Eurozone Private Sector Logs Subdued Growth

November 22 2019 - 2:09AM

RTTF2

Euro area private sector grew at a much slower pace in November,

indicating spillover effects from manufacturing to the services

activity, flash data from IHS Markit showed Friday.

The composite output index fell unexpectedly to 50.3 in November

from 50.6 in October. The expected reading was 50.9.

Although a score above 50 indicates expansion, it signaled the

second slowest growth across manufacturing and services since the

current upturn began in July 2013.

The services Purchasing Managers' Index dropped to 51.5 from

52.2 in the previous month. Economists had forecast a score of

52.4.

Meanwhile, the manufacturing PMI rose to 46.6 from 45.9 a month

ago. The score was forecast to drop to 46.4.

"The Eurozone economy remained becalmed for a third successive

month in November, with the lacklustre PMI indicative of GDP

growing at a quarterly rate of just 0.1 percent, down from 0.2

percent in the third quarter," Chris Williamson, chief business

economist at IHS Markit, said.

New orders fell for the third straight month. The survey showed

signs of the steep ongoing manufacturing decline spreading further

to services.

Employment growth slipped to the lowest for almost five years as

firms took an increasingly cautious approach to hiring. Price

pressures also cooled, running at the lowest for over three

years.

The survey revealed that Germany and France saw some signs of

improvement, while the rest of the euro area saw output fall,

albeit only marginally. Nonetheless, France continued to outpace

Germany.

Germany's private sector shrank at a moderate pace compared to

October. The composite output index rose to 49.2 in November from

48.9 in the previous month. The reading was slightly below forecast

of 49.3.

Manufacturing remained the main area of weakness in November.

The factory PMI advanced to a five-month high of 43.8 from 42.1 in

October.

The services PMI fell to a 38-month low of 51.3 from 51.6 in the

previous month. The expected score was 52.0. Services output grew

at the weakest pace since September 2016.

Elsewhere, France private sector logged strong growth in

November. The composite output index rose slightly to 52.7 from

52.6 in October, but below the forecast of 52.8.

The survey showed that the current run of expansion extended to

eight months and was driven by gains across both the manufacturing

and service sectors.

The services PMI held steady at 52.9 in November. The score was

expected to rise to 53.0.

At the same time, the factory PMI advanced to 51.6 from 50.7 a

month ago and stayed above expectations of 50.9. The sector

registered its fastest increase in output since June.

Overall, while there is some encouragement in today's data

releases for the German industry, these are offset by signs that

the services sector is now struggling too, Andrew Kenningham, an

economist at Capital Economics, said.

And none of this changes the fact that Germany is still flirting

with recession and the Eurozone economy as a whole is very anaemic,

the economist added.

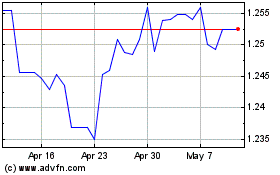

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024