Pound Climbs As Labour Announces Support For Bill Calling Dec. Election

October 29 2019 - 5:12AM

RTTF2

The pound advanced against its major counterparts in the

European session on Tuesday, erasing its early losses, after the

U.K. Labour Party indicated its support for a bill pushing for a

December election in Parliament, which is set to be tabled

today.

The Labour leader Jeremy Corbyn announced his backing for an

election, saying that "his party's condition of taking a no-deal

Brexit off the table had been met" after the European Union's

decision to extend the Brexit deadline until January 31, 2020.

His remarks came before Prime Minister Boris Johnson's new bill

calling for a snap election is set to be presented in

Parliament.

The new bill just requires a simple majority vote of MPs to pass

the legislation.

The PM's latest attempt come after he failed to get the support

of two-thirds of majority to win on Monday.

The Scottish National Party and Liberal Democrats have also

indicated support for an early election, raising strong possibility

for succeeding the bill.

Data from the Bank of England showed UK consumer credit grew at

the slowest pace in more than five years and mortgage approvals

rose only marginally in September.

The extra amount borrowed by consumers in order to buy goods and

services fell to GBP 0.8 billion in September. Consumer credit was

below GBP 1.1 billion for the second month in a row.

The currency declined against its most major counterparts in the

Asian session, as the British parliament rejected a plan by Boris

Johnson to allow a snap election.

The pound strengthened to a 5-day high of 1.2821 against the

franc, from a low of 1.2745 seen at 6:15 am ET. The currency is

seen locating resistance around the 1.31 level.

After falling to 1.2807 against the greenback at 5:00 am ET, the

pound bounced off to 1.2873. The currency may possibly challenge

resistance around the 1.30 level, if it rallies further.

The pound recovered to 140.25 against the yen, following a

decline to 139.47 at 6:15 am ET. On the upside, 142.5 is possibly

seen as its next resistance level.

Data from the Ministry of Internal Affairs and Communications

showed that consumer prices in the Tokyo region of Japan rose 0.4

percent on year in October.

That was unchanged from the September reading, although it was

well shy of forecasts for an increase of 0.7 percent.

The pound firmed to a 5-day high of 0.8610 against the euro,

reversing from a low of 0.8651 it touched at 6:15 am ET. Next

immediate resistance for the pound is seen around the 0.84

level.

Looking ahead, U.S. consumer confidence index for October and

pending home sales for September will be featured in the New York

session.

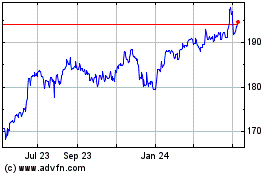

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

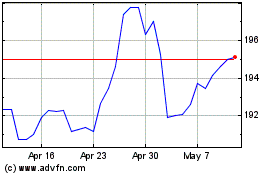

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024