Canadian Dollar Advances As Saudi's Remarks Lift Oil Prices

September 09 2019 - 5:01AM

RTTF2

The Canadian dollar strengthened against its most major

counterparts in the European session on Monday, as oil prices

advanced after Saudi Arabia's new energy minister Prince Abdulaziz

bin Salman indicated that OPEC and its allies would stick to its

production cuts to support oil prices.

Crude for October delivery rose $0.32 to $56.85 per barrel.

Prices were also supported by a rise in oil imports in China in

August and comments from the United Arab Emirates' energy minister

that OPEC and its allies are committed to balancing the crude

market.

After Prince Abdulaziz, a long-time member of the Saudi

delegation to OPEC, was appointed to the post on Sunday, replacing

Khalid al-Falih, a Saudi official said that there would be no shift

in Saudi and OPEC policy on the output cuts and that Prince

Abdulaziz would work to strengthen OPEC and non-OPEC

cooperation.

This is the first time the energy portfolio has been handed to a

member of the royal family.

European stocks were trading mixed after data showed that

China's exports fell unexpectedly in August amid escalating trade

dispute with the U.S. administration.

Hopes of further stimulus from global central banks helped to

limit the downside to some extent ahead of a European Central Bank

meeting slated for Thursday.

The loonie was trading mixed against its major counterparts in

the Asian session. While it held steady against the greenback and

the euro, it rose against the yen. Versus the aussie, it

declined.

The loonie advanced to 81.37 against the yen, its biggest since

August 2. If the loonie gains further, 83.5 is likely seen as its

next resistance level.

The loonie climbed to near a 6-week high of 1.3154 against the

greenback, from last week's closing value of 1.3164. On the upside,

1.30 is likely seen as the next resistance level for the

loonie.

The loonie appreciated to near a 2-year high of 1.4503 against

the euro, compared to 1.4514 hit late New York Friday. The next

likely resistance for the loonie is seen around the 1.43 level.

Data from Destatis showed that Germany's exports increased in

July, while imports decreased from the previous month.

Exports advanced 0.7 percent month-on-month in July, reversing a

0.1 percent fall in June. Meanwhile, imports dropped 1.5 percent

after rising 0.7 percent a month ago.

In contrast, the loonie dropped to 0.9045 against the aussie,

from a high of 0.9006 hit at 5:00 pm ET. The loonie is seen finding

support around the 0.92 level.

Data from the Australian Bureau of Statistics showed that

Australia's mortgage approvals increased more-than-expected in

July.

The number of owner occupier loans increased 4.2 percent, much

larger than the expected growth of 1.5 percent.

Looking ahead, U.S. consumer credit for July is scheduled for

release in the New York session.

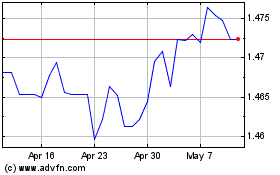

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024