Qualcomm's Earnings Slump Shows Signs of Easing

November 06 2019 - 5:03PM

Dow Jones News

By Asa Fitch

Qualcomm Inc. has been struggling to turn a leadership position

in the race to power 5G handsets into profit growth amid the

U.S.-China trade dispute and a slower pace of phone releases, but

signaled in quarterly earnings its fortunes would turn in coming

months.

The San Diego-based chip maker on Wednesday reported a revenue

decline of 17% year-over-year to $4.81 billion in its fiscal fourth

quarter, exceeding a FactSet analyst survey consensus of $4.76

billion.

Adjusted earnings per share fell to 78 cents, above analysts'

expectations and at the higher end of a range management forecast

three months ago.

The company said it shipped 152 million chips in the quarter,

down 34% compared with the same quarter a year ago, underscoring

the effect of trade turmoil and a weaker handset market. The

shipment figures were in line with executives' forecasts.

Many investors had been expecting worse after the company put

forth a gloomy forecast in July, suggesting shipments of key chips

could fall as much as 40% year-over-year in the fiscal fourth

quarter.

Qualcomm shares were up around 3% in after-hours trading

following the results.

Qualcomm issued an outlook for the current quarter that

generally was above market expectations, even though earnings are

still likely to trail last year's figure.

Qualcomm also said its interim chief financial officer, Akash

Palkhiwala, would hold the role on a full-time basis. Its former

financial, George Davis, left the company to become Intel's CFO in

April.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

November 06, 2019 16:48 ET (21:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

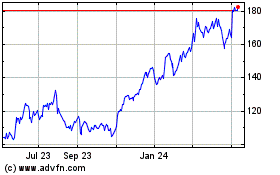

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

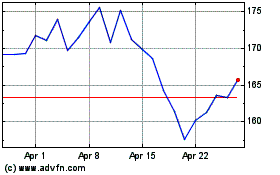

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024