Commodity Currencies Strengthen Amid Risk Appetite

March 17 2019 - 11:26PM

RTTF2

The commodity currencies such as the Australian, the New Zealand

and the Canadian dollars advanced against their major counterparts

in the Asian session on Monday as Asian shares rose, amid optimism

about U.S.-China trade talks as well as indications of more Chinese

economic stimulus.

China's Xinhua news agency reported that the U.S. and China have

made further "concrete progress" on the text of the trade agreement

between the two sides, after a telephone conversation between

Vice-Premier Liu He and US Trade Representative Robert Lighthizer

and Treasury Secretary Steven Mnuchin.

The report raised speculation that between Beijing and

Washington would reach a resolution to end their 10-month long

trade war.

Investors await Fed meeting due this week, amid hopes that it

will hold off raising interest rates.

The benchmark interest rate is likely to be kept in a range of

2.25 to 2.5 percent and futures markets see no additional hikes in

2019.

The aussie advanced to more than a 2-week high of 0.7115 against

the greenback and a 2-week high of 79.39 against the yen, from its

early lows of 0.7078 and 78.92, respectively. The next possible

resistance for the aussie is seen around 0.725 against the

greenback and 81.5 against the yen.

Reversing from its early lows of 1.5997 against the euro and

1.0340 against the kiwi, the aussie climbed to a 6-day high of

1.5932 and a 10-day high of 1.0372, respectively. On the upside,

1.57 and 1.05 are likely seen as its next resistance levels against

the euro and the kiwi, respectively.

The NZ currency appreciated to a 6-day high of 0.6868 against

the greenback, 3-month high of 76.62 against the yen and a 5-day

high of 1.6505 against the euro, off its previous lows of 0.6840,

76.25 and 1.6555, respectively. If the kiwi extends rise, 0.70,

78.00 and 1.62 are possibly seen as its next resistance levels

against the greenback, the yen and the euro, respectively.

The loonie reversed from its early lows of 1.3347 against the

greenback, 1.5114 against the euro and 83.54 against the yen,

rising to 1.3314, 1.5089 and 83.80, respectively. The loonie is

poised to find resistance around 1.31 against the greenback, 1.49

against the euro and 85.00 against the yen.

Looking ahead, at 6:00 am ET, Eurozone trade data for January is

due.

The U.S. NAHB housing market index for March is scheduled for

release in the New York session.

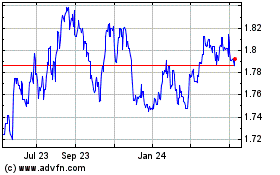

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

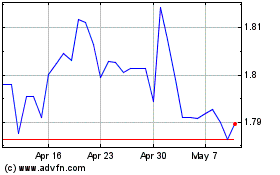

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024