump said that he was optimistic about resolving

the U.S. trade dispute with China.

"He just got back from China. We'll let you know in about three

or four weeks whether or not it was successful ... but I have a

feeling it's going to be very successful," Trump said, referring to

U.S. Treasury Secretary Steven Mnuchin's recent trade talks in

Beijing.

Final data from Destatis showed that Germany's consumer price

inflation accelerated as initially estimated to its highest level

in five months in April.

Consumer price inflation rose to 2 percent in April from 1.3

percent in March. The rate came in line with the flash estimate

published on April 30. This was the highest rate since November,

when prices were up 2.1 percent.

Meanwhile, survey data from the ZEW-Leibniz Centre for European

Economic Research showed that Germany's economic sentiment weakened

unexpectedly in May.

The economic sentiment index fell to -2.1 in May from +3.1 in

April. The reading was expected to rise to 5.0.

The currency has been trading in a positive territory against

its key counterparts in the Asian session.

The euro advanced to 0.8692 against the pound, its strongest

since March 21. The euro is seen finding resistance around the 0.88

level.

Data from the Office for National Statistics showed that the UK

jobless rate declined in the first quarter to the lowest since

1974, signaling continuing firming of the labor market.

The ILO jobless rate came in at 3.8 percent in the first

quarter, while the rate was expected to remain unchanged at 3.9

percent.

Having dropped to a 4-day low of 1.1220 against the greenback at

5:00 pm ET, the euro bounced off with the pair trading at 1.1244.

The next key resistance for the euro is likely seen around the 1.14

level.

The European currency that closed Monday's trading at 122.65

against the yen edged higher to 123.40. On the upside, 125.00 is

possibly seen as the next resistance level for the euro.

After falling to near a 5-week low of 1.1288 against the franc

at 5:00 pm ET, the euro reversed direction and gained to 1.1330.

Next key resistance for the euro is seen around the 1.15 area.

The euro recovered to 1.7092 against the kiwi, from a low of

1.7045 hit at 10:30 pm ET. If the euro rises further, it may find

resistance around the 1.73 region.

After a brief decline, the euro advanced against the aussie to

1.6196, its highest level since January 4. The euro is poised to

find resistance around the 1.63 level.

On the flip side, the euro showed directionless trading against

the loonie, after touching a session's high of 1.5147 at 6:30 pm

ET. The pair had finished Monday's trading at 1.5122.

Looking ahead, U.S. import and export prices for April are

scheduled for release in the New York session.

At 12:45 pm ET, Federal Reserve Bank of Kansas City President

Esther George will give a speech about the economy at the Economic

Club of Minnesota, in Minneapolis.

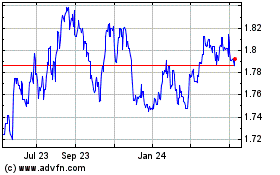

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

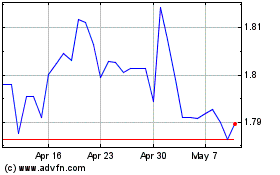

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024