The iPhone Isn't Made in China -- It's Made Everywhere

January 31 2020 - 11:08AM

Dow Jones News

By Fred P. Hochberg

At the Jan. 15 White House signing ceremony for an initial trade

deal with China, President Trump's top trade negotiator, Robert

Lighthizer, noted that his boss "has, for years, complained about

our enormous trade deficit with China." Indeed, Mr. Trump and

others have long considered that gap a reflection of American

economic weakness. The premise seems to be that a $420 billion

trade deficit with China is akin to Washington just forking over

$420 billion to Beijing each year. In 2012, Mr. Trump tweeted that

"every year... China is making almost $300 billion off the United

States." This is the equivalent of saying that your local gas

station "made $20 off you" when you put $20 worth of gas in your

car.

In fact, bilateral trade deficits are about as useful for

determining the health of trade relationships as they are for

determining the weather. A trade balance between two countries

simply measures the value of goods and services sold from country A

to country B versus the value of goods and services moving in the

other direction. The country that buys more than it sells is

running a bilateral trade deficit with the country that sells more

than it buys.

I run this kind of trade deficit with my barber because I

repeatedly purchase the service of a haircut from him, even though

he never purchases anything from me. That deficit doesn't tell you

much, of course, about the state of either of our finances. By the

same token, the nearly $420 billion trade deficit that the U.S. ran

with China in 2018 doesn't offer us much information about the

strength or weakness of the U.S. economy.

One object in many of our daily lives, the iPhone, renders trade

deficits especially laughable as a talking point. The iPhone was

invented and designed in America, is powered by Central African

minerals and is brought to life by European and Asian technologies,

but both the World Trade Organization and the U.S. nevertheless

classify it as a 100% Chinese export.

For the purposes of calculating the U.S. trade deficit, it

wouldn't matter if 99 out of every 100 iPhone suppliers were

located in downtown St. Louis. The country "where the last

substantial transformation" of a product occurs gets credit for it.

Because the overwhelming majority of iPhones have their final

assembly done in China, the value of their Swiss gyroscopes, Dutch

motion chips, Japanese retina displays and American glassware gets

assigned to the Chinese economy. The iPhone's assembly is largely

handled by the Taiwanese company Foxconn Technology Group, the

world's largest contract manufacturer of electronics. According to

Reuters, that final assembly is estimated to represent just 3-6% of

the cost of building each phone, or about $10 to $20 for every

iPhone X.

The price of iPhones varies considerably by model and features,

but let's say that a typical one retails for about $999. Business

Insider and the data portal Statista have estimated that, in 2017,

just over 69 million iPhones were sold in America. Because the

trade deficit is calculated using factory costs -- an estimated

$230 per iPhone -- rather than retail prices, iPhones would

contribute about $16 billion to the U.S. trade deficit with China.

Only Apple knows the exact number of iPhones sold in the U.S. each

year, so the actual value of these imports could be somewhat lower

or higher, but the figure is certainly in the tens of billions,

which gets factored straight into our $420 billion trade deficit

with China.

Yet every time a $999 iPhone gets sold to a U.S. customer, that

money doesn't get wired directly to Beijing. The global information

provider IHS Markit estimates that for every iPhone X that gets

sold, $110 is sent to Samsung, the South Korean conglomerate that

makes iPhone displays. (Samsung also produces the Galaxy series of

phones, making them Apple's chief rival in the smartphone market.)

Another $44.45 finds its way to the iPhone's memory chip suppliers:

Toshiba Corp. of Japan and SK Hynix Inc. of South Korea. A little

money goes to Singapore; a little goes to Brazil; a little goes to

Italy; and a little goes to Corning, N.Y. The vast majority of

those dollars go to Apple Park in Cupertino, Calif., while China

earns only an estimated $8.46 for the labor and parts that it

supplies.

The iPhone may be calculated as a Chinese import, but most of

the money that Americans spend on them doesn't travel far from

home. And this is just one of many possible examples showing how

America's trade deficit with China is artificially and

substantially inflated, simply because China often happens to be

the last stop in a given product's long global supply chain.

Trade deficits are also unreliable measures of economic health

for several other reasons. For one, they can be easily distorted by

factors that go beyond a tally of imports and exports. When the

U.S. dollar rises or falls in value, for example, our trade

balances fluctuate. A high dollar renders American exports more

expensive and imports cheaper. So even if the number of products

that the U.S. has imported from overseas hasn't changed, when the

dollar becomes more valuable, American shoppers will probably buy

more imports and sell fewer exports -- making the U.S. trade

deficit "worse." But is that a bad thing? Any change in exchange

rates, inflation or how much people in a country save or invest has

an effect on trade surpluses and deficits.

Global trade has made many products cheaper, stronger, more

innovative or more accessible by influencing supply and demand. It

lowers the price tag on our clothing, allows for more durable car

parts and provides us with blueberries in the wintertime.

But its impact on smartphones and other gadgets has been far

more profound than that: By weaving together the technologies and

resources of many countries, trade has made extraordinary products

possible. American audio chips, Korean batteries, Congolese

minerals, Japanese cameras, German accelerometers: The iPhone may

well be the most truly global product yet.

The oft-touted $420 billion trade deficit with China isn't just

a poor metric for determining the strength of the U.S. economy. It

is also an imprecise number that can lead to bad policy choices.

China isn't the enemy here. In fact, the Chinese make products like

the iPhone possible without reaping much of the benefits.

The lesson of the iPhone is clear: If Americans were left to our

own devices, we'd be left without many devices of our own.

--Mr. Hochberg was chairman and president of the U.S.

Export-Import Bank in 2009-17. This essay is adapted from his new

book, "Trade Is Not a Four-Letter Word: How Six Everyday Products

Make the Case for Trade," recently published by Avid Reader

Press.

(END) Dow Jones Newswires

January 31, 2020 10:53 ET (15:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

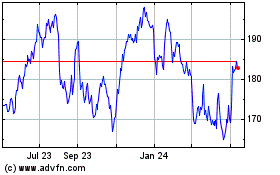

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

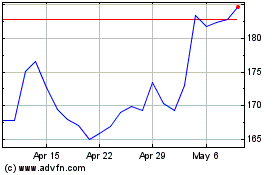

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024