- Strong investment performance, with 69%

and 74% of assets under management (“AUM”) outperforming relevant

benchmarks on a 3 and 5 year basis, respectively, as at 31 March

2019

- First quarter net income of US$94.1

million and adjusted net income of US$110.0 million

- AUM of US$357.3 billion, up 9% compared

to the prior quarter, reflecting positive markets partially offset

by net outflows of US$7.4 billion

- Completed US$31 million of share

buybacks during March; US$169 million remains authorised for

buybacks in 2019

- Board declared quarterly dividend of

US$0.36 per share

Janus Henderson Group plc (NYSE/ASX: JHG; ‘JHG’, ‘the Group’)

published its first quarter 2019 results for the period ended 31

March 2019.

First quarter 2019 net income attributable to JHG was US$94.1

million compared to US$106.8 million in the fourth quarter 2018 and

US$165.2 million in the first quarter 2018. Adjusted net income

attributable to JHG, adjusted for one-time, acquisition and

transaction related costs, of US$110.0 million declined 6% compared

to US$117.5 million in the fourth quarter 2018 and declined 23%

compared to US$143.6 million in the first quarter 2018.

First quarter 2019 diluted earnings per share was US$0.48

compared to US$0.54 in the fourth quarter 2018 and US$0.82 in the

first quarter 2018. Adjusted diluted earnings per share of US$0.56

declined 5% compared to US$0.59 in the fourth quarter 2018 and

declined 21% versus US$0.71 in the first quarter 2018.

Dick Weil, Chief Executive Officer of Janus Henderson Group

plc, stated:

“Overall investment performance for the quarter was strong, but

we continue to face pockets of underperformance which are driving

substantial net outflows. That said, we are seeing encouraging

results in several areas of our business, including momentum in the

US retail channel, primarily with our US Equity strategies, ongoing

growth in our Multi-Asset capability, and an improving environment

in Continental Europe.

“We finished the quarter with a 9% increase in assets under

management as strong investment performance and rebounding markets

offset outflows.

“We continue to be financially disciplined, remaining focused on

investing in sustainable growth and upholding our commitment to

return cash flow to shareholders, with over US$100 million returned

through dividends and our share buyback programme in the first

quarter.”

SUMMARY OF FINANCIAL RESULTS (unaudited) (in US$ millions,

except per share data or as noted)

The Group presents its financial results in US$ and in

accordance with accounting principles generally accepted in the

United States of America (‘US GAAP’ or ‘GAAP’). However, in the

opinion of Management, the profitability of the Group and its

ongoing operations is best evaluated using additional non-GAAP

financial measures on an adjusted basis. See adjusted statements of

income reconciliation for additional information.

Three months ended 31 Mar

31 Dec 31 Mar 2019

2018 2018

GAAP

basis:

Revenue 519.3 545.1 587.7 Operating expenses 394.8 395.1 411.5

Operating income 124.5 150.0 176.2 Operating margin 24.0% 27.5%

30.0% Net income attributable to JHG 94.1 106.8 165.2 Diluted

earnings per share 0.48 0.54 0.82

Three months

ended 31 Mar 31 Dec 31 Mar

2019 2018 2018

Adjusted

basis:

Revenue 417.4 442.7 470.4 Operating expenses 274.0 277.4 281.6

Operating income 143.4 165.3 188.8 Operating margin 34.4% 37.3%

40.1% Net income attributable to JHG 110.0 117.5 143.6 Diluted

earnings per share 0.56 0.59 0.71

First quarter 2019 adjusted revenue of US$417.4 million

decreased from the fourth quarter 2018 result of US$442.7 million

due to a slight decline in management fee margin, given outflows in

higher fee equity products, and lower performance fees from

segregated mandates. First quarter 2019 adjusted operating income

of US$143.4 million decreased from US$165.3 million in the fourth

quarter 2018, with lower adjusted revenue slightly offset by lower

operating expenses.

DIVIDEND AND SHARE BUYBACK

On 1 May 2019, the Board declared a first quarter dividend in

respect of the three months ended 31 March 2019 of US$0.36 per

share. Shareholders on the register on the record date of 13 May

2019 will be paid the dividend on 29 May 2019. Janus Henderson does

not offer a dividend reinvestment plan.

