Intercontinental Exchange Makes Takeover Offer for eBay -- Update

February 04 2020 - 4:17PM

Dow Jones News

By Cara Lombardo and Corrie Driebusch

New York Stock Exchange owner Intercontinental Exchange Inc. has

made a takeover offer for eBay Inc. that could value the sprawling

online marketplace at more than $30 billion, according to people

familiar with the matter.

Intercontinental Exchange, known as ICE, has approached eBay in

the past and did so again recently, the people said. The companies

aren't currently in formal talks and there is no guarantee eBay

would agree to a deal.

Should there be one, it would be big, given eBay's market value

of more than $28 billion and the premium ICE would likely have to

pay.

ICE is primarily interested in owning eBay's core marketplace

business, the people said, and not its classified unit, which eBay

has been considering selling. The classified unit could fetch

around $10 billion in a sale, people familiar with the matter have

said.

ICE may see an opening to apply its technological expertise

connecting buyers and sellers to eBay's core e-commerce site

covering everything from electronics to collectibles.

EBay shares soared on news of the possible deal, first reported

by The Wall Street Journal, and were up more than 7% in afternoon

trading Tuesday. Intercontinental Exchange stock fell more than 5%

as investors digested the possibility of another huge bite by the

acquisitive company.

EBay was a pioneer in e-commerce but has struggled to keep up

with competitors such as Amazon.com Inc. The company has sought to

distance itself from its reputation as an online auction house --

as opposed to an electronic marketplace -- as online auctions have

fallen out of vogue. As the luster it enjoyed in the dot-com era

has worn off, eBay has attracted the attention of multiple activist

investors in recent years including Carl Icahn, who pushed for its

2015 spinoff of the payment platform PayPal Holdings Inc.

Roughly a year ago, activist hedge funds Elliott Management

Corp. and Starboard Value LP urged eBay to consider selling both

its StubHub ticketing and classified-ads businesses. EBay later

struck settlement deals that handed the funds board

representation.

EBay late last year agreed to sell StubHub to Geneva-based

Viagogo Entertainment Inc. for $4.05 billion.

The company has been without a permanent chief executive since

former CEO Devin Wenig left in September, citing clashes with the

board. Unfilled executive ranks are often seen as opportunities for

suitors to pounce.

"In the past few weeks it became clear that I was not on the

same page as my new board," Mr. Wenig tweeted from his personal

account following his resignation. "Whenever that happens, its best

for everyone to turn that page over."

EBay last week reported a declining profit in its latest quarter

and gave a weaker-than-expected first-quarter revenue outlook. Its

shares lost 4.5% the following day and closed Monday at $34.39.

On its earnings call, when asked by an analyst if eBay's core

business is part of the company's strategic review, interim Chief

Financial Officer Andrew Cring said "Everything is part of it."

On Tuesday, Starboard published another letter to eBay

management saying the company hasn't made enough progress and

called on it to commit to a separation of its classifieds

business.

ICE is best known for operating the NYSE as well as futures

exchanges around the world. Chief Executive Jeffrey Sprecher

founded the company in 2000 and has turned it into a global

exchange empire by acquiring stock and futures markets including

the London-based International Petroleum Exchange in 2001 and the

Chicago Stock Exchange in 2018. ICE also runs a number of

financial-data businesses and clearinghouses for derivatives

trades.

Acquiring eBay would be an unusual move for Atlanta-based ICE,

which in its 20-year history has largely stuck to running

marketplaces for financial instruments like stocks and derivatives,

rather than the sorts of consumer goods sold on San Jose,

Calif.-based eBay's platform.

Still, ICE has a history of buying underperforming trading

platforms and making them more profitable. Since closing its

acquisition of the NYSE in 2013, it has slashed expenses at the Big

Board, revamped its outdated trading systems and spent tens of

millions of dollars on renovating the exchange's historic building

in Manhattan to make it a splashier place to host initial public

offerings.

ICE's interest in eBay comes as the traditional way that

exchange groups have grown -- through cross-border takeovers of

rival market operators -- has gotten tougher, due to the increasing

consolidation of the business and regulatory obstacles. In 2016,

ICE explored a possible offer for London Stock Exchange Group PLC,

but retreated, allowing Deutsche Börse AG to pursue a bid for the

LSE that was ultimately scuttled by European Union regulators. In

2017, ICE was forced to unwind its acquisition of Trayport, a

European energy-trading platform, after opposition from U.K.

antitrust authorities.

--Alexander Osipovich contributed to this article.

Write to Cara Lombardo at cara.lombardo@wsj.com and Corrie

Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

February 04, 2020 16:02 ET (21:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

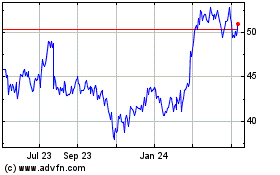

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

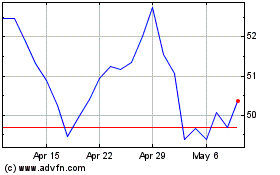

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024