TIDMN4P

RNS Number : 6738M

N4 Pharma PLC

18 September 2019

18 September 2019

N4 Pharma Plc

("N4 Pharma" or the "Company")

Interim Results

N4 Pharma Plc (AIM: N4P), the specialist pharmaceutical company

developing Nuvec(R), a novel delivery system for vaccines and

cancer treatments, announces its unaudited interim results for the

six months ended 30 June 2019.

Key events:

-- Placing of 10,500,000 ordinary shares to raise approximately GBP1.0m net of expenses

-- Commissioned repeat of its successful in vivo study using

Ovalbumin ("OVA) pDNA at University of Queensland ("UQ") to try and

identify causes of inconsistent results seen working with

University of Adelaide and other CROs

-- Commenced search for other asset opportunities to add to the Company portfolio

-- Appointment of Dr John Chiplin as non-executive Chairman

-- Appointment of Dr Chris Britten as non-executive Director

-- Cash balance at period end of approximately GBP1.2 million

Post period end:

-- Received successful results for UQ OVA pDNA study, confirming

the ability of Nuvec(R) to increase antibody responses using

multiple injections at certain doses

-- Commenced work to improve dispersity of Nuvec(R) formulations

loaded with pDNA and initiate further in vivo work to test improved

formulation

Nigel Theobald, Chief Executive Officer of N4 Pharma Plc,

commented:

"In this period, we have confirmed that Nuvec(R) works for both

DNA and mRNA delivery, having produced an antibody response for

both. We have also made progress in understanding how Nuvec(R)

behaves once loaded with DNA and mRNA. We have put in place a clear

plan to investigate how we can improve the dispersion of Nuvec(R)

once loaded with DNA. We will then test this improvement in both in

vitro and in vivo studies and conduct an oncology efficacy

model.

The development and improvement of our Nuvec(R) particle once

loaded with DNA and mRNA is an essential step on its path towards

use in clinical trials and usual for the evolution of any delivery

system. Nuvec(R) still shows great potential as a delivery system

for nucleic acids and we remain excited and confident about its

future."

Enquiries:

N4 Pharma Plc Via Scott PR

Nigel Theobald, CEO

Allenby Capital Limited Tel: +44 (0)203 328 5656

James Reeve/Asha Chotai

Scott PR Tel: +44 (0)1477 539 539

Georgia Smith

About N4 Pharma

N4 Pharma is a specialist pharmaceutical company developing a

novel delivery system for vaccines and cancer treatments using its

unique silica nanoparticle delivery system called Nuvec(R).

N4 Pharma's business model is to partner with companies

developing novel antigens for vaccines and cancer treatments to use

Nuvec(R) as the delivery vehicle to get their antigen into cells to

express the protein needed for the required immunity. As these

products progress through pre clinical and clinical programs, N4

Pharma will seek to receive up front payments, milestone payments

and ultimately royalty payments once products reach the market.

Chairman's Statement

Half year results

During the six months to 30 June 2019, the Company raised an

additional GBP1.0m net of expenses through the issue of 10,500,000

new ordinary shares.

The operating loss for the period was GBP550,573 (2018:

GBP553,379).

Cash balance at 30 June 2019 was GBP1,167,547 (30 June 2018:

GBP1,586,474).

Board changes

During the period, the Company appointed John Chiplin as

non-executive Chairman and Chris Britten as a non-executive

Director. Paul Titley stood down as a director and employee of the

Company. David Templeton became an executive director, taking

responsibility for the technical aspects of Nuvec(R) development.

These changes bring considerable experience and expertise to the

Board in order to take the Company forward.

