Australian Dollar Climbs After Positive China Data

December 30 2019 - 9:08PM

RTTF2

The Australian dollar strengthened against its most major

counterparts in the Asian session on Tuesday, as China's

manufacturing sector expanded for the second straight month in

December.

Data from the National Bureau of Statistics showed that the

manufacturing Purchasing Managers' Index held steady at 50.2 in

December.

The score was forecast to fall to 50.0.

The factory PMI has stayed above 50 for the second consecutive

month.

The aussie rose to 1.0415 against the kiwi from Monday's closing

value of 1.0395. The next likely resistance for the aussie is seen

around the 1.06 level.

The aussie firmed to 0.7009 against the greenback, its biggest

since July 23. The aussie may possibly face resistance around the

0.71 level.

The Australian currency that ended yesterday's trading at 1.6010

against the euro edged higher to 1.5988. The aussie is seen finding

resistance around the 1.57 level.

In contrast, the aussie held steady against the yen, after

falling to a 4-day low of 76.06 at 10:00 pm ET. At yesterday's

close, the pair was worth 76.15.

Looking ahead, U.S. FHFA's house price index and

S&P/Case-Shiller home price index for October and consumer

sentiment index for December are due out in the New York

session.

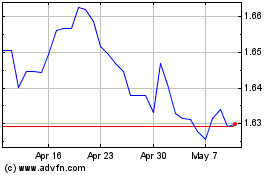

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024