Pound Higher After Boris Johnson's Victory In Tory Leadership Contest

July 23 2019 - 5:17AM

RTTF2

The pound was modestly higher against its key counterparts in

the European session on Tuesday, after Boris Johnson has been

appointed as the leader of the Conservative Party and will replace

Theresa May as the new Prime Minister on Wednesday.

In the leadership contest, Johnson won 92,153 votes, while rival

candidate and current Foreign Secretary Jeremy Hunt won 46,656

votes.

Johnson will take over the post of PM after May submits her

resignation to Queen on Wednesday.

Foreign Office minister Sir Alan Duncan and Education Minister

Anne Milton resigned in protest against Johnson's victory.

Chancellor Philip Hammond, Justice Secretary David Gauke and

International Development Secretary Rory Stewart are expected to

quit soon.

The latest quarterly Industrial Trends survey from the

Confederation of British Industry showed that UK manufacturers

reported a decline in activity over three months to July but firms

forecast a slight recovery in months ahead.

A balance of 15 percent reported a fall in new orders compared

to +5 percent in three months to April.

The currency showed mixed performance against its major

counterparts in the Asian session. While it rose against the yen

and the franc, it was steady against the euro. Against the

greenback, it dropped.

The pound spiked higher to 0.8960 against the euro, from a 5-day

low of 0.9005 it touched at 4:45 am ET. On the upside, 0.88 is

possibly seen as the next resistance for the pound.

Results of a quarterly survey by the European Central Bank

showed that Euro area banks unexpectedly tightened the conditions

business firms should meet to get loans during the second quarter,

due to an uncertain economic outlook.

By contrast, banks had expected credit standards to ease in the

second quarter during the previous survey.

The U.K. currency bounced off to 1.2482 against the greenback,

from a 6-day low of 1.2418 seen at 4:45 am ET. The pound is likely

to find resistance around the 1.27 level.

The pound, having dropped to a 2-year low of 1.2225 against the

franc at 4:45 am ET, reversed direction and moved up to 1.2271.

Next key resistance for the pound is seen around the 1.25

region.

Following a 5-day low of 134.32 reached at 4:45 am ET, the pound

recovered and touched as high as 134.98 against the yen. Should the

pound rises further, 136.5 is seen as its next resistance

level.

Data from the Cabinet Office showed that Japan's government

maintained its economic assessment but lifted its view on

industrial production.

The government repeated that the economy is recovering at a

moderate pace while weakness continuing mainly in exports.

Looking ahead, U.S. existing home sales data for June is due in

the New York session.

Eurozone flash consumer sentiment index for July will be out at

10:00 am ET.

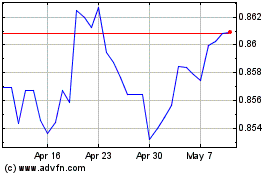

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

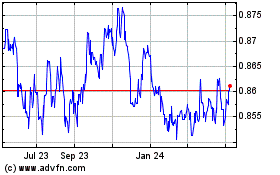

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024