Walmart Lays Off 56 Managers in India -- Update

January 13 2020 - 7:54AM

Dow Jones News

By Eric Bellman

NEW DELHI -- Walmart Inc. has laid off more than 50 of its

managers in India as it pivots its focus to business-to-business

e-commerce to take on Amazon.com and other rivals in the South

Asian nation.

Walmart said Monday that it has let go of 56 managers -- eight

of who were senior -- as it reorganizes operations of its more than

25 Best Price wholesale outlets in India.

"Our members are increasingly becoming omni-channel shoppers,"

buying both online and offline, Krish Iyer, president and chief

executive of Walmart India said in a news release. "We are also

looking for ways to operate more efficiently, which requires us to

review our corporate structure to ensure that we are organized in

the right way."

Walmart India has a total of 5,391 employees in the country.

India's restrictions on foreign investment in retail have kept

Walmart from selling directly to consumers there for decades

through stores. Instead it has set up a wholesale stores. Growth

has been slow but it bought one of India's largest e-commerce

companies, Flipkart Group, for $16 billion in 2018 to turbocharge

its expansion.

The management shake-up is part of Walmart's plans to use the

know-how, connections and talent it acquired when it bought

Flipkart to grow much faster and better serve its members online,

said one person familiar with its plans.

The change in management was needed as the company shifts away

from opening more stores quickly and building its own logistics

chain, and invests more in developing e-commerce and delivery

technology, the person said.

Walmart's more than one million members customers in India are

mostly small businesses, such as restaurants, hotels and

mom-and-pop grocery stores, called kirana in India.

"You look at the kirana stores and there is a change of focus.

Members are going online now and fewer are going to stores," the

person said. "Business is growing very rapidly but the propensity

to visit stores is less today."

India's massive retail market is largely untouched by global

retailers and tough to crack because it is dominated by millions of

tiny shops, tea stalls and vegetable carts. Rather than battle this

powerful lobby, Amazon, Flipkart and other e-commerce leaders in

India have been trying to join forces with the local merchants by

hiring them for deliveries and helping supply their stores.

India's richest man, Mukesh Ambani, is about to launch his own

e-commerce initiative which is also trying to use the mom-and-pop

shows as intermediaries. Walmart's maneuvers should better set it

up for the new competition.

"We are thus investing heavily in technology and have a healthy

pipeline of Best Price stores," said Mr. Iyer in the release. "We

are also looking for ways to operate more efficiently, which

requires us to review our corporate structure to ensure that we are

organized in the right way."

Walmart denied local media reports that it was planning a second

round of layoffs or intended to pull out of the bricks-and-mortar

store business.

Write to Eric Bellman at eric.bellman@wsj.com

(END) Dow Jones Newswires

January 13, 2020 07:39 ET (12:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

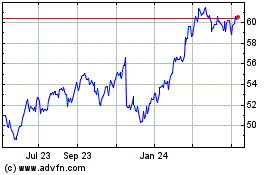

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

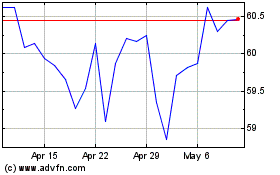

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024