Nuvec(R) development work

The first part of 2019 has seen the Company make considerable

progress in enhancing the understanding and performance of the

Nuvec(R) system through a series of its own studies and research

collaborations. Following this work, and together with previous

studies, the Company has established that:

-- a range of DNA and mRNA antigens can be loaded onto the

Nuvec(R) particles and successfully transfect cells in vitro;

-- Nuvec(R) mechanism of action to transfect cells is via

endocytosis into the cell and release of payload into the

cytoplasm;

-- Nuvec(R) has a good safety profile, degrades naturally in the

body and, since it is not lipid in composition, is devoid of

potential lipid induced liver damage;

-- importantly, Nuvec(R) works for pDNA and mRNA having shown in

vivo antibody response for both;

-- Nuvec(R) currently delivers a good antibody response from 2-3 injections; and

-- evidence from in vitro studies suggests that Nuvec(R), when

prepared for in vivo dosing, does not produce a monodisperse

suspension after the addition of DNA, which the Directors believe

is the most likely cause of the inconsistent results observed

across certain studies.

The data generated so far is encouraging and shows that, with

proposed enhancements, Nuvec(R) has the potential to be an

effective delivery system for nucleic acids.

Repeat University of Queensland Study

The recent repeat of the University of Queensland (UQ) study

using OVA pDNA was performed because work with other CROs and

collaborators, undertaken subsequently to the initial UQ studies,

showed inconsistent results. The repeat study with UQ added an

additional arm to investigate the response with one injection as

well as three injections, and at different dose levels. The repeat

study confirmed a good response using Nuvec(R) at higher doses

using three injections but no response with just one injection. The

original UQ study had not tested the response using just one

injection.

Together with other data, this work also showed that once the

Nuvec(R) particles were loaded with OVA pDNA, the formulation was

not ideally dispersed. This lack of dispersion is not an issue for

in vitro work but is also a key likely explanation as to the

inconsistency seen when using Nuvec(R) in vivo and may also

contribute to previous study inconsistencies using just one

injection.

Going forward

The work the Company has undertaken itself and with

collaborators shows that the focus now needs to be on improving the

formulations of Nuvec(R) once loaded with DNA and RNA to ensure

delivery of maximum antibody generation in vivo. This is standard

work in the evolution of any delivery system. The focus of this

work is not to alter the basic silica nanoparticle, but rather to

look at the processes of how to load a linker to the silica

particle to enable DNA or RNA to be loaded to the particle and also

how the DNA or RNA is then loaded onto the Nuvec(R) particle. The

objective of the work is to improve these processes so that a more

monodisperse formulation of DNA loaded Nuvec(R) is achieved and any

agglomeration is minimized.

It is anticipated that a more monodisperse formulation would

likely lead to improved transfection efficiency in vivo, greater

consistency of results and may also increase the response from a

single injection.

To that end, the Company has put the following top-level plan in

place. The work is divided into two distinct phases, each of which

has certain stages upon which the Company will provide updates as

they progress.

The first is to generate Nuvec(R) with better potential for

dispersion in aqueous suspensions, improve dispersion techniques,

and optimise the addition of DNA. In doing so the Company will seek

to address the issues it perceives may have been causing

inconsistencies to date. The work to be done will involve four,

sequential, stages:

1. Nuvec(R) manufacturing process alterations (i.e. addition of

PEI onto silica nanoparticles which allows for subsequent loading

of DNA/mRNA)

2. Nuvec(R) dispersion testing

3. Improved Nuvec(R) DNA loading process

4. Analyse the effect of the Nuvec(R) concentration, the

DNA:Nuvec(R) ratio and solution composition on DNA: Nuvec(R)

agglomeration

These four stages of the first phase of work are expected to

take approximately six months and conclude by early Q2 2020.

Following a successful conclusion of phase one, phase two will

be to focus on in vitro testing of the improved product, followed

by in vivo testing seeking an improved transfection and immune

response, before finally conducting an in vivo cancer model study.

Subject to the phase one timetable being achieved, it is expected

that these three stages of phase two would conclude before the end

of 2020.

These two phases will be key milestones to achieve in order for

the Company to start working with partners in any clinical programs

and embark on licencing discussions.

