GROUPE RENAULT : Quarterly information - September 30, 2019

PRESS

RELEASE#RenaultResults

REVENUES OF €11.3 BILLION IN THE THIRD QUARTER OF

2019

- Group revenues reached €11,296 million (-1.6%) in the

quarter. At constant exchange rates and

perimeter1, the decrease would have been

-1.4%.

- The Group sold 852,198 vehicles in the quarter, down

-4.4% in a global market down -3.2%2. Excluding

Iran, the decrease would have been -1.8% in a market down

-2.3%.

- The Group is pursuing its pricing policy in the third

quarter.

Boulogne-Billancourt, 10/25/2019

COMMERCIAL RESULTS: THIRD QUARTER

HIGHLIGHTS

In the third quarter, Groupe Renault sold

852,198 vehicles, down -4.4% in a market that fell by -3.2%.

Excluding Iran, the decrease would have been -1.8% in a market down

-2.3%.

In Europe, the Group recorded a

-3.4% decline in sales in a market up +2.4%. This decrease is

partly due to a high comparison basis related to the introduction

of the WLTP3 for passenger cars in September 2018 and the awaiting

of the full availability of New Clio in Europe.

In regions outside Europe, the

Group over-performed the market. In a market down -6.2%, the Group

recorded a -5.4% decrease in sales, mainly due to the decline in

markets in Turkey (-21.7%), Argentina (-30.0%), and the end of

sales in Iran since August 2018 (23,649 vehicles sold in the third

quarter 2018). Excluding Iran, sales would have been down

-0.3%.

In Eurasia, market share

increased by +1.8 points. Group sales increased by +5.1% despite

the fall of the Turkish market. Sales volume increased in

Russia (+6.1%) in a market down -1.2%, thanks in

particular to the launch of Arkana and the continuing success of

Lada products.

In Americas, market share was

up +0.2 points. Brazil saw its volumes increase by

+5.6% but Argentina recorded a fall of -37.7%.

In Africa, Middle East, India and

Pacific region, excluding Iran, market share was up +0.1

points. Sales volumes in the region are impacted by the decline of

its main markets. In India, market share increased

by +0.5 points, thanks to the successful launch of Triber. Sales

fell by -7.8% in a market down -27.4%. In South

Korea, the Group recorded a sales increase of +11.5% in a

market down -1.7% thanks to the success of QM6.

In the China region, Group's

volumes were down -15.5% in a market down -5.0% awaiting the launch

of New Captur and Renault City K-ZE, the new electric city car.

THIRD QUARTER REVENUES BY OPERATING

SECTOR

In the third quarter of 2019, Group

revenues reached €11,296 million (-1.6%). At constant

exchange rates and perimeter4, Group revenues would have decreased

by -1.4%.

Automotive excluding AVTOVAZ

revenues amounted to €9,662 million, down -3.9%. Sales to partners

dropped by -5.5 points due to lower production for Nissan and

Daimler, the closure of the Iranian market since August 2018 and

the decline in demand for diesel engines in Europe.The negative

-0.7 points currency effect was mainly due to the devaluation of

the Argentinian Peso. The volume effect weighed -0.8 points, mainly

due to the fall in the Argentinian, Indian, Turkish markets and a

high comparison basis in 2018 in Europe. This decrease was

partially offset by a favorable impact of the change in

inventories. The price effect was positive by +2.1 points. It

reflects the effects of the Group's pricing policy in Europe as

well as efforts to offset the devaluation of the Argentinian

Peso.

Sales Financing (RCI Banque)

posted revenues of €843 million in the third quarter, up +5.4%

compared to 2018. The number of new financing contracts fell -0.8%,

mainly due to lower activity in Argentina and in Turkey. Average

performing assets increased by +5.1% to €47.6 billion.

AVTOVAZ contribution to Group

revenues amounted to €791 million in the quarter, up +26.2%, after

taking into account a positive exchange rate effect of €59 million.

At constant exchange rates, revenues would have been up +16.7%.

OUTLOOK 2019

In 2019, the Global Automotive market5 is

expected to decline by around -4% compared to 2018 (versus around

-3% previously anticipated).

The European market is expected to be between 0%

to -1% (versus stable previously), the Russian market to be down by

around -3% (versus -2% to -3% previously) and the Brazilian market

to grow around +7% (versus around +8% previously).

On October 17, 2019, Groupe Renault revised its

guidance:

- Published Group revenues should decline between -3% and

-4%

- Group operating margin should be around 5%

- The Automotive operating free cash flow should be positive in

H2 while not guaranteed for the full year.

