Exxon Found Not Guilty of Fraud in Climate-Change Accounting Case -- Update

December 10 2019 - 11:06AM

Dow Jones News

By Corinne Ramey

A New York state judge found Exxon Mobil Corp. not guilty of

fraud, saying Tuesday that the New York state attorney general had

failed to establish the oil giant had deceived its investors about

how it accounted for the cost of future climate-change

regulations.

The verdict, which capped a nearly three-week civil trial

between Exxon and the New York attorney general's office, is a

victory for the company, which had spent several years fighting the

case. The company is also battling similar accusations in other

state and federal courts.

In his 55-page ruling, New York State Supreme Court Justice

Barry Ostrager said the attorney general's office had failed to

prove the company violated either the Martin Act, a broad antifraud

statute commonly used to pursue financial crime, or other similar

laws.

"The Office of the Attorney General failed to prove, by a

preponderance of the evidence, that ExxonMobil made any material

misstatements or omissions about its practices and procedures that

misled any reasonable investor," Justice Ostrager wrote.

Still, he noted the case was a securities-fraud one, and his

ruling only revolved around that issue. "Nothing in this opinion is

intended to absolve ExxonMobil from responsibility for contributing

to climate change through the emission of greenhouse gases in the

production of its fossil fuel products," the judge wrote.

During the trial, the office of Attorney General Letitia James,

a Democrat, accused the company of using two different accounting

methods -- one public, and one internal -- to project its business

costs in countries that were expected to implement policies to

combat climate change. How the company planned for these costs

mattered to investors, the office said, since it would impact the

future health of the company.

The attorney general had estimated the damage to shareholders to

be as much as $1.6 billion.

Lawyers for Exxon said the company had done nothing wrong. A

reasonable investor wouldn't expect to know such internal

calculations, the company said. It had also accused the attorney

general's office of being motivated by politics in bringing the

case.

A spokesman for Exxon said the ruling affirmed the company

position that it had provided investors with accurate information.

"The court agreed that the Attorney General failed to make a case,

even with the extremely low threshold of the Martin Act in its

favor," the spokesman said.

A spokesman for the attorney general didn't immediately comment

on the ruling.

During the trial's closing arguments, the attorney general's

office dropped two of the four fraud counts from its case. Lawyers

for Exxon argued the office shouldn't be allowed to drop those

counts, saying the company deserved a ruling.

Justice Ostrager said because he found the attorney general

hadn't proved the Martin Act-related counts, his ruling also

established the company wasn't liable on the other fraud counts,

which carry a higher burden of proof.

In addition to the New York case, Exxon faces a lawsuit from the

Massachusetts attorney general's office, in addition to shareholder

lawsuits that accuse the company of deceiving investors. Exxon has

repeatedly denied wrongdoing.

Write to Corinne Ramey at Corinne.Ramey@wsj.com

(END) Dow Jones Newswires

December 10, 2019 10:51 ET (15:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

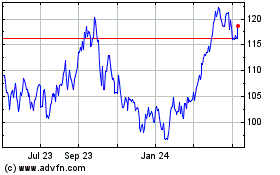

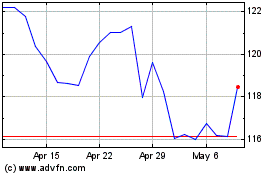

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024