Rolls-Royce Warns of Further Hit From Trent 1000 Issues

November 07 2019 - 3:11AM

Dow Jones News

By Adria Calatayud

Rolls-Royce Holdings PLC (RR.LN) on Thursday warned of a further

earnings and cash-flow hit on the back of issues in its troubled

Trent 1000 engines, as the company expects to book a charge of 1.4

billion pounds ($1.80 billion).

The British aircraft-engine maker said it now expects full-year

operating profit and free cash-flow to be toward the lower end of

its guidance ranges as a result of higher costs in fixing Trent

1000 engines used on Boeing Co.'s (BA) 787 Dreamliner planes.

The company estimates in-service cash costs over the Trent 1000

issues will amount to GBP2.4 billion across the 2017-23 period.

This includes GBP1.6 billion previously expected, a fresh GBP400

million hit and a further GBP400 million in costs previously

included within the company's normal program contingency,

Rolls-Royce said.

Separately, Rolls-Royce will book an exceptional charge to

operating profit of GBP1.4 billion in 2019, it said. This reflects

additional cash costs associated with customer disruption and

remediation as well as recognition of future contract losses, the

company said.

Rolls-Royce said it is taking further action, including

accelerated investments in additional maintenance capacity and

spare engines, to reduce disruption.

The company said it expects to deliver a free cash flow of at

least GBP1 billion in 2020 and that it is confident in its midterm

ambition of a free cash-flow of GBP1 a share as Trent 1000 costs

subside.

"My top priority is improving customer confidence in the Trent

1000," Chief Executive Warren East said.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

November 07, 2019 02:56 ET (07:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

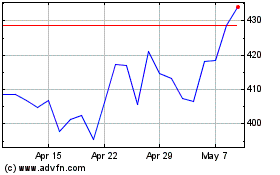

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

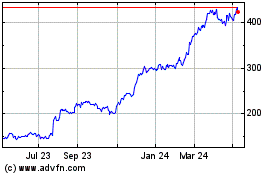

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024