Global Stocks Gain as China Moves to Boost Intellectual Property Rights

November 25 2019 - 9:12AM

Dow Jones News

By Caitlin Ostroff

Global stocks rose Monday after China said it would step up

intellectual property protection and enforcement, a move that

investors hope may address one of the key concerns for U.S.

negotiators on the trade deal.

Futures linked to the Dow Jones Industrial Average edged up

0.2%, while the Shanghai Composite Index ended the day up 0.7%. The

pan-continental Stoxx Europe 600 Index rose over 0.8%, led by gains

in the basic resources and travel and leisure sectors.

China's government called for speeding up the introduction on

penalties and punitive action for infringement of patents and

copyrights in a document released Sunday.

That step has cheered markets as better protection of

intellectual property rights is among a host of issues that are

being negotiated between the world's two largest economies. The

U.S. has indicated it wants clearer assurances that China will

follow through on the commitments it has made on the issue, and on

others such as agricultural purchases, before negotiators will

travel to Beijing for a new round of talks for a "phase one" trade

deal.

"People think China is willing to make concessions," said Lewis

Grant, a portfolio manager at Hermès Investment Management. "It

shows a willingness on China's part to come to the table and keep

talking."

The optimism about prospects for the trade talks boosted

markets' appetite for riskier assets, and sapped demand for haven

investments. The yield on the 10-year German bund rose to minus

0.349%, from minus 0.358% Friday, while the rate on 10-year U.S.

Treasurys rose to 1.786%, from 1.772% Friday. Gold prices fell

0.4%.

Ahead of the opening bell, shares in Uber Technologies dropped

4% after the ride-sharing company lost its license to operate in

London, one of its biggest markets. The firm, which has pledged to

fight the regulator's decision, can continue to operate until the

appeal process is completed.

A pickup in deal making activity also led to big swings in some

stocks in offhours trading. Shares in Tiffany were buoyed 5.6%

after LVMH Moët Hennessy Louis Vuitton said it reached an agreement

to buy the U.S. jeweler for more than $16 billion. LVMH shares

gained 1.2% in Paris. Shares in Medicines Co. rose over 22% in

offhours trading after Switzerland's Novartis agreed to buy the

cholesterol-drugmaker for nearly $10 billion.

Charles Schwab declined 2.5% in premarket trading after it

agreed to buy smaller rival TD Ameritrade Holding in a stock-swap

transaction valued at about $26 billion. Meanwhile, shares in eBay

gained 3.9% after The Wall Street Journal reported that the online

auctioneer was nearing a deal to sell its ticketing and

classified-ads business StubHub to Viagogo for roughly $4

billion.

Over in the U.K., the pound rose almost 0.3% against the U.S.

dollar as the Conservative Party maintained a lead in weekend

opinion polls after unveiling its manifesto for the Dec. 12 general

elections. Prime Minister Boris Johnson on Sunday made a series of

spending pledges and ruled out increases in income tax. The FTSE

100 index advanced about 1%.

The market is starting to anticipate that the Conservative

Party, which has avoided taking any extreme positions in its

manifesto, will win a majority in the elections, Mr. Grant

said.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

November 25, 2019 08:57 ET (13:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

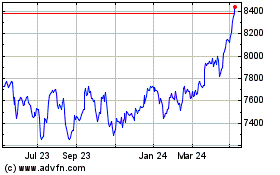

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

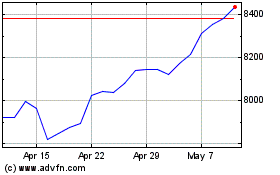

FTSE 100

Index Chart

From Apr 2023 to Apr 2024