Arcelormittal To Temporarily Reduce Annualised European Primary Steelmaking Production By Three Million Tonnes

May 06 2019 - 3:25AM

Dow Jones News

TIDMMT

Regrettable decision necessary due to combination of weakening demand,

rising imports coupled with insufficient EU trade protection, high

energy costs and rising carbon costs

6 May 2019, 08:55 CET

ArcelorMittal today announces its intention to temporarily idle

production at its steelmaking facilities in Kraków, Poland and

reduce production in Asturias, Spain. In addition, the planned increase

of shipments at ArcelorMittal Italia to a six million tonne annual

run-rate will be slowed down following a decision to optimise cost and

quality over volume in this environment.

Together, these actions will result in a temporary annualised production

reduction of around three million tonnes.

Commenting, Geert van Poelvoorde, CEO, ArcelorMittal Europe -- Flat

Products, said:

"The difficult decision to temporarily reduce our European primary flat

steel production has not been taken lightly. We understand the impact

this has on employees and the local communities and will be working to

ensure social measures are in place to support them during this period.

"These actions reflect the weak demand environment in Europe today, a

situation further compounded by increased imports despite the safeguard

measures introduced by the European Commission. High energy costs and

increasing carbon costs are adding to the tough environment.

"We are engaging with stakeholders to request that the safeguards are

strengthened to prevent a further increase in imports as a result of

continued global overcapacity and a weakening economy in neighbouring

countries including Turkey. We will also continue to make our case for a

green border adjustment to be introduced to ensure that imports into

Europe face the same carbon costs as producers in Europe. The steel

industry in Europe can have a strong future but there must be a level

playing field to ensure that an unfair advantage is not given to

competitors outside the region."

In Kraków, the primary production (blast furnace and steel plant)

will be temporarily idled. The Polish steel market has been particularly

hard hit, due to a near fourfold year-on-year increase in Russian steel

imports in 2018, and among the highest electricity prices in Europe.

In Asturias, primary production will be reduced. Electricity costs are

also very high in Spain, and the southern European market has been hit

by an unprecedented rise in imports from outside the EU.

Despite the introduction of the permanent EU safeguard tariffs in

February 2019 there has been a continued and consistent rise in flat

steel imports into Europe. Flat steel imports into Europe are currently

at record highs, with imports of hot rolled coil up 37 per cent this

year from 2017, on an annualised basis. In addition, the price of carbon

has risen by approximately 230 per cent since the start of 2018, placing

further competitive pressure on European steelmakers. In the EU

Emissions Trading System (ETS), only steel produced in Europe is subject

to a carbon levy. ArcelorMittal has previously called for the

introduction of a green border adjustment whereby steel imported into

Europe has the same standards applied on CO(2) as European produced

steel under the ETS.

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a

presence in 60 countries and an industrial footprint in 19 countries.

Guided by a philosophy to produce safe, sustainable steel, we are the

leading supplier of quality steel in the major global steel markets

including automotive, construction, household appliances and packaging,

with world-class research and development and outstanding distribution

networks.

Through our core values of sustainability, quality and leadership, we

operate responsibly with respect to the health, safety and wellbeing of

our employees, contractors and the communities in which we operate.

For us, steel is the fabric of life, as it is at the heart of the modern

world from railways to cars and washing machines. We are actively

researching and producing steel-based technologies and solutions that

make many of the products and components people use in their everyday

lives more energy efficient.

We are one of the world's five largest producers of iron ore and

metallurgical coal. With a geographically diversified portfolio of iron

ore and coal assets, we are strategically positioned to serve our

network of steel plants and the external global market. While our steel

operations are important customers, our supply to the external market is

increasing as we grow.

In 2018, ArcelorMittal had revenues of $76.0 billion and crude steel

production of 92.5 million metric tonnes, while own iron ore production

reached 58.5 million metric tonnes.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock

exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit:

http://corporate.arcelormittal.com/

Contact information ArcelorMittal

Investor Relations

Europe +44 20 7543 1156

Americas +1 312 899 3985

Retail +44 20 7543 1156

SRI +44 20 7543 1156

Bonds/Credit +33 171 921 026

Contact information ArcelorMittal

Corporate Communications

mailto:press@arcelormittal.com

E-mail: press@arcelormittal.com

--------------------------------

Phone: +4420 7629 7988

ArcelorMittal Corporate Communications

Paul Weigh

ArcelorMittal Europe Communications +44 20 3214 2419

Sophie Evans +44 7825 595849

(END) Dow Jones Newswires

May 06, 2019 03:10 ET (07:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

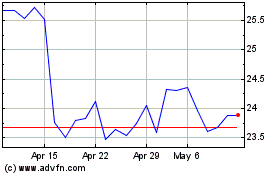

ArcelorMittal (EU:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

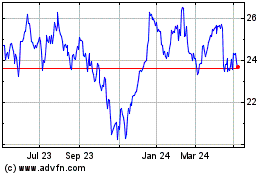

ArcelorMittal (EU:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024