Procter & Gamble Expected to Report $18.42 Billion in Revenue for 4Q -- Earnings Preview

January 22 2020 - 9:33AM

Dow Jones News

By Micah Maidenberg

Procter & Gamble Co. (PG) is scheduled to report its fiscal

second-quarter results before the market opens Thursday. Here is

what you need to know:

EARNINGS FORECAST: P&G is expected to report a profit of

$1.39 a share, or $1.37 a share following adjustments, per the

consensus estimate from FactSet.

REVENUE FORECAST: Analysts believe the Cincinnati-based

consumer-products giant will generate $18.42 billion in

revenue.

OUTLOOK: In October, Procter & Gamble raised the upper end

of its organic-sales forecast for its 2020 fiscal year, predicting

growth of 3% to 5%, compared with the previous outlook of 3% to 4%.

The company also said then that adjusted profits per share would

rise 5% to 10% for the year, up from an increase of 4% to 9%.

The company is scheduled to hold an investor call covering the

quarter starting at 8:30 a.m. ET Thursday.

SALES GROWTH: The maker of Tide laundry detergent, Pampers

diapers and other staples delivered organic-sales growth of 7% for

its quarter that ended Sept. 30, a performance that outpaced gains

on that metric at other consumer-product companies. The question is

whether P&G can maintain such a pace. The company, which sells

its brands to mass merchants, pharmacy chains, club stores,

groceries and other retailers, may have a bit of tailwind from

consumer spending, which in December rose at a seasonally adjusted

rate of 0.3% from the month earlier, according to the Commerce

Department.

HIGH EXPECTATIONS: P&G's stronger quarterly results have

bolstered its stock, with shares rising 39.4% over the last year, a

stronger performance that the 24.3% gain from the S&P 500 (SPX)

over that time, per FactSet. In a recent survey of 26 institutional

investors conducted by Bernstein analysts, 70% of respondents said

their initial responses to P&G as an investment were positive.

That is a reversal from 2015, when 69% of respondents offered

negative initial views about the company's potential. One challenge

for Procter & Gamble is keeping up with these heightened

expectations.

CLOSE SHAVE: Investors may also be looking for updates about the

company's Gillette shaving business. Last summer, P&G recorded

an $8 billion charge as it wrote down the value of that unit, which

has faced intense competition from rivals that have focused on

offering lower prices. But organic sales in the segment that

includes Gillette, as well as the Braun and Venus shaving brands,

rose 1% the previous quarter.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

January 22, 2020 09:18 ET (14:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

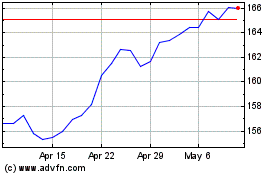

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

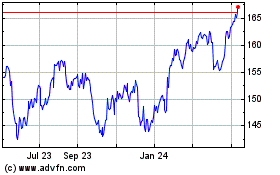

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024