GROUPE RENAULT CONSOLIDATED

REVENUES

|

(€ million) |

2019 |

2018 |

Change2019/2018 |

|

Q1 |

|

|

|

|

Automotive excluding AVTOVAZ |

10,916 |

11,646 |

-6.3% |

|

Sales Financing |

844 |

793 |

+6.4% |

|

AVTOVAZ |

767 |

716 |

+7.1% |

|

Total |

12,527 |

13,155 |

-4.8% |

|

Q2 |

|

|

|

|

Automotive excluding AVTOVAZ |

13,875 |

15,221 |

-8.8% |

|

Sales Financing |

859 |

820 |

+4.8% |

|

AVTOVAZ |

790 |

761 |

+3.8% |

|

Total |

15,524 |

16,802 |

-7.6% |

|

Q3 |

|

|

|

|

Automotive excluding AVTOVAZ |

9,662 |

10,057 |

-3.9% |

|

Sales Financing |

843 |

800 |

+5.4% |

|

AVTOVAZ |

791 |

627 |

+26.2% |

|

Total |

11,296 |

11,484 |

-1.6% |

|

9 months YTD |

|

|

|

|

Automotive excluding AVTOVAZ |

34,453 |

36,924 |

-6.7% |

|

Sales Financing |

2,546 |

2,413 |

+5.5% |

|

AVTOVAZ |

2,348 |

2,104 |

+11.6% |

|

Total |

39,347 |

41,441 |

-5.1% |

TOTAL GROUP’S SALES PC+LCV BY

REGION

|

|

Q3 |

Ytd end of September |

|

Regions |

2019 |

2018 |

% var. |

2019 |

2018 |

% var. |

|

France |

136,645 |

142,320 |

-4.0% |

516,099 |

531,536 |

-2.9% |

|

Europe* (Excl France) |

280,722 |

289,548 |

-3.0% |

972,440 |

971,386 |

+0.1% |

|

France + Europe Total |

417,367 |

431,868 |

-3.4% |

1,488,539 |

1,502,922 |

-1.0% |

|

Africa Middle East India Pacific |

99,392 |

124,205 |

-20.0% |

319,205 |

428,201 |

-25.5% |

|

Eurasia |

183,507 |

174,664 |

+5.1% |

536,112 |

546,428 |

-1.9% |

|

Americas |

109,543 |

110,709 |

-1.1% |

315,284 |

324,854 |

-2.9% |

|

China |

42,389 |

50,138 |

-15.5% |

132,138 |

167,849 |

-21.3% |

|

Total Excl France + Europe |

434,831 |

459,716 |

-5.4% |

1,302,739 |

1,467,332 |

-11.2% |

|

World |

852,198 |

891,584 |

-4.4% |

2,791,278 |

2,970,254 |

-6.0% |

* Europe = European Union (exclude France & Romania),

Island, Norway, Switzerland, Serbia and Balkan states

TOTAL SALES BY BRAND

|

|

Q3 |

Ytd end of September |

|

|

2019 |

2018 |

% var |

2019 |

2018 |

% var |

|

RENAULT |

|

|

|

|

|

|

|

PC |

425,786 |

491,797 |

-13.4% |

1,437,709 |

1,666,697 |

-13.7% |

|

LCV |

93,036 |

87,020 |

+6.9% |

309,338 |

301,673 |

+2.5% |

|

PC+LCV |

518,822 |

578,817 |

-10.4% |

1,747,047 |

1,968,370 |

-11.2% |

|

RENAULT SAMSUNG MOTORS |

|

|

|

|

|

|

|

PC |

21,621 |

20,218 |

+6.9% |

55,084 |

58,798 |

-6.3% |

|

DACIA |

|

|

|

|

|

|

|

PC |

156,194 |

141,484 |

+10.4% |

527,977 |

496,431 |

+6.4% |

|

LCV |

9,982 |

10,574 |

-5.6% |

35,291 |

33,777 |

+4.5% |

|

PC+LCV |

166,176 |

152,058 |

+9.3% |

563,268 |

530,208 |

+6.2% |

|

LADA |

|

|

|

|

|

|

|

PC |

100,803 |

97,050 |

+3.9% |

294,136 |

276,800 |

+6.3% |

|

LCV |

3,416 |

3,184 |

+7.3% |

9,166 |

9,918 |

-7.6% |

|

PC+LCV |

104,219 |

100,234 |

+4.0% |

303,302 |

286,718 |

+5.8% |

|

ALPINE |

|

|

|

|

|

|

|

PC |

1,103 |

749 |

+47.3% |

3,949 |

1,385 |

+185.1% |

|

JINBEI&HUASONG |

|

|

|

|

|

|

|

PC |

2,838 |

1,958 |

+44.9% |

7,253 |

10,615 |

-31.7% |

|

LCV |

37,419 |

37,550 |

-0.3% |

111,375 |

114,160 |

-2.4% |

|

PC+LCV |

40,257 |

39,508 |

+1.9% |

118,628 |

124,775 |

-4.9% |

|

GROUPE RENAULT |

|

|

|

|

|

|

|

PC |

708,345 |

753,256 |

-6.0% |

2,326,108 |

2,510,726 |

-7.4% |

|

LCV |

143,853 |

138,328 |

+4.0% |

465,170 |

459,528 |

+1.2% |

|

PC+LCV |

852,198 |

891,584 |

-4.4% |

2,791,278 |

2,970,254 |

-6.0% |

GROUPE RENAULT’S TOP 15 MARKETS YEAR-TO-DATE SEPTEMBER

2019

|

Year-to-date 09-2019 |

Volumes* |

PC+LCV market share |

| |

|

(units) |

(in %) |

|

1 |

FRANCE |

516,099 |

25.8 |

|

2 |

RUSSIA |

