Tech Shares Power U.S. Stocks Higher

November 25 2019 - 4:55PM

Dow Jones News

By Caitlin Ostroff and Akane Otani

U.S. stocks rose to records at the start of a holiday-shortened

week, buoyed by a rally in shares of technology companies.

Stocks around the world got a boost after Chinese officials

called for speeding up the introduction of penalties and punitive

action for infringement of patents and copyrights in a document

released Sunday.

The U.S. has indicated it wants clearer assurances that China

will follow through on the commitments it has made on the issue,

and on others such as agricultural purchases, before negotiators

will travel to Beijing for a new round of talks.

The statement from China showed officials there are willing to

make concessions and to "come to the table and keep talking," said

Lewis Grant, a portfolio manager at Hermès Investment

Management.

That is a good sign for riskier assets like stocks, which have

swung throughout the year on uncertainty about the U.S. and China's

trade negotiations.

The Dow Jones Industrial Average rose 190.85 points, or 0.7%, to

28066.47. The S&P 500 added 23.35 points, or 0.8%, to 3133.64

and the Nasdaq Composite advanced 112.60 points, or 1.3%, to

8632.49.

All three indexes set fresh closing highs.

Barring any unexpected news, traders expect the week to be

relatively quiet: The stock and bond markets will be closed

Thursday in observance of Thanksgiving Day and then shut early

Friday.

Shares of technology companies were among the biggest gainers in

the U.S. on Monday, with Advanced Micro Devices rising 64 cents, or

1.6%, to $39.79 and Nvidia adding $10.32, or 4.9%, to $221.21.

The semiconductor firms' shares have often fallen when investors

have gotten more nervous about U.S.-China trade tensions and

rebounded on signs of progress between Beijing and Washington.

A flurry of deal-making activity also drove swings among

individual stocks Monday.

Tiffany shares added $7.74, or 6.2%, to $133.25 after LVMH Moët

Hennessy Louis Vuitton said it reached an agreement to buy the U.S.

jeweler for more than $16 billion. LVMH shares gained 2% in

Paris.

Charles Schwab rose $1.11, or 2.3%, to $49.31 after it agreed to

buy smaller rival TD Ameritrade Holding in a stock-swap transaction

valued at about $26 billion. TD Ameritrade shares climbed $3.65, or

7.6%, to $51.78.

EBay shares jumped 73 cents, or 2.1%, to $35.85 after the

e-commerce company said it agreed to sell its StubHub ticketing

business to a Switzerland-based firm, Viagogo.

In the U.K., the pound rose 0.6% against the U.S. dollar as the

Conservative Party maintained a lead in weekend opinion polls after

unveiling its manifesto for the Dec. 12 general elections. Prime

Minister Boris Johnson on Sunday made a series of spending pledges

and ruled out increases in income tax. The FTSE 100 index advanced

0.9%.

The market is starting to anticipate that the Conservative

Party, which has avoided taking any extreme positions in its

manifesto, will win a majority in the elections, Hermès Investment

Management's Mr. Grant said.

The pan-continental Stoxx Europe 600 Index rose 1%, led by gains

in the basic resources and travel and leisure sectors.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com and Akane

Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

November 25, 2019 16:40 ET (21:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

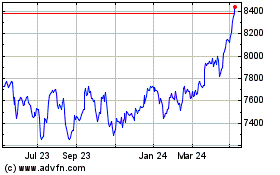

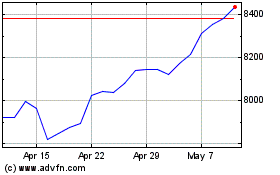

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

FTSE 100

Index Chart

From Apr 2023 to Apr 2024