As part of the US$200 million on-market buyback programme

approved by the Board in February, JHG purchased approximately 1.3

million of its ordinary shares on the NYSE and its CHESS Depositary

Interests (CDIs) on the ASX in March, for a total outlay of US$31

million.

During the first quarter, the firm also purchased shares on

market for the annual share grants associated with 2018 variable

compensation, which is not connected with the buyback programme. As

a firm policy, Janus Henderson does not issue new shares to

employees as part of its annual compensation practices.

Net tangible assets per share

US$ 31 Mar 2019 31 Dec

2018 Net tangible assets per ordinary share 1.31

1.32

Net tangible assets are defined by the ASX as being total assets

less intangible assets less total liabilities ranking ahead of, or

equally with, claims of ordinary shares.

AUM AND FLOWS (in US$ billions)

FX reflects movement in AUM resulting from changes in foreign

currency rates as non-USD denominated AUM is translated into USD.

Redemptions include impact of client switches. The reclassification

in the fourth quarter 2018 reflects an operational reclassification

of an existing client’s funds.

Total Group comparative AUM and

flows

Three months ended 31 Mar 31

Dec 31 Mar 2019 2018

2018 Opening AUM 328.5 378.1

370.8 Sales 15.6 16.6 19.7 Redemptions (23.0 ) (25.0 ) (22.4

) Net sales / (redemptions) (7.4 ) (8.4 ) (2.7 ) Market / FX 36.2

(41.2 ) 3.8

Closing AUM 357.3

328.5 371.9

Quarterly AUM and flows by

capability

Equities Fixed

Income

Quantitative

Equities

Multi-Asset Alternatives Total AUM 31 Mar

2018 190.7 80.0 50.4 31.8

19.0 371.9 Sales 8.5 5.0 0.4 1.8 1.4 17.1 Redemptions

(9.6 ) (5.6 ) (1.2 ) (1.3 ) (2.1 ) (19.8 ) Net sales /

(redemptions) (1.1 ) (0.6 ) (0.8 ) 0.5 (0.7 ) (2.7 ) Market / FX

3.7 (2.9 ) 0.5 0.3 (0.7 ) 0.9

AUM 30

Jun 2018 193.3 76.5 50.1 32.6

17.6 370.1 Sales 6.8 6.0 1.3 2.2 1.4 17.7 Redemptions

(9.9 ) (7.6 ) (1.3 ) (1.3 ) (1.9 ) (22.0 ) Net sales /

(redemptions) (3.1 ) (1.6 ) (0.0 ) 0.9 (0.5 ) (4.3 ) Market / FX

9.0 (0.4 ) 2.8 1.1 (0.2 ) 12.3

AUM

30 Sep 2018 199.2 74.5 52.9 34.6

16.9 378.1 Sales 8.6 4.7 0.3 2.3 0.7 16.6 Redemptions

(12.7 ) (6.0 ) (1.4 ) (2.0 ) (2.9 ) (25.0 ) Net sales /

(redemptions) (4.1 ) (1.3 ) (1.1 ) 0.3 (2.2 ) (8.4 ) Market / FX

(29.2 ) (1.3 ) (7.5 ) (2.5 ) (0.7 ) (41.2 ) Reclassification 1.7

0.5 - (2.2 ) - -

AUM 31 Dec

2018 167.6 72.4 44.3 30.2

14.0 328.5 Sales 6.9 4.9 0.7 2.2 0.9 15.6 Redemptions

(9.8 ) (7.7 ) (1.7 ) (1.5 ) (2.3 ) (23.0 ) Net sales /

(redemptions) (2.9 ) (2.8 ) (1.0 ) 0.7 (1.4 ) (7.4 ) Market / FX

24.1 2.9 6.3 2.5 0.4 36.2

AUM 31 Mar 2019 188.8 72.5 49.6

33.4 13.0 357.3

Average AUM

Three months ended 31 Mar

2019

31 Dec

2018

31 Mar

2018

Equities 182.8 179.5 194.6 Fixed Income 73.3 73.0 79.7 Quantitative

Equities 48.3 47.6 51.4 Multi-Asset 32.1 32.2 32.1 Alternatives

13.5 15.5 19.6

Total 350.0 347.8 377.4

INVESTMENT PERFORMANCE

% of AUM outperforming benchmark (at 31 Mar 2019)

