Global Stocks Mixed Amid Trade Uncertainty

October 14 2019 - 5:07AM

Dow Jones News

By Caitlin Ostroff and Joanne Chiu

-- Asian equities rally on optimism about U.S.-China trade deal

-- European shares drop as region braces for fresh U.S. tariffs

-- Pound weakens with Brexit-deal optimism wavering

-- Pound weakens with Brexit-deal optimism wavering

-- European shares drop as region braces for fresh U.S.

tariffs

-- Asian equities rally on optimism about U.S.-China trade

deal

Global stocks painted a mixed picture at the start of the week

as optimism about a potential U.S.-China trade deal was offset by

uncertainty surrounding Brexit and fresh tariffs in Europe.

Stocks in Asia, which had ended trading before President Trump

said Friday that the U.S. and China had completed the early stages

of a deal, rallied on the news Monday. The Shanghai Composite gauge

advanced 1.2% while the benchmark Hang Seng Index in Hong Kong rose

0.9%. The Chinese yuan strengthened 0.4% to 7.0564 a dollar in

offshore trading.

"The ceasefire suggested that China and U.S. trade negotiations

were moving back to the right track," said Ken Cheung, chief Asian

foreign-exchange strategist at Mizuho Bank.

Still, U.S. stock futures ticked slightly lower on Monday as

fresh questions cropped up over the weekend about the two

countries' ability to reach a broader agreement.

The world's two largest economies ended last week by saying they

had taken initial steps to cement a trade agreement, with

Washington forgoing a planned increase in tariffs on imports from

China that was scheduled to go into place in the coming days. While

Beijing agreed to boost purchases of U.S. agricultural products,

details remained elusive, and disagreements on a number of other

issues remained unresolved.

Over in Europe, the pound fell 0.5% against the dollar. The

weekend of talks between European Union and British negotiators,

who face a deadline this week to reach a deal on Brexit, failed to

result in a breakthrough. Diplomats said even the outline of a deal

looked difficult to clinch given the gap between the sides and the

complexity of the issues, erasing some of last week's optimism. The

U.K.'s FTSE 100 barometer dropped 0.5%.

The pan-continental Stoxx Europe 600 gauge fell 0.7%, led by

declines in basic-resources companies. Questions about economic

growth prospects in the region continue to mount, especially after

the U.S. earlier this month announced plans to hit European

airlines, whiskey, cheese and hand tools with tariffs later this

week.

While U.S. bond markets will be closed Monday in observance of

Columbus Day, stock trading will resume, though likely with lower

volumes than normal.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com and Joanne

Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

October 14, 2019 04:52 ET (08:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

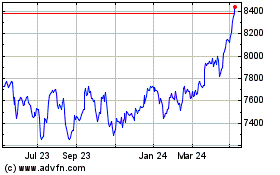

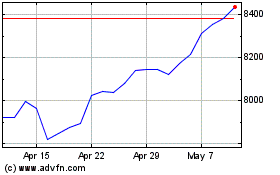

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

FTSE 100

Index Chart

From Apr 2023 to Apr 2024