Unexplained Trading in Pound Last Month Wasn't a First

February 09 2020 - 5:29AM

Dow Jones News

By Anna Isaac and Caitlin Ostroff

A sharp move in the British pound last month in the minutes

ahead of a crucial central-bank decision wasn't a unique

occurrence, according to data reviewed by The Wall Street

Journal.

The U.K.'s Financial Conduct Authority has said it is looking

into unusual trading that occurred before a Bank of England policy

meeting on Jan. 30. Yet trading-volume data show there was also

unusually high activity in the pound the previous month, compared

with other announcements dating back to early 2017.

The spike in activity before the official announcement of

interest-rate policy comes at a time when the Bank of England has

been scrutinizing whether investors are gaining unfair access to

its decisions.

On Dec. 19, in the 10 seconds before the bank released its

decision to keep interest rates steady, trading volumes for

three-month futures tied to the pound against the dollar spiked to

more than 300 contracts changing hands in one second, from single

digits. At the same time, pound futures ticked as high as $1.3113

from $1.3090 10 seconds before the announcement, according to data

and academic analysis.

Following the central bank's decision to hold rates steady in

December, the pound rose 0.5% in the minutes after the

announcement. It later traded down 0.3% to $1.3029 by 4 p.m. London

time, according to FactSet.

At the same meeting, the bank had to shut down an audio feed of

market-sensitive information after it was used to offer some

traders a competitive time advantage. The feed had been misused by

a supplier, the BOE said, and it referred the matter to the

FCA.

The volume, price movement and period preceding the central

bank's announcement in December were similar to the activity noted

in January, according to Alex Kurov, a finance professor at West

Virginia University, as well as data from Genesis Financial

Technologies and Dow Jones Market Data.

"High volume and sizable price moves in the 10 to 15 seconds

before the last two announcements were unusual," said Prof. Kurov,

who teaches about financial markets and whose work includes

research into market reactions to macroeconomic data. "There's

usually very low volume before announcements."

While the unusual move in sterling could indicate that someone

had prior knowledge of the central bank's decision, it might also

have been a lucky trade, or based on other market information,

analysts said. Thin volumes in the futures market -- where

investors hold off on any bets ahead of the central bank's

announcement -- can amplify the impact of any trade as a potential

cause for the sharp rise of the pound.

An FCA spokesman on Friday declined to confirm or deny whether

the watchdog's probe into the Jan. 30 matter included other

instances of movement in the pound ahead of the release of

market-sensitive information. The BOE declined to comment on

whether it had observed any unusual market movements ahead of the

December interest-rate decision.

In the January instance, the spot rate for the pound, and

futures contracts tied to both the FTSE 100 equity benchmark and

sterling against the dollar, moved upward ahead of the central

bank's announcement.

Central banks, including the U.S. Federal Reserve, take a range

of precautions to prevent market-sensitive information from

leaking.

At the BOE, reporters are allowed to take one electronic device

into an underground room about two hours before the scheduled

release of the monetary-policy announcement. There, they are given

freshly printed documents with the central bank's decision. When

the release becomes public at noon London time, a staff person

flips a switch that turns on internet access inside the room and

the lock-in, as it is called, ends.

Unlike the Fed and the European Central Bank, which make their

decisions public on the day they are made, the Bank of England

reveals its decision a day later.

The U.S. Labor Department, which releases market-moving jobs and

inflation data, said recently it plans to end the practice of

giving reporters an early peek at data at a secure facility

controlled by the government. Under that system, it would allow the

reporters to publish articles at the same time that the data was

publicly disclosed.

The change was engineered in part to remove the potential

advantage that media organizations and their clients had over the

broader public.

Write to Anna Isaac at anna.isaac@wsj.com and Caitlin Ostroff at

caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

February 09, 2020 05:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

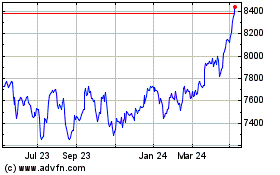

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

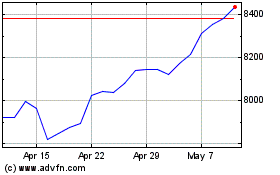

FTSE 100

Index Chart

From Apr 2023 to Apr 2024