Capability 1 year

3 years 5 years Equities

64% 69% 77% Fixed Income 58% 92% 89% Quantitative Equities 15% 14%

12% Multi-Asset 88% 91% 91% Alternatives 89% 98% 100%

Total

60% 69% 74%

Note: Outperformance is measured based on composite performance

gross of fees vs primary benchmark, except where a strategy has no

benchmark index or corresponding composite in which case the most

relevant metric is used: (1) composite gross of fees vs zero for

absolute return strategies, (2) fund net of fees vs primary index

or (3) fund net of fees vs Morningstar peer group average or

median. Non-discretionary and separately managed account assets are

included with a corresponding composite where applicable.

Cash management vehicles, ETFs, Managed CDOs, Private Equity

funds and custom non-discretionary accounts with no corresponding

composite are excluded from the analysis. Excluded assets represent

4% of AUM as at 31 Mar 2019. Capabilities defined by Janus

Henderson.

% of mutual fund AUM in top 2 Morningstar quartiles (at 31

Mar 2019)

Capability 1 year

3 years 5 years Equities

78% 72% 86% Fixed Income 68% 42% 48% Quantitative Equities 63% 3%

97% Multi-Asset 84% 86% 88% Alternatives 93% 33% 94%

Total

78% 67% 81%

Note: Includes Janus Investment Fund, Janus Aspen

Series and Clayton Street Trust (US Trusts), Janus Henderson

Capital Funds (Dublin based), Dublin and UK OEIC and Investment

Trusts, Luxembourg SICAVs and Australian Managed Investment

Schemes. The top two Morningstar quartiles represent funds in the

top half of their category based on total return. On an

asset-weighted basis, 80% of total mutual fund AUM was in the top 2

Morningstar quartiles for the 10-year period ended 31 Mar 2019. For

the 1-, 3-, 5- and 10-year periods ending 31 Mar 2019, 62%, 50%,

62% and 62% of the 205, 195, 181 and 141 total mutual funds,

respectively, were in the top 2 Morningstar quartiles.

Analysis based on ‘primary’ share class (Class I Shares,

Institutional Shares or share class with longest history for US

Trusts; Class A Shares or share class with longest history for

Dublin based; primary share class as defined by Morningstar for

other funds). Performance may vary by share class. Rankings may be

based, in part, on the performance of a predecessor fund or share

class and are calculated by Morningstar using a methodology that

differs from that used by Janus Henderson. Methodology differences

may have a material effect on the return and therefore the ranking.

When an expense waiver is in effect, it may have a material effect

on the total return, and therefore the ranking for the period.

ETFs and funds not ranked by Morningstar are excluded from the

analysis. Capabilities defined by JHG. © 2019

Morningstar, Inc. All Rights Reserved.

SECOND QUARTER 2019 RESULTS

Janus Henderson intends to publish its second quarter 2019

results on 31 July 2019.

FIRST QUARTER 2019 RESULTS BRIEFING INFORMATION

Chief Executive Officer Dick Weil and Chief Financial Officer

Roger Thompson will present these results on 2 May 2019 on a

conference call and webcast to be held at 8am EDT, 1pm BST, 10pm

AEST.

Those wishing to participate should call:

United Kingdom 0800 358 6377 (toll free) US

& Canada 800 239 9838 (toll free) Australia 1 800 573 793 (toll

free) All other countries: +1 323 794 2551 (this is not a toll free

number) Conference ID: 6246882

Access to the webcast and accompanying slides will be available

via the investor relations section of Janus Henderson’s website

(www.janushenderson.com/IR).

About Janus Henderson

Janus Henderson Group (JHG) is a leading global active asset

manager dedicated to helping investors achieve long-term financial

goals through a broad range of investment solutions, including

equities, fixed income, quantitative equities, multi-asset and

alternative asset class strategies.

