Newell Brands Inc. (NASDAQ:NWL) (the “Company” or “Newell

Brands”) announced today the pricing terms of its previously

announced tender offer to purchase for cash (such offer, the “Any

and All Offer”) any and all of the Company’s outstanding 3.900%

Notes due 2025 and 4.000% Notes due 2024 (collectively, the “Any

and All Notes”). The Any and All Offer is being made upon and is

subject to the terms and conditions set forth in the Offer to

Purchase, dated August 12, 2019, and the related Notice of

Guaranteed Delivery (as they may each be amended or supplemented

from time to time, the “Offer Documents”).

The applicable Total Consideration (as set forth in the table

below) is payable to holders of the Any and All Notes who validly

tender and do not properly withdraw their Any and All Notes at or

prior to 5:00 p.m., New York City time, on August 16, 2019 (the

“Any and All Expiration Date”) and whose Any and All Notes are

accepted for purchase by the Company. The Reference Yields listed

in the table below were determined at 10:00 a.m., New York City

time, on August 16, 2019 (the “Any and All Price Determination

Date”) by the Lead Dealer Managers for the Any and All Offer.

Payments for Any and All Notes accepted for purchase will also

include accrued and unpaid interest from and including the last

interest payment date applicable to the relevant series of Any and

All Notes up to, but not including, the settlement date for the Any

and All Notes, which is currently expected to be on or about August

19, 2019 (the “Any and All Settlement Date”).

Title of Security

Principal Amount

Outstanding

CUSIP/ISIN

Reference U.S.

Treasury

Security

Bloomberg Reference

Page/Screen

Reference Yield

Fixed Spread (basis

points)

Total Consideration(1)

3.900% Notes due 2025

$91,088,000

CUSIP: 651229 AS5

1.75% due 7/31/2024

FIT1

1.433%

185

$1,033.10

ISIN: US651229AS52

4.000% Notes due 2024

$500,000,000

CUSIP: 651229 AQ9

ISIN: US651229AQ96

1.75% due 7/31/2024

FIT1

1.433%

165

$1,042.45

________________

(1) Payable for each $1,000 principal

amount of Any and All Notes validly tendered at or prior to the Any

and All Expiration Date and accepted for purchase by us. In

addition, holders whose Any and All Notes are accepted will also

receive accrued interest on such Any and All Notes.

Holders intending to utilize the Notice of Guaranteed Delivery

available for tendering Any and All Notes in the Any and All Offer

should refer to the discussion of the guaranteed delivery

procedures contained in the Offer Documents. The Company expects to

accept for purchase, and pay for, all Any and All Notes validly

tendered pursuant to guaranteed delivery procedures, if any, on or

about August 21, 2019. For the avoidance of doubt, accrued interest

will cease to accrue on the Any and All Settlement Date for all Any

and All Notes accepted for purchase in the Any and All Offer,

including those tendered pursuant to the guaranteed delivery

procedures.

The Any and All Offer is scheduled to expire on the Any and All

Expiration Date. Tenders of Any and All Notes may be properly

withdrawn at any time at or prior to the Any and All Expiration

Date, but not thereafter, except where additional withdrawal rights

are required by law. Promptly after the Any and All Expiration

Date, the Company will issue a press release specifying, among

other things, the aggregate principal amount of each series of Any

and All Notes validly tendered at or prior to the Any and All

Expiration Date and expected to be accepted for purchase.

The Company does not currently intend to call for redemption the

Any and All Notes not tendered and accepted for purchase in the Any

and All Offer, if any.

Newell Brands’ obligation to accept for payment and to pay for

the Any and All Notes validly tendered in the Any and All Offer is

subject to the satisfaction or waiver of the conditions described

in the Offer to Purchase.