In parallel to the work outlined above, the Company continues to

see progress on its licensed patent application from UQ. The UQ

patent application is now going through dialogue with the European

and US patent examiners and has entered Australia, China, India and

Japan national phases where examiner response is awaited. Should

the grant be received in 2020, it would dovetail well with the

conclusion of the ongoing work on Nuvec(R) and further support any

discussions with potential partners.

The Company is still awaiting feedback from the European

Nanomedicine Characterisation Laboratory ("EUNCL") characterisation

program for Nuvec(R), initially estimated for the end of this

quarter. The characterisation program aims to provide

state-of-the-art pre-clinical characterisation of innovative

nanomaterials such as Nuvec(R) in order to accelerate their

development towards regulatory approval by the European Medicines

Agency ("EMA") and the national agencies. Whilst these results will

further enhance our data package and increase our understanding of

the variables which may affect Nuvec(R) it is not expected that

they would impact on the work plan identified to address the

findings of other studies to date. A further update will be

provided once these results have been received.

Outlook

Fundamentally, our strategy remains the same and therefore the

prospects and value potential for Nuvec(R) remain as previously

stated. To date, we have focused on generating our own in vitro and

in vivo data using Nuvec(R) and undertaking research collaborations

with third parties to gather extra information. The ultimate aim of

doing this work is to get to a point where we could begin widescale

commercial collaboration and licensing in 2020. The recent

learnings and subsequent proposed plan still keep us on track to

start these discussions, albeit towards the end of 2020. In terms

of typical pharmaceutical development time lines, this is a

relatively minor delay.

The use of DNA and RNA as vaccines and treatments, especially in

oncology, is increasingly of interest clinically and, consequently,

the market potential is substantial. A consistent theme in all

discussions about the potential for DNA and RNA antigens to become

products is the need for a safe and effective delivery system and

it is the Boards opinion that Nuvec(R) could have a significant

role in that market.

The Board remains very optimistic about the future of the

Company and its prospects. We are aware that the change in

timelines can be viewed as disappointing, but it is vital to

remember that we are a Lifescience Company and as such need to take

the appropriate time and degree of accuracy to ensure that we will

be able to commercialise Nuvec(R). Regular updates will be provided

on the progress of the workplan.

The Board also recognises the need to investigate other assets

and opportunities that the Company can add to its portfolio and

continue to seek such opportunities.

On behalf of the Board, I would like to thank all of our

shareholders for their continued support and look forward to

providing further updates on our progress.

By order of the Board

John Chiplin

Chairman

N4 Pharma Plc

Glossary of technical terms

Monodisperse: containing particles of uniform size

Agglomeration: particles clumping together

N4 Pharma Plc and its controlled entities

Condensed consolidated Statement of Comprehensive Income

(unaudited) for the six months ended 30 June 2019

Notes Six months Six months Twelve months

to 30 June to 30 June to 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------ ------------ -------------------------------

Government grant income - 49,308 72,832

Gross Profit - 49,308 72,832

Research and development

costs (117,694) (287,160) (846,176)

General and administration

costs (432,879) (315,527) (643,745)

Operating loss for the

period (550,573) (553,379) (1,417,089)

Finance expenditure (1,587) (535) (981)

Gain on sale of investment - 27,693 27,693

Loss for the period before

tax (552,160) (526,221) (1,390,377)

Taxation - (16,134) 205,534

Loss for the period after

tax (552,160) (542,355) (1,184,843)

Other comprehensive income -

net of tax - -

Total comprehensive loss

for the period attributable

to equity owners of N4

Pharma Plc (552,160) (542,355) (1,184,843)

======================================== ============ ============ ===============================

Loss per share attributable

to owners of the parent

Weighted average number

of shares:

Basic 98,852,040 87,892,979 89,440,373

Diluted 104,379,981 92,128,151 91,305,287

Basic loss per share (0.56p) (0.62p) (1.32p)

Diluted loss per share (0.53p) (0.59p) (1.30p)

All activities derive from continuing operations.

The notes below form an integral part of these financial

statements.