Janus Henderson has approximately US$357 billion in assets under

management (at 31 March 2019), more than 2,000 employees, and

offices in 28 cities worldwide. Headquartered in London, the

company is listed on the New York Stock Exchange (NYSE) and the

Australian Securities Exchange (ASX).

FINANCIAL DISCLOSURES

Period ending 31 March 2018 reflects the reclassification of

certain revenue amounts from ‘Other revenue’ to ‘Shareowner

servicing fees’.

Condensed consolidated statements of

comprehensive income (unaudited)

Three months ended 31 Mar

31 Dec 31 Mar (in US$

millions, except per share data or as noted) 2019

2018 2018 Revenue: Management fees 441.9 452.3

502.9 Performance fees (5.6 ) 3.5 (3.9 ) Shareowner servicing fees

35.9 37.0 38.4 Other revenue 47.1 52.3 50.3

Total revenue 519.3 545.1

587.7 Operating expenses: Employee

compensation and benefits 145.0 155.8 146.7 Long-term incentive

plans 48.4 32.3 40.0 Distribution expenses 101.9 102.4 117.3

Investment administration 11.8 11.6 11.4 Marketing 7.5 12.8 8.5

General, administrative and occupancy 65.2 62.4 72.2 Depreciation

and amortisation 15.0 17.8 15.4

Total

operating expenses 394.8 395.1

411.5 Operating income 124.5

150.0 176.2 Interest expense (4.1 ) (4.0 )

(3.8 ) Investment gains (losses), net 13.3 (15.3 ) (0.7 ) Other

non-operating income (expenses), net (3.9 ) 13.5 38.9

Income before taxes 129.8 144.2 210.6 Income tax provision (29.9 )

(43.4 ) (47.4 ) Net income 99.9 100.8 163.2 Net loss (income)

attributable to noncontrolling interests (5.8 ) 6.0 2.0

Net income attributable to JHG 94.1

106.8 165.2 Less: allocation of earnings to

participating stock-based awards (2.4 ) (2.8 ) (4.2 )

Net income

attributable to JHG common shareholders 91.7

104.0 161.0 Basic

weighted-average shares outstanding (in millions) 191.8 193.3 195.9

Diluted weighted-average shares outstanding (in millions) 192.5

194.1 196.9

Diluted earnings per share (in US$)

0.48 0.54 0.82

Adjusted statements of income (unaudited)

The following are reconciliations of US GAAP basis revenues,

operating income, net income attributable to JHG and diluted

earnings per share to adjusted revenues, adjusted operating income,

adjusted net income attributable to JHG and adjusted diluted

earnings per share.

Three months ended 31 Mar

31 Dec 31 Mar

(in US$ millions, except per share data or as noted)

2019 2018 2018 Reconciliation of revenue to

adjusted revenue Revenue 519.3 545.1 587.7 Distribution

expenses1 (101.9 ) (102.4 ) (117.3 ) Adjusted revenue 417.4

442.7 470.4

Reconciliation of operating

income to adjusted operating income Operating income 124.5

150.0 176.2 Employee compensation and benefits2,4 4.3 4.4 2.9

Long-term incentive plans2 (0.2 ) (0.2 ) 0.1 Marketing2 - 0.1 0.1

General, administration and occupancy2,4 7.4 1.9 2.1 Depreciation

and amortisation2,3 7.4 9.1 7.4 Adjusted

operating income 143.4 165.3 188.8

Operating margin 24.0 % 27.5 % 30.0 % Adjusted operating margin

34.4 % 37.3 % 40.1 %

Reconciliation of net income

attributable to JHG to adjusted net income attributable to JHG

Net income attributable to JHG 94.1 106.8 165.2 Employee

compensation and benefits2,4 4.3 4.4 2.9 Long-term incentive plans2

(0.2 ) (0.2 ) 0.1 Marketing2 - 0.1 0.1 General, administration and

occupancy2,4 7.4 1.9 2.1 Depreciation and amortisation2,3 7.4 9.1

7.4 Interest expense4 0.9 0.9 0.7 Other non-operating income

(expenses), net4 0.4 0.3 (44.8 ) Income tax provision5 (4.3 ) (5.8

) 9.9 Adjusted net income attributable to JHG

110.0

117.5 143.6 Less: allocation of earnings to

participating stock-based awards (2.8 ) (3.2 ) (3.6 ) Adjusted net

income attributable to JHG common shareholders

107.2

114.3 140.0 Weighted average

diluted common shares outstanding – diluted (two class) (in

millions) 192.5 194.1 196.9 Diluted earnings per share (two class)

