Energy Giants Confront Glut With Wave of Write-Downs

December 20 2019 - 9:26AM

Dow Jones News

By Sarah McFarlane

LONDON -- Royal Dutch Shell PLC joined a clutch of big oil

companies that have taken big financial hits because of a global

glut of oil and gas.

Shell said Friday that it would take an impairment charge of

around $2 billion and warned of lower margins in its refining,

chemicals and retail businesses given the weaker economic

outlook.

The company didn't offer details about the posttax impairment

charge, but analysts said it is likely linked to lower projections

for gas prices. Shell also indicated up to $1 billion in additional

charges from well write-offs, decommissioning costs and deferred

tax charges.

Shell's announcement follows a write-down of more than $10

billion by Chevron Corp. earlier this month, the largest by an

energy producer in years. Spain's Repsol SA, the U.K.'s BP PLC and

Norway's Equinor ASA have also cut asset values in recent

months.

Energy companies are grappling with one of the U.S. shale boom's

unintended consequences: a global oversupply of natural gas. As a

result, companies are predicting weaker-than-expected U.S. gas

prices in the coming years.

Among the energy majors, Exxon Mobil Corp. and BP have the

greatest exposure to U.S. gas at 12% of their production, followed

by Chevron and Shell at 5%, according to RBC Capital Markets.

Doubts over future demand for oil and gas are also weighing on

the sector. In the past decade, the energy industry has switched

from worrying about running out of oil and gas, to predicting

demand for fossil fuels will peak within 20 years as the world

moves to cut carbon emissions.

The falling value of assets on big oil companies' balance sheets

could push up a closely watched measure of their financial

stability, and in turn affect investor returns.

Shell's announcement Friday prompted a 1% fall in the company's

share price in London, potentially driving up its gearing level --

the ratio of market capitalization to debt.

"This is likely to put pressure on gearing and hence raise the

risk that Shell will moderate its current pace of buybacks," said

Colin Smith, an analyst at Panmure Gordon.

Some companies, including BP and Shell, link shareholder returns

to gearing targets.

Shell has a gearing level of around 28% and is targeting 25%. BP

has the highest gearing level among its peers at 36% including

leases, but has said it is aiming to reduce the number below

30%.

Further impairments could be on the way from Exxon and BP,

according to analysts.

Exxon didn't immediately respond to a request for comment.

BP Chief Financial Officer Brian Gilvary said in October that he

wasn't expecting any major impairments in the company's

fourth-quarter results, due Feb. 4. The expectation, he said,

depended on whether the company sold more U.S. gas assets and what

sale prices were in relation to their book value.

"Gearing and net debt coming down will be a strong signal in

terms of [shareholder] distributions," said Mr. Gilvary.

Falling costs across the sector, partly driven by developments

in technology such as predictive maintenance to extract oil and gas

more efficiently, are another driver for lower oil-and-gas price

assumptions, according to analysts.

Digitization has contributed $1 billion to Shell's cash flow,

via cost reductions, production increases and increased customer

margins, the company said at a technology event it hosted in

Amsterdam in November.

"If costs are going to be coming down then a number of the

companies will have to look at the oil and gas price assumptions

they use," said Lydia Rainforth, an analyst at Barclays, adding

that prices tend to follow costs.

According to the bank, however, energy companies' forecasts for

Brent oil prices in 2025 range from $70 to $90 a barrel, higher

than the current level of around $66 a barrel.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

December 20, 2019 09:11 ET (14:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

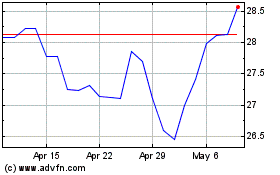

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

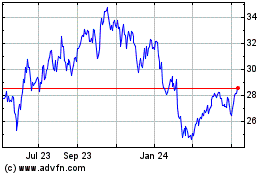

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024