N4 Pharma Plc and its controlled entities

Condensed consolidated Statement of Financial Position

(unaudited) for the six months ended 30 June 2019

Notes 30 June 2019 30 June 2018 31 December

2018

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------- ------------- ---------------------------

Assets

Non-current assets

Investments - - -

------------------------------ ------ ------------- ------------- ---------------------------

- - -

Current assets

Trade and other receivables 265,481 128,275 276,926

Cash and cash equivalents 1,167,547 1,586,474 793,141

1,433,028 1,714,749 1,070,067

Total Assets 1,433,028 1,714,749 1,070,067

------------------------------ ------ ------------- ------------- ---------------------------

Liabilities

Current liabilities

Trade and other payables (81,863) (174,897) (159,666)

Accruals and deferred income (22,200) (18,049) (30,457)

------------------------------ ------ ------------- ------------- ---------------------------

Total assets less current

liabilities 1,328,965 1,521,803 879,944

------------------------------ ------ ------------- ------------- ---------------------------

Net Assets 1,328,965 1,521,803 879,944

------------------------------ ------ ------------- ------------- ---------------------------

Equity

Share capital 4 8,676,675 8,634,675 8,634,675

Share premium 5 10,328,797 9,307,849 9,328,848

Share option reserve 6 41,141 102,279 81,909

Reverse acquisition reserve 5 (14,138,244) (14,138,244) (14,138,244)

Merger relief reserve 5 279,347 279,347 279,347

Retained earnings (3,858,751) (2,664,103) (3,306,591)

------------------------------ ------ ------------- ------------- ---------------------------

Total Equity 1,328,965 1,521,803 879,944

------------------------------ ------ ------------- ------------- ---------------------------

N4 Pharma Plc and its controlled entities

Condensed consolidated Statement of Changes in Equity

(unaudited) for the six months ended 30 June 2019

(i) Six months

ended 30 June

2019 -

Unaudited

----------- ------------- ------------------------ --------------- ------------------- ------------- ---------------------

Share Share Share Option Reverse Merger Relief Retained Total Equity

Capital Premium Reserve Acquisition Reserve Earnings

Reserve

GBP GBP GBP GBP GBP GBP GBP

----------- ------------- ------------------------ --------------- ------------------- ------------- ---------------------

Balance at 1

January 2019 8,634,675 9,328,848 81,909 (14,138,244) 279,347 (3,306,591) 879,944

Total

comprehensive

loss for

the period - - - - - (552,160) (552,160)

Share issue 42,000 958,000 - - - - 1,000,000

Share option

reserve - 41,949 (41,949) - - - -

Share based

payment - - 1,181 - - - 1,181

----------- ------------- ------------------------ --------------- ------------------- ------------- ---------------------

At 30 June

2019 8,676,675 10,328,797 41,141 (14,138,244) 279,347 (3,858,751) 1,328,965

(ii) Six

months ended

30 June

2018 -

Unaudited

----------- ------------- ------------------------ --------------- ------------------- ------------- ---------------------

Share Share Share Option Reverse Merger Relief Retained Total Equity

Capital Premium Reserve Acquisition Reserve Earnings

Reserve

GBP GBP GBP GBP GBP GBP GBP

----------- ------------- ------------------------ --------------- ------------------- ------------- ---------------------

Balance at 1

January 2018 8,579,396 8,513,670 147,635 (14,138,244) 299,045 (2,121,748) 1,279,754

Total

comprehensive

loss for

the period - - - - - (542,355) (542,355)

Share issue 55,279 794,179 - - (19,698) - 829,760

Share option

reserve - - (45,356) - - - (45,356)

At 30 June

2018 8,634,675 9,307,849 102,279 (14,138,244) 279,347 (2,664,103) 1,521,803

N4 Pharma Plc and its controlled entities

Condensed consolidated Statement of Changes in Equity

(unaudited) for the six months ended 30 June 2019 (Continued)

(iii) Twelve

months ended

31 December

2018 - Audited

---------- -------------- ------------- ------------- -------------- ------------ -------------