(in US$)

0.48 0.54 0.82 Adjusted diluted

earnings per share (two class) (in US$) 0.56 0.59

0.71 1 Distribution expenses are paid to financial

intermediaries for the distribution of JHG’s investment products.

JHG management believes that the deduction of third-party

distribution, service and advisory expenses from revenue in the

computation of net revenue reflects the nature of these expenses,

as these costs are passed through to external parties that perform

functions on behalf of, and distribute, the Group’s managed AUM. 2

Adjustments primarily represent integration costs in relation to

the Merger, including severance costs, legal costs and consulting

fees. JHG management believes these costs do not represent the

ongoing operations of the Group. 3 Investment management contracts

have been identified as a separately identifiable intangible asset

arising on the acquisition of subsidiaries and businesses. Such

contracts are recognised at the net present value of the expected

future cash flows arising from the contracts at the date of

acquisition. For segregated mandate contracts, the intangible asset

is amortised on a straight-line basis over the expected life of the

contracts. JHG management believes these non-cash and

acquisition-related costs do not represent the ongoing operations

of the Group. 4 Adjustments for the three months ended 31 March

2019 and 31 December 2018 primarily represent increased debt

expense as a consequence of the fair value uplift on debt due to

acquisition accounting and deferred consideration costs associated

with acquisitions prior to the Merger. Adjustments for the three

months ended 31 March 2018 include the gain on the sale of JHG’s

back-office, middle-office and custody function in the US to BNP

Paribas, fair value movement on options issued to Dai-ichi in

addition to the same adjustments affecting the three-month 2019

period. JHG management believes these costs do not represent the

ongoing operations of the Group. 5 The tax impact of the

adjustments is calculated based on the US or foreign statutory tax

rate as they relate to each adjustment. Certain adjustments are

either not taxable or not tax-deductible.

Condensed consolidated balance sheets

(unaudited)

31 Mar 31 Dec (in US$ millions)

2019 2018 Assets Cash and cash equivalents

717.1 880.4 Investment securities 270.7 291.8 Property, equipment

and software, net 72.6 69.5 Intangible assets and goodwill, net

4,619.0 4,601.3 Assets of consolidated variable interest entities

330.0 323.9 Other assets 1,013.7 745.0

Total assets

7,023.1 6,911.9 Liabilities, redeemable

noncontrolling interests and equity Debt 318.4 319.1 Deferred

tax liabilities, net 730.7 729.9 Liabilities of consolidated

variable interest entities 11.0 6.5 Other liabilities 950.9 859.5

Redeemable noncontrolling interests 137.0 136.1 Total equity

4,875.1 4,860.8

Total liabilities, redeemable noncontrolling

interests and equity 7,023.1 6,911.9

Condensed consolidated statements of

cash flows (unaudited)

Three months ended (in US$ millions) 31

Mar

2019

31 Dec

2018

31 Mar

2018

Cash provided by (used for) Operating activities (34.7 )

243.3 61.7 Investing activities 51.3 13.0 11.6 Financing activities

(198.3 ) (127.8 ) (208.2 ) Effect of foreign exchange rate changes

5.0 (8.0 ) 6.1

Net change during period

(176.7 ) 120.5 (128.8 )

STATUTORY DISCLOSURES

Associates and joint ventures

At 31 March 2019, the Group holds interests in the following

associates and joint ventures managed through shareholder

agreements with third party investors, accounted for under the

equity method:

- Long Tail Alpha LLC. Ownership 20%

Basis of preparation

In the opinion of management of Janus Henderson Group plc, the

condensed consolidated financial statements contain all normal

recurring adjustments necessary to fairly present the financial

position, results of operations and cash flows of JHG in accordance

with US GAAP. Such financial statements have been prepared in

accordance with the instructions to Form 10-Q pursuant to the rules

and regulations of the SEC. Certain information and footnote

disclosures normally included in financial statements prepared in

accordance with GAAP have been condensed or omitted pursuant to

such rules and regulations. The financial statements should be read

in conjunction with the annual consolidated financial statements

and notes presented in Janus Henderson Group’s Annual Report on

Form 10-K for the year ended 31 December 2018, on file with the SEC

(Commission file no. 001-38103). Events subsequent to the balance

sheet date have been evaluated for inclusion in the financial

statements through the issuance date and are included in the notes

to the condensed consolidated financial statements.

Corporate governance principles and recommendations

In the opinion of the Directors, the financial records of the

Group have been properly maintained, and the Condensed Consolidated

Financial Statements comply with the appropriate accounting

standards and give a true and fair view of the financial position

and performance of the Group. This opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

FORWARD-LOOKING STATEMENTS DISCLAIMER

Past performance is no guarantee of future results. Investing

involves risk, including the possible loss of principal and

fluctuation of value.

This document includes statements concerning potential future

events involving Janus Henderson Group plc that could differ

materially from the events that actually occur. The differences

could be caused by a number of factors including those factors

identified in Janus Henderson Group’s Annual Report on Form 10-K

for the fiscal year ended 31 December 2018, on file with the

Securities and Exchange Commission (Commission file no. 001-38103),

including those that appear under headings such as ‘Risk Factors’

and ‘Management’s Discussion and Analysis of Financial Condition

and Results of Operations’. Many of these factors are beyond the

control of JHG and its management. Any forward-looking statements

contained in this document are as at the date on which such

statements were made. Janus Henderson Group assumes no duty to

update them, even if experience, unexpected events, or future

changes make it clear that any projected results expressed or

implied therein will not be realised.

Annualised, pro forma, projected and estimated numbers are used

for illustrative purposes only, are not forecasts and may not

reflect actual results.

The information, statements and opinions contained in this

document do not constitute a public offer under any applicable

legislation or an offer to sell or solicitation of any offer to buy

any securities or financial instruments or any advice or

recommendation with respect to such securities or other financial

instruments.

Not all products or services are available in all

jurisdictions.

Mutual funds in the US are distributed by Janus Henderson

Distributors.

Please consider the charges, risks, expenses and investment

objectives carefully before investing. For a US fund prospectus or,

if available, a summary prospectus containing this and other

information, please contact your investment professional or call

800.668.0434. Read it carefully before you invest or send

money.

Janus Henderson, Janus, Henderson, Intech, Alphagen and

Knowledge. Shared are trademarks of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190502005117/en/

Investor enquiries:John GronemanGlobal Head of Investor

Relations+44 (0) 20 7818 2106john.groneman@janushenderson.comJim

KurtzUS Investor Relations Manager+1 (303) 336

4529jim.kurtz@janushenderson.comMelanie HortonNon-US Investor

Relations Manager+44 (0) 20 7818

2905melanie.horton@janushenderson.comOrInvestor

Relationsinvestor.relations@janushenderson.comMedia

enquiries:North America:Taylor Smith+1 303 336

5031taylor.smith@janushenderson.comEMEA:Sally Todd+44 (0) 20 7818

2244sally.todd@janushenderson.comUnited Kingdom: FTI ConsultingTom

Blackwell+ 44 (0) 20 3727 1051tom.blackwell@FTIConsulting.comAsia

Pacific: HonnerMichael Mullane+ 61 28248

3740michaelmullane@honner.com.au

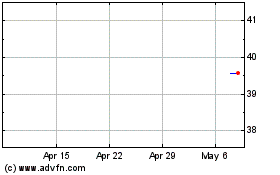

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

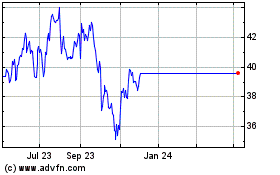

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Apr 2023 to Apr 2024