Bayer's Board Adds Farming Expert -- WSJ

October 02 2019 - 3:02AM

Dow Jones News

By Ruth Bender

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 2, 2019).

MONHEIM AM RHEIN, Germany -- Bayer AG Tuesday appointed a

prominent U.S. agriculture expert to its board in the German

chemicals and pharmaceuticals company's latest effort to convince

investors that it has its troubled crop-science business under

control.

Bayer said Ertharin Cousin, a former director of the United

Nations World Food Program, would succeed German manager Thomas

Ebeling on its supervisory board.

Large Bayer shareholders had expressed concern about a lack of

expertise among the company's nonexecutive directors in assessing

the difficulties Bayer has faced since acquiring U.S. agriculture

giant Monsanto Co. last year.

With the acquisition, Bayer inherited thousands of lawsuits

claiming that Monsanto's Roundup herbicide causes cancer. Bayer has

argued that Roundup is safe, but it lost the first three U.S. jury

trials, which sent its share price plummeting and frustrated

shareholders.

As tension rose between shareholders and management, culminating

in a rare no-confidence vote at this year's general meeting,

investors pushed the company to beef up its legal expertise and

bring in more people to oversee an agriculture business that now

accounts for nearly half of group sales.

Ms. Cousin, a lawyer by training, served as the U.S. ambassador

to the U.N. Agencies for Food and Agriculture from 2009 to 2012,

and held several positions in the private sector, such as head of

public affairs at U.S. supermarket chain Albertsons.

Bayer Chairman Werner Wenning said Ms. Cousin's "expertise and

international experience at the interface between government,

business, academia and civil society" would give Bayer new

perspective.

Under Germany's dual-board structure, nonexecutive directors who

represent shareholders and employees act as a controlling instance

on management. And with their trust in the company's leaders

severely dented, shareholders have pushed to tighten their

control.

In June, Bayer responded by creating a special committee of the

board with responsibility for the Roundup lawsuits. The company

also hired a lawyer to advise directors on the proceedings.

While they welcomed the efforts, analysts said nothing short of

resolving the Roundup lawsuits would suffice to lift the

uncertainty that is still clouding the group's prospects and

weighing on its stock.

In recent months, Bayer has hinted that it was growing more open

to settling with plaintiffs, prompting a limited rally in its

shares. But it also continues to fight cases in court and is

appealing all three verdicts against it.

"The point for us is to have finality," Liam Condon, head of

Bayer's crop-science unit, told The Wall Street Journal at a

Bayer-organized conference on the future of farming. "What doesn't

make any sense is to settle and leave a lot of cases open, because

that doesn't settle anything for anybody."

When pharmaceuticals companies settle damage claims that target

their drugs, they typically withdraw the medicine from sale or add

additional warning labels. Bayer's plan to continue to sell Roundup

even after a settlement is complicating the process.

One of the keys to finding a potential settlement agreement, Mr.

Condon said, was finding a way to prevent future lawsuits over a

product that not only is still being sold but also can't be labeled

as risky since regulators deem it safe. Whether that could be

achieved remained unclear, he said.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

October 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

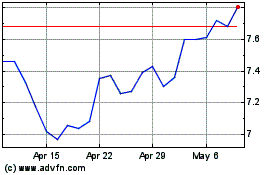

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

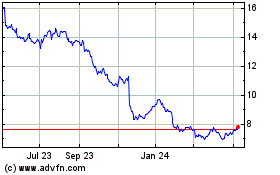

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024