Share Share Premium Share Option Reverse Merger Relief Retained Total Equity

Capital Reserve Acquisition Reserve Earnings

Reserve

GBP GBP GBP GBP GBP GBP GBP

---------- -------------- ------------- ------------- -------------- ------------ -------------

Balance at 1

January 2018 8,579,396 8,513,670 147,635 (14,138,244) 299,045 (2,121,748) 1,279,754

Total

comprehensive

loss for

the year - - - - - (1,184,843) (1,184,843)

Share issue 55,279 815,178 - - (19,698) - 850,759

Share option

reserve - - (65,726) - - - 147,635

At 31 December

2018 8,634,675 9,328,848 81,909 (14,138,244) 279,347 (3,306,591) 879,944

The notes below form an integral part of these financial

statements.

N4 Pharma Plc and its controlled entities

Condensed consolidated Statement of Cash Flows (unaudited) for

the six months ended 30 June 2019

Six months Six months Twelve months

to 30 June to to 31 December

2019 30 June 2018 2018

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------------------------------ ------------ ----------------------- ----------------

Operating activities

Loss before tax (552,160) (526,221) (1,390,377)

Interest 1,587 535 981

Share based payments to

employees 1,181 - 629

Gain on sale of investment - (27,693) (27,693)

Taxation - (16,134) -

Operating loss before changes

in working capital (549,392) (569,513) (1,416,460)

Movements in working capital:

Decrease/(Increase) in trade

and other receivables 11,445 4,425 (9,266)

(Decrease)/Increase in trade

and other payables (86,060) 13,728 10,905

Taxation - - 70,574

Cash used in operations (624,007) (551,360) (1,344,247)

-------------------------------------- ------------ ----------------------- ----------------

Net cash flows used in operating

activities (624,007) (551,360) (1,344,247)

-------------------------------------- ------------ ----------------------- ----------------

Investing activities

Proceeds from sale of investment - 27,693 27,693

Net cash flows from investing

activities - 27,693 27,693

-------------------------------------- ------------ ----------------------- ----------------

Financing activities

Interest paid (1,587) (535) (981)

Net proceeds of ordinary

share issue 1,000,000 784,404 784,404

Net cash flows from in financing

activities 998,413 783,869 783,423

-------------------------------------- ------------ ----------------------- ----------------

Net increase/ (decrease)

in cash and cash equivalents 374,406 260,202 (533,131)

Cash and cash equivalents

at beginning of the period 793,141 1,326,272 1,326,272

Cash and cash equivalents

at 30 June /

31 December 1,167,547 1,586,474 793,141

The notes below form an integral part of these

financial statements.

N4 Pharma Plc and its controlled entities

Notes to the condensed consolidated interim financial statements

for the six months ended 30 June 2019

1. Corporate information

N4 Pharma Plc (the "Company") is the holding company for N4

Pharma UK Limited ("N4 UK"), and N4 Biotech Limited ("N4 Biotech"),

and together form the group (the "Group"). N4 UK is a specialist

pharmaceutical company engaged in the development of

mesoparticulate silica delivery systems to improve the cellular

delivery and potency of vaccines. The nature of the business is not

deemed to be impacted by seasonal fluctuations and as such

performance is expected to be consistent.

The Company is domiciled in England and Wales and was

incorporated and registered in England and Wales on 6 July 1979 as

a public limited company and its shares are admitted to trading on

AIM (LSE: N4P). The Company's registered office is located at 6th

Floor, 60 Gracechurch Street, London, EC3V 0HR.

