Shares of NYSE Owner Slide on Fresh eBay Deal Jitters

February 06 2020 - 2:41PM

Dow Jones News

By Alexander Osipovich

Shares of Intercontinental Exchange Inc. dropped 5.5% on

Thursday after it failed to tamp down investors' jitters that it

could pursue a costly acquisition of eBay Inc.

Speaking to analysts, ICE Chairman and Chief Executive Officer

Jeffrey Sprecher reiterated the company's previous statement that

no such deal was imminent and that eBay had rebuffed ICE's

overtures.

But he also discussed at length why ICE -- best known as the

owner of the New York Stock Exchange -- was interested in the

e-commerce platform, outlining what could be seen as a rationale

for the deal.

"We both match buyers and sellers," Mr. Sprecher said on a

fourth-quarter earnings call. "We both collect and organize data.

We both work with third parties to provide physical distribution.

We both provide useful analytics to enhance the transaction

experience."

The comments were Mr. Sprecher's first public remarks on eBay

since The Wall Street Journal reported on Tuesday that ICE had

approached the e-commerce platform about a possible deal. The news

has sparked a selloff in Atlanta-based ICE's stock, as investors

have questioned the strategic value and potential cost of the

transaction.

Since Monday's close, ICE's share price has sunk 12%, wiping out

more than $6 billion of the company's market capitalization. ICE is

now worth about $50 billion, while eBay's market cap is around $30

billion.

EBay's shares gained 3.3% after Mr. Sprecher's remarks on the

earnings call, which took place before markets opened Thursday,

ICE reported fourth-quarter earnings of 95 cents a share and net

revenue of $1.3 billion, in line with analysts' expectations.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 14:26 ET (19:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

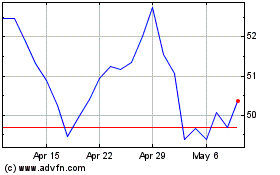

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

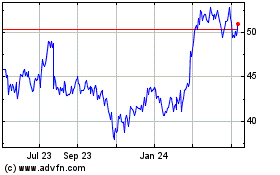

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024