LONDON MARKETS: London Stocks In The Black After Upbeat Retail Sales Data

February 15 2019 - 9:04AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Standard Life, Royal Bank of Scotland among the movers

London's main stock index was headed for its third straight week

of gains, rising modestly on Friday after data that showed strength

in retail sales, and continued hopes for progress in U.S.-China

trade talks.

The biggest mover of the day was financial firm Standard Life

Aberdeen PLC, dropping on a share sale.

How are markets performing?

The FTSE 100 rose 0.4% to 7,227.12, after finishing flat on

Thursday. For the week, the index is set to rise 2.2%, marking a

third week of gains.

The pound edged up to $1.2822 from $1.2802 late in New York on

Thursday.

What's driving the markets?

Trade talks between the U.S. and China wrapped up on Friday with

the White House citing progress toward a memorandum of

understanding that could lead to a trade deal

(http://www.marketwatch.com/story/us-china-trade-round-wraps-up-with-progress-toward-expected-memorandum-of-understanding-2019-02-15),

and plans to continue the discussions next week. That news was

helping lift U.S. stock futures and could help Wall Street recover

from Thursday losses triggered by the biggest drop in retail sales

in nine years

(http://www.marketwatch.com/story/retail-sales-sink-12-in-december-to-mark-biggest-drop-since-2009-as-holiday-season-fizzles-out-2019-02-14).

"Negative sentiment concerning trade issues will almost

certainly cast a dark cloud over the natural resources industry and

so it is that London-listed miners and oil stocks are the main

contributors to the FTSE's negative performance on Friday," says

Russ Mould, investment director at AJ Bell.

Meanwhile in the U.K., retail sales rebounded in January

(http://www.marketwatch.com/story/clothing-footwear-sales-boost-uk-retail-sales-2019-02-15)

driven by clothing and footwear and as stores cut their prices.

That comes after a drop in December, which sparked worries about

consumers holding back on spending owing to Brexit worries.

Embattled Prime Minister Theresa May suffered fresh rejection in

parliament

(http://www.marketwatch.com/story/brexit-brief-embattled-prime-minister-dealt-fresh-blow-by-own-mps-2019-02-15)

after pro-Brexit politicians refused to support her strategy in the

withdrawal from the European Union. Meanwhile, data showed

investment in property in the City of London slumped 75% in January

from a year ago, with deals stymied by Brexit worries.

What shares were active?

Standard Life (SLA.LN) shares slumped over 7% after Mitsubishi

UFJ Financial Group Inc(8306.TO) unloaded its entire 5.9% stake

(http://www.marketwatch.com/story/standard-life-falls-on-mitsubishi-share-sale-2019-02-15)

in the asset manager for 349.3 million pounds ($448.0 million).

Retailer Marks & Spencer Group PLC (MKS.LN) was another

loser, dropping 2%, while National Grid PLC (NG.LN) fell around 2%

as well.

Royal Bank of Scotland Group PLC (RBS.LN) (RBS.LN) said Friday

that its 2018 profit rose sharply and it will pay a special

dividend, but warned that Brexit uncertainty is putting its

medium-term cost targets at risk. Shares rose 1% in London.

(END) Dow Jones Newswires

February 15, 2019 08:49 ET (13:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

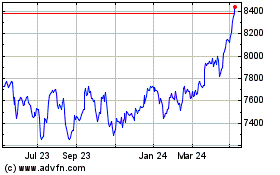

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

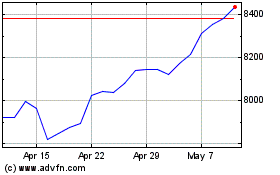

FTSE 100

Index Chart

From Apr 2023 to Apr 2024