Bayer Sells Pet-Health Unit for $7.6 Billion -- WSJ

August 21 2019 - 3:02AM

Dow Jones News

Divestiture to rival Elanco comes as legal liabilities from

Roundup cases mount

By Ruth Bender

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 21, 2019).

BERLIN -- Bayer AG is selling its animal-health business to an

American rival for $7.6 billion, part of the German

drug-and-chemicals giant's plan to shed assets amid mounting legal

liabilities from its Roundup herbicide.

The deal to sell the unit to Elanco Animal Health Inc. would

create a formidable competitor in the business of preventing and

treating diseases for pets and livestock. The combined company's

roughly 13% share of the animal-health market would rank it behind

only Zoetis Inc. and ahead of Boehringer Ingelheim, according to

Germany's Baader Bank.

Elanco, based in Greenfield, Ind., was a division of Eli Lilly

& Co. until the drugmaker sold a minority stake in the

animal-health unit last September in an initial public offering.

Elanco said the Bayer deal, its largest since going public, will

double its pet business and strengthen its presence in emerging

markets and in the cattle business.

Several private-equity firms had also expressed an interest in

the Bayer unit, according to people familiar with the matter.

Bayer said it would get $5.3 billion in cash and a stake in

Elanco worth $2.3 billion, which it plans to exit over time.

Bayer's share price has slumped in the past year as jury

verdicts have gone against the company in early trials over claims

that Roundup causes cancer. More than 18,000 plaintiffs have now

filed similar suits over the weedkillers, which Bayer acquired in

its deal for U.S. agriculture giant Monsanto.

Bayer said in December it was exploring options to exit its

animal-health business, the smallest of its four divisions.

The move is part of a wider plan to shed operations that are

diverting resources from its core pharmaceutical and agriculture

businesses, with cost savings also helping to bring down its debt.

The Leverkusen, Germany-based company has a debt load of around

EUR35.7 billion ($39.56 billion), inflated by its acquisition of

Monsanto.

Bayer is battling to regain investor confidence after a majority

of shareholders signaled in April a lack of confidence in the

company's leadership. Shareholders have accused Bayer Chief

Executive Werner Baumann of underestimating the legal and

reputational risks of the Monsanto deal.

Bayer has said it acted conscientiously in its due diligence for

the acquisition. But its share price has dropped roughly a third

since the deal closed last summer as unfavorable verdicts in the

three Roundup jury trials so far have fueled fears that the company

could face billions of dollars in liabilities.

Bayer is appealing the verdicts and argues that Roundup and its

active ingredient, glyphosate, are safe. But shareholders have

grown more frustrated with every loss in court, prompting Bayer in

June to hire a prominent U.S. lawyer to help to advise its board on

trial tactics and mediation.

Amid uncertainty over how much the lawsuits might end up costing

the company, investors have said Bayer must deliver on its

restructuring plans. The Elanco deal, struck earlier than Bayer had

forecast, adds to a series of asset sales.

In recent months, Bayer sold its 60% stake in industrial park

operator Currenta, Coppertone sunscreens and Dr. Scholl's foot-care

products. The Elanco deal is expected to close in mid-2020, pending

regulatory clearance.

Bayer shares were little changed Tuesday. Analysts say the

Roundup lawsuits will continue to weigh on the stock until they run

their course or Bayer decides to settle, allowing the market to put

a price on the total liability.

--Ben Dummett contributed to this article.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

August 21, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

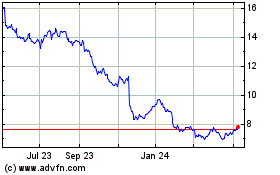

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

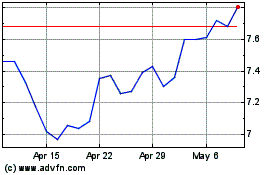

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024