Skandinaviska Seb Publishes Historical Transactional Data For The Baltics

November 26 2019 - 12:00PM

Dow Jones News

TIDMSEBA

Press release

Stockholm 26 November 2019

SEB publishes historical transactional data for the Baltics

Since 2006, SEB has taken considerable measures in order to minimize the

risk of being exploited for money laundering in the Baltics. This is

shown in the historical transactional data for Estonia 2005--2018, which

SEB publishes today. The text below is related to the enclosed graph,

which provides further details on the aforementioned transactional

flows.

-- We want to continue being transparent and have now presented our

historical data for the Baltic region in more detail. We have been

perceptive to signals of foul play and taken action, when needed. In the

comprehensive analysis that we have made of our business in the Baltics,

we have not seen that SEB has been used for money laundering in a

systematic way. Still, at any given time, all banks are subjected to the

risks that financial crime entail, says Johan Torgeby, President and

CEO.

From 2006 and onwards, SEB has been working in a structured and

determined way, in order to reduce the risk of being exploited in money

laundering activities in the Baltic countries. After receiving criticism

from the Estonian financial supervisory authority and information from

another external source in 2006, the bank took several active decisions

in order to reduce risk exposure related to money laundering. A large

number of customer relations were ended. As new information has emerged,

SEB has continuously ended customer relations and has been reporting

suspicious activities to relevant financial police.

SEB has conducted a thorough analysis of each individual customer

relationship and categorized these based on the bank's knowledge of

their operations and payment flows, with an increased focus on Estonia,

since that is where a majority of the transactions took place.

The category "low-transparency-customers" consists of customers whose

historical payment flows to a large part do not meet today's standards

regarding transparency or linkage to authentic business activity.

Approximately 95 percent of these historical low-transparency-flows stem

from Estonia. These types of flows have declined early on in the period

analysed and have, thereby, made up a small and diminishing part of the

total payment flows from non-resident customers. These flows can not be

equated to confirmed money laundering activities, but there is rather an

increased risk for money laundering here.

SEB's comprehensive review covers the bank's customers, processes, risk

culture, systems and transaction volumes during the period 2008-2018 and

the bank's statements are based on these reviews. The review is part of

the basis for the investigation conducted by Sweden's financial

supervisory authority in collaboration with its Baltic counterparts. In

the attached graph, the internal analysis for the years 2008-2018, has

been supplemented with data from 2005-2007.

SEB wants to give everyone who follows the bank equal, accurate and

transparent information. If new relevant information that SEB has not

been aware of before emerges, the bank will take action.

For further information, please

contact

Frank Hojem, Head of Corporate

Communication

+46 70 763 99 47

frank.hojem@seb.se

This is information that Skandinaviska Enskilda Banken AB (publ.)

is obliged to make public pursuant to the EU Market Abuse Regulation.

The information was submitted for publication, through the

agency of the contact persons set out above, at 17.30 CET,

on 26 November 2019.

------------------------------------------------------------------------

SEB is a leading Nordic financial services group with a strong

belief that entrepreneurial minds and innovative companies

are key in creating a better world. SEB takes a long-term perspective

and supports its customers in good times and bad. In Sweden

and the Baltic countries, SEB offers financial advice and a

wide range of financial services. In Denmark, Finland, Norway,

Germany and UK the bank's operations have a strong focus on

corporate and investment banking based on a full-service offering

to corporate and institutional clients. The international nature

of SEB's business is reflected in its presence in some 20 countries

worldwide. At 30 September 2019, the Group's total assets amounted

to SEK 3,046bn while its assets under management totalled SEK

1,943bn. The Group has around 15,000 employees. Read more about

SEB at http://www.sebgroup.com http://www.sebgroup.com.

------------------------------------------------------------------------

Attachment

-- 191126 Historical non-resident flows in Estonia

https://ml-eu.globenewswire.com/Resource/Download/8e4e57f3-4b50-4b3f-aac0-ed0cc108391b

(END) Dow Jones Newswires

November 26, 2019 11:45 ET (16:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

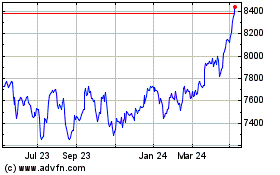

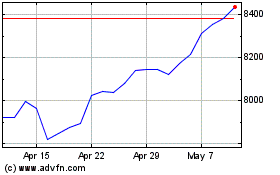

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

FTSE 100

Index Chart

From Apr 2023 to Apr 2024