Bayer Faces Shareholder Showdown Over Monsanto Despite Strong Earnings -- 2nd Update

April 25 2019 - 7:29AM

Dow Jones News

By Ruth Bender

BERLIN-- Bayer AG's shares rose over 3% Thursday on

better-than-expected results, giving the company a brief respite

ahead of Friday's potentially unruly shareholder meeting, as

investors grow impatient with the company's legal woes in the

U.S.

The German chemicals and pharmaceuticals company reported an

above-expected rise in adjusted earnings before interest, taxes,

depreciation and amortization and sales, driven mostly by the

integration of Monsanto Co., which it acquired for $63 billion last

year.

But Bayer said the number of lawsuits tying Monsanto's Roundup

weedkillers to cancer rose another 20% since late January. As of

April 11, 13,400 plaintiffs had claimed the weedkillers containing

the chemical glyphosate had given them cancer and other illnesses.

Bayer has so far lost the first two Roundup suits in California. A

third trial is under way there and four more are scheduled to begin

this year in Missouri and Montana.

The Monsanto acquisition was meant to add a strong second leg to

Bayer's midsize pharmaceuticals business. But it has become an

open-ended liability that has chopped off more than a third of the

company's market capitalization and unnerved investors. Some

shareholders are now openly criticizing management for

underestimating the acquisition's legal risks and are expected to

vent their frustration at Friday's annual general meeting in Bonn,

Germany.

"Today, one can't talk of a successful purchase if it brings

such striking legal and reputational risks," said Ingo Speich, head

of corporate governance at Deka, a fund manager that owns roughly

1% of Bayer.

Bayer's position has been that there is overwhelming scientific

evidence that Roundup is safe to use. It is appealing the verdicts

and continues to defend the merits of the Monsanto deal.

But Chief Executive Werner Baumann and his fellow directors will

face a grilling on Friday about the merits of the deal and how they

are working to contain the damage, according to several large

shareholders.

Some--including BlackRock Inc., which holds more than 5% of

voting rights--plan to reject or abstain on a motion to endorse the

board's actions for 2018, according to a person familiar with the

matter. Some proxy advisories, as well as Deka, have called on

shareholders to express their dissatisfaction by voting against

management.

While such a no-confidence vote is largely symbolic, it is seen

as an important gauge of investor confidence. A strong rebuke could

put Mr. Baumann under increased pressure to resolve the crisis

engulfing the company.

Axel von Werder, who runs the Berlin Center of Corporate

Governance at Berlin's Technical University, said "if a significant

number of shareholders vote against it, then every supervisory

board must ask itself the question whether it still has the right

management in place."

Bayer's management and supervisory boards have rejected the

criticism as unfounded. They said both boards thoroughly reviewed

all risks of the deal and determined the Monsanto acquisition

didn't present substantial risks, legal or otherwise.

Few shareholders expect Mr. Baumann to go. He and Chairman

Werner Wenning share a close bond and the supervisory board trusts

them, according to people familiar with the company. But some Bayer

executives are growing nervous that large shareholders could start

to unload shares, said one of the people.

David Einhorn's Greenlight Capital Inc. exited a 2 1/2 year

investment in Bayer. "Essentially, this investment failed at nearly

every turn," the hedge fund's officials told investors in a

February letter, mentioning the Roundup litigation as well as

troubles in Bayer's pharmaceutical and consumer health

businesses.

Peter Verdult from Citi said Thursday's results weren't likely

to distract investors from the legal concerns. Analysts and

investors have their eyes on the next trials and the company's

appeal on the first California verdict.

Until there is more clarity over how the legal battle will end,

Bayer could at least in the short term be shielded from becoming

the target of activists trying to push the company for more radical

changes, such as a breakup, some analysts and investors said.

Elliott Management Corp., a hedge fund with an aggressive record

at forcing management and strategic changes, has built up a small

undisclosed stake in Bayer--but there is no sign it is pushing for

specific changes, according to people familiar with the matter.

Bayer and Elliott both declined to comment.

Ben Dummett and Jacob Bunge contributed to this article.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

April 25, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

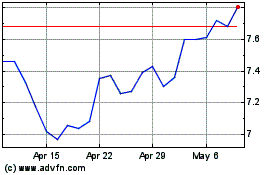

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

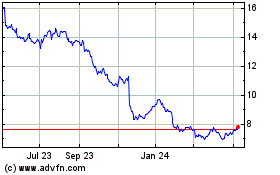

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024