Treasury Rally, Low Rates Key to Stock Gains, Bill Gross Says

October 15 2019 - 2:00PM

Dow Jones News

By Daniel Kruger

About 15% of the stock market's gains this year are attributable

to the rally in U.S. Treasurys, a sign investors should abandon

expectations for double-digit returns, according to the man once

known as Wall Street's "bond king."

The bond rally has pushed as much as $17 trillion in global bond

yields below zero, pushing up stock prices and narrowing the amount

of extra yield investors receive for owning riskier debt, Bill

Gross, co-founder of Pimco, said in an investment note Tuesday.

"In the absence of substantial fiscal stimulation, the economic

and asset boost from negative interest-rate yields may have reached

an end," Mr. Gross said, in his first market commentary since

retiring in February from Janus Henderson Group PLC.

The S&P 500 has climbed almost 20% this year. The movement

is supported by continued economic growth and investor expectations

that supportive central bank policy will sustain the current

expansion, analysts said.

The decline in Treasury bond yields, which fall when bond prices

rise, is important because they are a key reference rate which

lenders use to set interest rates on other debt, such as consumer

mortgages and corporate bonds. Lower bond yields and central bank

interest rates typically stimulate economic growth and support

stock prices.

Mr. Gross, however, expects slowing growth. He said further

efforts by central banks to ease monetary policy probably won't

push stocks higher because of the harmful effects of negative

interest-rate policies.

Those policies "literally rob small savers and larger financial

institutions such as banks, insurance companies and pension funds

of their ability to earn" interest on the bonds they purchase in

order to match assets and liabilities, Mr. Gross said.

Mr. Gross recommended that investors own "high yielding,

secure-dividend stocks."

U.S. government bond prices declined Tuesday after reports that

negotiators for the U.K. and European Union were making progress

toward a preliminary Brexit agreement. The yield on the benchmark

10-year Treasury note rose to a recent 1.753%, according to

Tradeweb, compared with 1.748% Friday. The yield ended last year at

2.684%. Yields fall as bond prices rise.

Federal-funds futures, which investors use to bet on the path of

the central bank's interest-rate policy, show about three-in-four

odds that the Federal Reserve will cut interest rates at its

meeting at the end of this month, compared with an 83% probability

a week ago, according to CME Group data.

Write to Daniel Kruger at Daniel.Kruger@wsj.com

(END) Dow Jones Newswires

October 15, 2019 13:45 ET (17:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

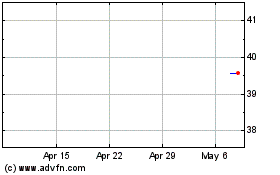

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Apr 2024 to May 2024

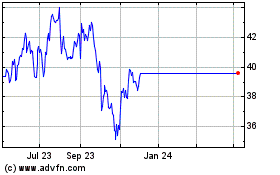

Janus Henderson (ASX:JHG)

Historical Stock Chart

From May 2023 to May 2024