Starboard Renews Push on EBay's Classified Unit -- Update

February 04 2020 - 2:56PM

Dow Jones News

By Micah Maidenberg

Hedge fund Starboard Value LP reiterated its call for eBay Inc.

to shed its classified-advertising business, a move it claims will

help the company sharpen its focus on its main online

marketplace.

About a year ago, Starboard and Elliott Management Corp.

publicly called on the company to rid itself of the classified unit

along with ticket-seller StubHub. Last March, eBay said it would

conduct a strategic review and add three new directors to its

board. EBay in November agreed to sell its StubHub business for

$4.05 billion to a Swiss company.

In a letter to eBay Chairman Thomas Tierney and interim Chief

Executive Scott Schenkel that Starboard released Tuesday, the

investor criticized what it said was eBay's resistance to selling

the classified business. Starboard said in many markets, eBay's

main marketplace and the classified unit compete for the same

customers and product listings.

"If the businesses were separate, both would be better equipped

to attempt to acquire customers and grow without this

complication," Starboard said in the letter.

Starboard currently owns more than 1% of eBay's stock. It first

took the stake in 2018.

EBay said it has taken significant measures to boost shareholder

value and strengthen its business, but will review the letter from

the activist investor.

"The board and eBay's management team are aligned in their

commitment to taking all appropriate steps to drive the value of

the company," eBay said in a statement.

The online marketplace also said it plans to provide an update

about the classified business by the middle of the year.

The company's classified group includes a range of platforms for

such advertising in markets around the world, including Gumtree,

which targets the U.K., Australia and other countries, and

Vivanuncios in Mexico.

The classified business generated $1.06 billion in

marketing-related revenue last year, roughly 10% of the San Jose,

Calif.-based company's total.

Starboard said in the letter it is "open-minded" about how eBay

could shed the unit, adding that the business could be sold.

A representative from Elliott declined to comment.

Starboard called for eBay to conduct a more intensive review of

costs related to its main marketplace and drive stronger revenue in

part through advertising initiatives.

"We also believe eBay should return to its roots in targeting

its historical core buyer universe of 'self-expressionists and

treasure hunters,' who are seeking unique, hard-to-find, or

value-oriented items, " Starboard said in its letter.

In September, eBay's former CEO Devin Wenig stepped down, saying

he wasn't on the same page as the company's board. Mr. Schenkel,

the company's finance chief, was appointed interim CEO.

The company had agreed to add three new directors to the group

as part of a deal with Starboard and Elliott. Last March, Elliott

partner Jesse Cohn, who focuses on U.S. equity activism for the

investor, and Marvell Technology's Matt Murphy joined the

board.

EBay said in its statement that five new independent directors

have joined the board since 2016.

Colin Kellaher contributed to this article.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 04, 2020 14:41 ET (19:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

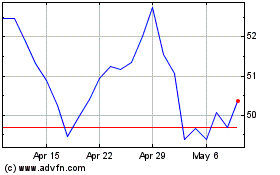

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

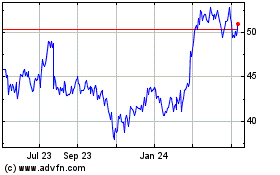

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024