Barclays Capital Inc. and RBC Capital Markets, LLC are serving

as the Lead Dealer Managers, and HSBC Securities (USA) Inc. is

serving as Co-Dealer Manager, in connection with the Any and All

Offer. The information agent and tender agent is Global Bondholder

Services Corporation. The full details of the Any and All Offer,

including complete instructions on how to tender Any and All Notes,

are included in the Offer Documents. Holders are strongly

encouraged to read carefully the applicable Offer Documents,

including materials incorporated by reference therein, because they

contain important information. Copies of the Offer Documents are

available at https://www.gbsc-usa.com/newellbrands/ and requests

for copies may also be directed to the information agent at (212)

430-3774 (banks and brokers) or (866) 807-2200 (all others).

Questions regarding the Any and All Offer should be directed to

Barclays Capital Inc., Liability Management Group, at (212)

528-7581 (collect) or (800) 438-3242 (toll free) or RBC Capital

Markets, LLC, Liability Management Group, at (212) 618-7843

(collect) or (877) 381-2099 (toll free).

None of the Company or its affiliates, their respective boards

of directors, the dealer managers, the information agent and tender

agent or the trustee with respect to the Any and All Notes is

making any recommendation as to whether holders should tender in

response to the Any and All Offer, and neither the Company nor any

such other person has authorized any person to make any such

recommendation. Holders must make their own decision as to whether

to tender any of their Any and All Notes, and, if so, the principal

amount of Any and All Notes to tender.

This news release shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities.

The Any and All Offer is being made only pursuant to the Offer to

Purchase and only in such jurisdictions as is permitted under

applicable law.

About Newell Brands

Newell Brands (NASDAQ:NWL) is a leading global consumer goods

company with a strong portfolio of well-known brands, including

Paper Mate®, Sharpie®, Dymo®, EXPO®, Parker®, Elmer’s®, Coleman®,

Marmot®, Oster®, Sunbeam®, FoodSaver®, Mr. Coffee®, Rubbermaid

Commercial Products®, Graco®, Baby Jogger®, NUK®, Calphalon®,

Rubbermaid®, Contigo®, First Alert® and Yankee Candle®. For

hundreds of millions of consumers, Newell Brands makes life better

every day, where they live, learn, work and play.

This press release and additional information about Newell

Brands are available on the company’s website,

www.newellbrands.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements that constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 and other federal

securities laws. These “forward-looking statements” are statements

other than statements of historical fact and may include, among

other things, statements in relation to the Company’s current

expectations and beliefs as to its ability to consummate the tender

offers, including the timing, size, pricing or other terms of the

tender offers, and other future events. All information set forth

in this release is as of the date hereof. The Company does not

intend, and undertakes no duty, to update this information to

reflect future events or circumstances. Actual results are subject

to a number of risks and uncertainties and may differ materially

from the current expectations and beliefs discussed in this press

release. Certain potential factors, risks and uncertainties that

could affect the Company’s business and financial results and cause

actual results to differ materially from those expressed or implied

in any forward-looking statements include the Company’s ability to

complete the tender offers and satisfy the conditions thereto, and

other potential factors, risks and uncertainties under the captions

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” in its Annual

Report on Form 10-K for the year ended December 31, 2018 and its

Quarterly Report on Form 10-Q for the quarterly period ended June

30, 2019, which are on file with the Securities and Exchange

Commission (“SEC”) and available at the SEC’s website at

www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190816005348/en/

Investors: Nancy O’Donnell SVP, Investor Relations and

Communications +1 (201) 610-6857 nancy.odonnell@newellco.com

Media: Claire-Aude Staraci Director, External

Communications +1 (201) 610-6717

claireaude.staraci@newellco.com

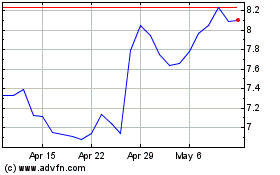

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

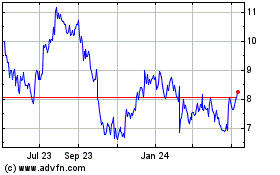

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Apr 2023 to Apr 2024