2. Accounting policies

Adoption of new and revised International Financial Reporting

Standards

The following IFRS standards, amendments or interpretations

became effective in the six months to 30 June 2019 but have not had

a material effect on this interim consolidated financial

information:

IFRS 16 Leases

IFRIC 23 Uncertainty over Income Tax

Treatments

-----------------------------------

IFRS 9 Prepayments Features with Negative

Compensation

-----------------------------------

IAS 28 Long-term Interests in Associates

and Joint Ventures

-----------------------------------

IAS19 Plan amendment, Curtailment

and Settlement

-----------------------------------

The following relevant new standards, amendments to new

standards and interpretations have been issued, but are not yet

effective, and have not been early adopted:

Title As Issued by the IASB, mandatory

for accounting periods starting

Amendments to Reference to the Accounting periods beginning

Conceptual Framework in IFRS on or after 1 January 2020

Standards

---------------------------------

Basis of Preparation:

The Group's condensed consolidated interim financial statements,

which are unaudited, have been prepared in accordance with

International Accounting Standard ("IAS") 34, "Interim Financial

Reporting".

The annual financial statements for the year ended 31 December

2018 were prepared in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the European Union.

The interim consolidated financial information for the six

months ended 30 June 2019 are unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period.

The financial statements are presented in sterling, which is the

Group's functional currency as the UK is the primary environment in

which it operates.

Basis of consolidation:

These consolidated financial statements have been prepared in

accordance with IFRS 2 for both the comparative six month period

ended 30 June 2018 and the current period ended 30 June 2019. These

consolidated financial statements have been prepared in accordance

with IFRS 2 as a result of the consolidation of the Company and N4

UK, constituting a reverse takeover transaction.

Significant Accounting Policies:

The condensed, consolidated interim financial statements have

been prepared under the historical cost convention, with the

exception of investments, in accordance with International

Financial Reporting Standards ('IFRS') as adopted by the European

Union.

While the financial information has been prepared in accordance

with IFRS, as adopted by the European Union, the interim condensed,

consolidated financial statements do not contain sufficient

information to comply with IFRSs.

Financial assets at fair value through profit or loss:

Financial assets designated at fair value through profit or loss

at inception are financial instruments that are not classified as

held for trading but are managed, and their performance is

evaluated on a fair value basis in accordance with the Group's

documented investment strategy.

The Group's policy requires the Board of Directors to evaluate

the information about these financial assets on a fair value basis

together with other related financial information.

Segmental reporting:

The Group operated in one business segment, that of the

development and commercialisation of medicines via its delivery

system called Nuvec(R). No revenue has yet been generated by any of

the work undertaken by the Group.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors, for the

purposes of resource allocation and assessment of performance, is

based wholly on the overall activities of the Group.

Cash and cash equivalents:

The Directors consider any cash on short term deposit and other

short term investments to be cash equivalents.

Government grant income

Government grants are recognised only when there is reasonable

assurance that the Company will comply with the conditions

attaching to them and that the grants will be received.

Government grants are recognised in the income statement on a

systematic basis over the periods in which the Company recognises

and expenses the related costs for which the grants are intended to

compensate.

Government grants that are receivable as compensation for

expenses or losses already incurred or for the purpose of giving

immediate financial support to the Company with no future related

costs are recognised in the income statement in the period in which

they become receivable.

Tax

The Group has accumulated losses available to carry forward

against future trading profits. No deferred tax asset has been

recognised in respect of tax losses since it is uncertain at the

balance sheet date as to whether future profits will be available

against which the unused tax losses can be utilised.

Share-based payment arrangements

Equity-settled share-based payments are measured at fair value

at the date of grant using a Black Scholes pricing model. The key

assumptions used in the model have been adjusted, based on

management's best estimate, for the effects of non-transferability,

exercise restrictions and behavioural considerations.

Cancellations of equity instruments are treated as an

acceleration of the vesting period and any outstanding charge is

recognised in full immediately.

3. Critical accounting judgements and estimates

The preparation of the interim condensed consolidated financial

statements in conformity with IFRS requires management to make

certain estimates, assumptions and judgements that affect the

application of accounting policies and the reported amounts of

assets and liabilities and the reported amounts of income and

expenses during the reporting period.

In the process of applying the Group's accounting policies,

management have decided that there are no estimates and assumptions

significant to causing potentially material adjustments to the

carrying amounts of assets and liabilities recognised in the

condensed consolidated financial statements.

