Canadian Dollar Advances After Consumer Inflation Data

September 18 2019 - 5:29AM

RTTF2

The Canadian dollar strengthened against its major counterparts

in the European session on Wednesday, following the release of

better than expected inflation data for August.

Data from Statistics Canada showed that the inflation came in

flat on a seasonally adjusted monthly basis in August, after rising

0.4 percent in the previous month. Economists had expected a 0.2

percent drop.

Core CPI, excluding food and energy, grew 0.2 percent in August,

unchanged from last month.

On an annual basis, consumer prices rose an unadjusted 1.9

percent in August, following a 2.0 percent increase in July. The

rate was forecast to rise 2.0 percent.

The loonie traded mixed against its major rivals in the previous

session. While it held steady against the yen and the euro, it fell

against the greenback. Against the aussie, it rose.

The loonie advanced to 1.3237 against the greenback, from an

early low of 1.3272. The next possible resistance for the loonie is

seen around the 1.30 level.

Reversing from its early lows of 0.9098 against the aussie and

1.4676 against the euro, the loonie edged up to 0.9059 and 1.4630,

respectively. Next immediate resistance for the loonie is eyed

around 0.89 against the aussie and 1.44 against the euro.

The loonie gained to 81.71 against the yen, off an early low of

81.54. The loonie is poised to find resistance around the 83.5

level.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 136.329 billion yen in August.

That beat forecasts for a shortfall of 365.4 billion yen

following the 250.7 billion yen deficit in July.

Looking ahead, at 2:00 pm ET, the Fed announces its decision on

interest rates. Economists widely expect the Fed to cut federal

funds rate to between 1.75 percent and 2.00 percent.

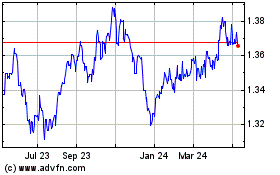

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

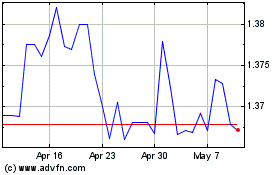

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024