Investors Hold Fire Ahead of Fed Minutes

October 09 2019 - 5:09AM

Dow Jones News

By Anna Isaac

-- Brent crude falls

-- Gold prices rise

-- Asian markets mixed

Global stocks were mixed as investors awaited the resumption of

U.S.-China trade talks and looked for fresh signals from the

Federal Reserve on monetary easing.

Japan's benchmark Nikkei 225 index slipped 0.6% as data on

machine-tool orders confirmed a bleak picture for the country's

manufacturing sector.

The "numbers remain abysmal," analysts at Pantheon

Macroeconomics said in a note. "The absence of any hints of a

sustainable recovery suggests that industrial production in Japan,

and output globally, looks set to stay subdued in year-on-year

terms," they said.

Hong Kong's Hang Seng dropped 0.8% amid tensions over protests

in the city. The Shanghai Composite gauge climbed 0.4%.

In Europe, the Stoxx Europe 600 edged up 0.2%, led by equities

in Germany. The U.K.'s FTSE 100 index ticked up 0.3%, a day after

the pound weakened and made British assets appear more

attractive.

Sterling, which fell Tuesday after U.K. leaders clashed with

their European counterparts over Brexit, edged up 0.1% against the

U.S. dollar.

Investors moved toward haven assets such as gold. The precious

metal rose 0.6% Wednesday and remained above $1,500 a troy ounce, a

level it broke through for the first time in six years in August.

It is up around 17% this year.

Later Wednesday, investors are likely to listen closely to any

fresh signals from Federal Reserve Chairman Jerome Powell in a

speech in Kansas City. The Fed will increase its purchases of

short-term securities soon in an effort to avoid stress in lending

markets, Mr. Powell said Tuesday.

The U.S. central bank will later Wednesday release the minutes

from its September meeting, which will likely be scrutinized

closely for any insight into the interest-rate outlook.

In commodities, the benchmark for global oil, Brent crude, fell

0.2% to $58.11 a barrel.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

October 09, 2019 04:54 ET (08:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

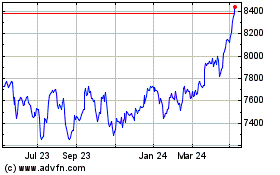

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

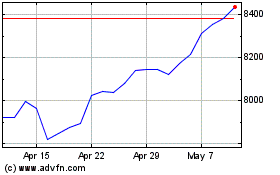

FTSE 100

Index Chart

From Apr 2023 to Apr 2024