Royal Bank of Scotland Group PLC Director/PDMR Shareholding (8544S)

November 08 2019 - 10:00AM

UK Regulatory

TIDMRBS

RNS Number : 8544S

Royal Bank of Scotland Group PLC

08 November 2019

8 November 2019

The Royal Bank of Scotland Group plc

INITIAL NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING

MANAGERIAL RESPONSIBILITY (PDMRs) in accordance with Article 19 of

the EU Market Abuse Regulation 596/2014

1. The Royal Bank of Scotland Group plc (the Company) announces

that ordinary shares of GBP1 each in the Company (Shares) (ISIN:

GB00B7T77214) were delivered to PDMRs on 7 November 2019, as set

out below.

The Shares delivered represent payment of a fixed share

allowance for the three month period ending 31 December 2019,

unless otherwise indicated below, and have been calculated using a

share price of GBP2.149

The number of Shares delivered, the number of Shares withheld to

meet associated tax liabilities and the number of Shares retained

by each PDMR is as follows:-

Name of PDMR Position of PDMR No. of No. of Shares No. of

Shares withheld to Shares

delivered satisfy associated retained

tax liability

Chief Executive

Alison Rose(1) Officer 101,811 47,852 53,959

------------------------ ----------- -------------------- ----------

Andrew McLaughlin(2) CEO, RBS International 17,454 - 17,454

------------------------ ----------- -------------------- ----------

Bruce Fletcher Chief Risk Officer 34,907 16,407 18,500

------------------------ ----------- -------------------- ----------

Chris Marks CEO, NatWest Markets 58,178 27,344 30,834

------------------------ ----------- -------------------- ----------

Chief Marketing

David Wheldon Officer 13,090 6,153 6,937

------------------------ ----------- -------------------- ----------

Helen Cook Chief HR Officer 14,254 6,700 7,554

------------------------ ----------- -------------------- ----------

Chief Financial

Katie Murray(3) Officer 174,533 82,031 92,502

------------------------ ----------- -------------------- ----------

CEO, Personal

Les Matheson Banking 34,907 16,756 18,151

------------------------ ----------- -------------------- ----------

Mark Bailie CEO, Bó 46,542 21,875 24,667

------------------------ ----------- -------------------- ----------

Chief Administrative

Simon McNamara Officer 37,816 18,152 19,664

------------------------ ----------- -------------------- ----------

Chief Risk Officer,

Vanessa Bailey NatWest Holdings 29,089 13,672 15,417

------------------------ ----------- -------------------- ----------

1. Alison Rose's fixed share allowance represents payment for

the period from 1 October 2019 to 31 October 2019 in respect

of her role as Deputy CEO, NatWest Holdings and CEO, Commercial

& Private Banking, and 1 November 2019 to 31 December 2019

in respect of her role as Chief Executive Officer.

2. The fixed share allowance was delivered when Andrew McLaughlin

was resident in Jersey and therefore is taxable in Jersey only

and not in the UK. No employer tax withholding is required

under Jersey law. The Jersey income tax payable in respect

of the vesting of the award will be paid by the PDMR directly

to the Jersey tax authority.

3. Katie Murray's fixed share allowance represents payment

for the period from 1 July 2019 to 31 December 2019.

The above transactions took place outside of a trading venue.

The market price used to determine the number of Shares withheld to

meet associated tax liabilities was GBP2.157. Shares retained after

payment of associated tax liabilities will be held on behalf of

PDMRs in the Computershare Retained Share Nominee account and will

be released in instalments over a three year period.

Legal Entity Identifier: 2138005O9XJIJN4JPN90

For further information contact:-

RBSG Investor Relations

Alexander Holcroft

Head of Investor Relations

+44(0)20 7672 1758

RBSG Media Relations

+44(0)131 523 4205

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHLLFESLFLTIIA

(END) Dow Jones Newswires

November 08, 2019 10:00 ET (15:00 GMT)

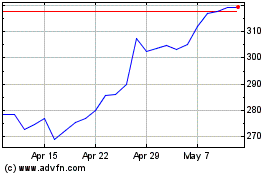

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

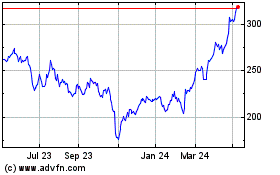

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024