367,679 |

28.9 |

|

3 |

GERMANY |

191,852 |

6.5 |

|

4 |

BRAZIL |

174,478 |

9.0 |

|

5 |

ITALY |

170,646 |

10.7 |

|

6 |

SPAIN+CANARY

ISLANDS |

144,293 |

12.8 |

|

7 |

CHINA |

132,078 |

0.8 |

|

8 |

UNITED

KINGDOM |

89,659 |

4.2 |

|

9 |

BELGIUM+LUXEMBOURG |

71,685 |

13.0 |

|

10 |

SOUTH KOREA |

60,402 |

4.8 |

|

11 |

INDIA |

54,507 |

2.1 |

|

12 |

POLAND |

53,608 |

11.7 |

|

13 |

ARGENTINA |

53,353 |

14.6 |

|

14 |

TURKEY |

53,037 |

18.9 |

|

15 |

ROMANIA |

52,871 |

37.6 |

* Sales, excluding Twizy

About Groupe RenaultGroupe

Renault has manufactured cars since 1898. Today it is an

international multi-brand Group, selling close to 3.9 million

vehicles in 134 countries in 2018, with 36 manufacturing sites,

12,700 points of sales and employing more than 180,000 people. To

address the major technological challenges of the future, while

continuing to pursue its profitable growth strategy, Groupe Renault

is focusing on international expansion. To this end, it is drawing

on the synergies of its five brands (Renault, Dacia, Renault

Samsung Motors, Alpine and LADA), electric vehicles, and its unique

alliance with Nissan and Mitsubishi Motors. With a 100% Renault

owned team committed to the Formula 1 World Championship since

2016, the brand is involved in motorsports, a real vector for

innovation and awareness.

FOR MORE INFORMATION, PLEASE CONTACT:

Frédéric

Texierfrederic.texier@renault.comDirector of Corporate

Communications+33 1 76 84 33 67 +33 6 10 78 49 20

Delphine

Dumonceaudelphine.dumonceau-costes@renault.comPress

officer+33 1 76 84 36 71+33 6 09 36 40 53

Renault Press: + 33 1 76 84 63 36Website:

Grouperenault.comFollow us: @Groupe_Renault

1 In order to analyze the change in consolidated revenues at

constant perimeter and exchange rates, Groupe Renault recalculates

revenues for the current year by applying the average annual

exchange rates of the previous year, and excluding significant

changes in perimeter that occurred during the year.

2 The evolution of the Global Automotive market

for all brands also called Total Industry Volume (TIV) indicates

the annual variation in sales* volumes of passenger cars and light

commercial vehicles** in the main countries including USA &

Canada, provided by official authorities or statistical agencies in

each country, and consolidated by Groupe Renault to constitute this

world market (TIV). *Sales: registrations or deliveries or invoices

according to the data available in each consolidated

country.**Light commercial vehicles of less than 5.1 tons.

3 WLTP : Worldwide harmonized Light vehicles Test Procedures

4 In order to analyze the change in consolidated revenues at

constant perimeter and exchange rates, Groupe Renault recalculates

revenues for the current year by applying the average annual

exchange rates of the previous year, and excluding significant

changes in perimeter that occurred during the year.

5 The evolution of the Global Automotive market

for all brands also called Total Industry Volume (TIV) indicates

the annual variation in sales* volumes of passenger cars and light

commercial vehicles** in the main countries including USA &

Canada, provided by official authorities or statistical agencies in

each country, and consolidated by Groupe Renault to constitute this

world market (TIV). *Sales: registrations or deliveries or invoices

according to the data available in each consolidated

country.**Light commercial vehicles of less than 5.1 tons.

- 20191025_PR_Q3_GROUPE RENAULT VDEF

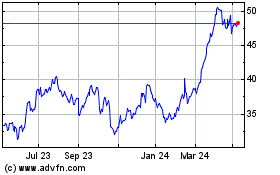

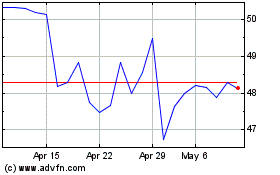

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024