4. Share Capital

Allotted, called up and 30 June 2019 30 June 2018 31 Dec 2018

fully paid (Unaudited) (Unaudited) (Audited)

GBP GBP GBP

101,462,537 Ordinary Shares

of 0.4p each (30 June 2018

and 31 December 2018: 90,962,537

Ordinary shares of 0.4p

each) 405,850 363,850 363,850

137,674,431 Deferred Shares

of 4p each (30 June 2018

and 31 December 2018: 137,674,431

Deferred shares of 4p each) 5,506,977 5,506,977 5,506,977

279,176,540 Deferred Shares

of 0.099p each (30 June

2018 and 31 December 2018:

279,176,540 Deferred shares

of 0.099p each) 2,763,848 2,763,848 2,763,848

8,676,675 8,634,675 8,634,675

===================== ===================== =====================

The transactions that took place during the period were as

follows:

-- 10,500,000 new ordinary shares of 0.4p each were issued.

All ordinary shares rank equally in all respects, including for

dividends, shareholder attendance and voting rights at meetings, on

a return of capital and in a winding-up.

The 137,674,431 deferred shares of 4p, have no right to

dividends nor do the holders thereof have the right to receive

notice of or to attend or vote at any general meeting of the

Company. On a return of capital or on a winding up of the Company,

the holders of the deferred shares shall only be entitled to

receive the amount paid up on such shares after the holders of the

ordinary shares have received the sum of GBP1,000,000 for each

ordinary share held by them.

5. Reserves

The share premium account represents the amount received on the

issue of ordinary shares by the Company in excess

of their nominal value and is non-distributable.

The merger relief reserve arose on the Company's acquisition of

N4 UK and consists of both the consideration shares and deferred

consideration amounting to GBP299,045. There is no legal share

premium on the shares issued as consideration as section 612 of the

Companies Act 2006, which deals with merger relief, applies in

respect of the acquisition.

The reverse acquisition reserve arises due to the elimination of

the Company's investment in N4 UK. Since the shareholder in N4 UK

became a shareholder of the Company, the acquisition is accounted

for as though the legal acquiree (N4 UK) is the accounting

acquirer.

6. Share-based payments and Share Option Reserve

a) Options

The Company has the ability to issue options to Directors to

compensate them for services rendered and incentivise them to add

value to the Group's longer term share value. Equity settled

share-based payments are measured at fair value at the date of

grant.

Cancellations of equity instruments are treated as an

acceleration of the vesting period and any outstanding charge is

recognised in full immediately.

Fair value is measured using a Black Scholes pricing model. The

key assumptions used in the model have been adjusted based on

management's best estimate for the effects of non-transferability,

exercise restrictions and behavioural considerations.

As at 30 June 2019, there were 7,679,370 (30 June 2018:

6,245,084, 31 December 2018: 7,249,084) options in existence over

ordinary shares of the Company.

On 14 October 2015, 10,804,840 and 2,701,210 share options were

granted to Gavin Burnell, (the Company's former chief executive)

and Luke Cairns respectively. Following the post-Share

Re-Organisation, including the consolidation of shares and

subsequent sub-division, these options now equate to a quarter of

the original options issued. The 2,701,210 options held by Gavin

Burnell and the 675,302.50 options held by Luke Cairns, issued on

14 October 2015 are exercisable at a price of 0.7p per share

(pre-Share Re-Organisation) at any time before 14 October 2025.

The aggregate fair value of the share options issued on 14

October 2015 as at 30 June 2019 is GBP19,385 (30 June 2018:

GBP23,636, 31 December 2018: GBP20,910).

Following the RTO and subsequent re-admission to AIM on 3 May

2017 ("Admission"), the following options over new ordinary shares

were granted under the Company's share option scheme and are

exercisable at a price of 7p per share:

Luke Cairns 717,143 options

David Templeton 717,143 options

Paul Titley 1,434,286 options

The above share options are exercisable following the third

anniversary of Admission, being 3 May 2020.

In the case of Paul Titley, the exercise of options over 717,143

ordinary shares were subject to certain performance conditions.

These options were exercisable at a price of 7 pence per share

(post-Share Re-Organisation) at any time before 14 October 2025.

However, these share options lapsed prior to the interim reporting

date of 30 June 2019 due to his departure from the Company and

those targets not being met. This leaves Paul Titley with 717,143

options which are exercisable on the 3(rd) anniversary of

Admission, being 3 May 2020.

The fair value of the share options issued on 3 May 2017 and not

yet exercised as at 30 June 2019 is GBP7,550 (30 June 2018:

GBP6,040, 31 December 2018: GBP26,040).

On 26 September 2018 the following options over ordinary shares

were granted under the Company's share option scheme and are

exercisable at a price of 6.60p per share:

Andrew Leishman 286,857 options

Allan Hey 717,143 options

The share options granted to Andrew Leishman have now lapsed due

to his departure from the Company.

The fair value of the share options issued on 26 September 2018

and not yet exercised as at 30 June 2019 is GBP21,887, (31 December

2018: GBP26,950).

On 21 May 2019 the following options over ordinary shares were

granted under the Company's share option scheme and are exercisable

at a price of 3.55p per share:

John Chiplin 717,143 options

Chris Britten 717,143 options

The fair value of the share options issued on 21 May 2019 and

not yet exercised as at 30 June 2019 is GBP22,793.

b) Warrants

As at 30 June 2019, the total number of warrants in issue was

nil (30 June 2018: 11,054,071, 31 December 2018: 11,054,071).

The remaining warrants were exercisable at 8.5p and entitled

holders to subscribe for new ordinary shares at any time in the

period of two years following the grant of the warrants. These all

relate to the warrants issued as part of the Placing on 3 May 2017.

The expiry date of the placing warrants was 3 May 2019.

Details of the lapsed warrants during the period are as

follows:

During the period, an amount of GBP54,329, representing the fair

value of the remaining 11,054,071 warrants that have lapsed in the

period, has been recognised against the share option reserve and

share premium. The fair value of the warrants in issue and not yet

exercised was determined using the Black Scholes model. The fair

value of the warrants at 30 June 2019 was nil (30 June 2018:

GBP54,329, 31 December 2018: GBP54,329).

8. Earnings per share

Basic earnings per share is calculated by dividing the loss

after tax attributable (excluding the deemed cost of acquisition)

to the equity holders of the Company by the weighted average number

of shares in issue during the period.

Diluted earnings per share is calculated by adjusting the

weighted average number of shares outstanding to assume conversion

of all potential dilutive shares, namely share options and

warrants.

9. Related Party Transactions

During the period to 30 June 2019, the non-executive directors'

fees amounted to GBP27,894 (6 months to 30 June 2018: GBP24,000, 12

months to 31 December 2018: GBP48,000).

During the period to 30 June 2019, the Company charged N4 UK

GBP12,000 in respect of 50 per cent. of the post RTO fees paid to

non-executive directors for the services rendered to N4 UK (6

months to 30 June 2018: GBP12,000, 12 months to 31 December 2018:

GBP24,000)

10. Subsequent events

The Board are in the process of winding up N4 Biotech Limited, a

100% owned subsidiary of N4 Pharma Plc. Subsequent to the interim

financial statements date of 30 June 2019 the bank account has been

closed and it is the Boards intention that N4 Biotech will be wound

up fully prior to the year end.

Aside from the item disclosure there are no other significant

subsequent events that require adjustment or disclosure in these

interim condensed consolidated financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR GGUPGBUPBGQM

(END) Dow Jones Newswires

September 18, 2019 02:00 ET (06:00 GMT)

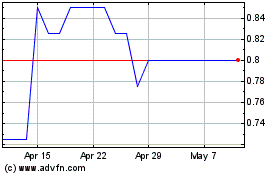

N4 Pharma (LSE:N4P)

Historical Stock Chart

From Mar 2024 to Apr 2024

N4 Pharma (LSE:N4P)

Historical Stock Chart

From Apr 2023 to Apr 2024