- AUM $1.6 billion

- Quarter-end Book Value per share was $39.21 vs. $38.36 as of

year-end 2018

- G.research, LLC and Morgan Group Holding Co. Merger in

Process

Associated Capital Group, Inc. (“AC” or the “Company”) reported

its financial results for the quarter ended June 30, 2019.

Financial Highlights

($000s except per share data or as noted)

(Unaudited)

Second Quarter

First Half

2019

2018

2019

2018

AUM - end of period (in millions)

$ 1,607

$ 1,633

$ 1,607

$ 1,633

Average AUM (in millions)

1,592

1,589

1,576

1,568

Revenues

4,821

4,796

9,473

9,499

Operating loss

(3,285)

(3,446)

(7,901)

(7,696)

Investment and other non-operating

income/(expense), net

3,026

19,697

41,747

(5,159)

Income/(loss) before income taxes

(125)

16,251

30,720

(12,855)

Net income/(loss)

(932)

11,824

22,215

(10,405)

Net income/(loss) per share – diluted

$ (0.04)

$ 0.51

$ 0.98

$ (0.45)

Shares outstanding at June 30

(thousands)

22,533

22,991

22,533

22,991

Second Quarter Overview

Second quarter revenues of $4.8 million were unchanged from the

prior year period. Operating expenses were $8.0 million, $0.3

million lower than the year ago quarter. The operating loss

declined to $3.2 million from $3.5 million in last year’s second

quarter. Net investment and other non-operating income was $3.0

million, $16.7 million less than the $19.7 million reported in the

second quarter of 2018. AC recorded an income tax benefit of

$300,000 in the second quarter of 2019 versus a tax expense of $3.4

million in comparable quarter of 2018.

The Company recorded a net loss for the second quarter of 2019

of $0.9 million, or $0.04 per share, compared to net income of

$11.8 million, or $0.51 per share, in the prior year’s quarter.

Commitment to Community

Our firm has long understood that success is measured by not

only generating returns for our clients, but also aligning their

values with their investment portfolio. AC has been involved in the

field of responsible investing since its inception, which has

evolved into integrating environmental, social and governance (ESG)

factors into clients’ portfolio analysis.

Over our first three years as a public company, AC made

approximately $15 million of donations to 501(c)3 eligible

organizations chosen by shareholders addressing a broad range of

community and social needs. More than 95 such organizations

received support through 2019.

Financial Condition

As of June 30, 2019, AC’s book value was $884 million, or $39.21

per share, vs. a book value of $912 million, or $39.66 per share,

as June 30, 2018.

At March 31, 2019, AC’s book value $889 million, or $39.38 per

share compared to $866 million, or $38.36 per share, at December

31, 2018.

First Quarter Results of Operations

Assets Under Management (AUM)

Assets under management at June 30, 2019 were $1.6 billion, an

increase of $16.0 million from March 31, 2019. This increase

reflects $15.6 million of net appreciation plus $0.4 million of net

capital inflows.

June 30,

March 31,

December 31,

June 30,

2019

2019

2018

2018

(in millions)

Event Merger Arbitrage

$ 1,422

$ 1,401

$ 1,342

$ 1,480

Event-Driven Value

127

127

118

87

Other

58

63

60

66

Total AUM

$ 1,607

$ 1,591

$ 1,520

$ 1,633

Revenues

Total operating revenues for the three months ended June 30,

2019 were unchanged from the prior year period at $4.8 million.

- Investment advisory fees increased to $2.7 million, up $0.1

million from the prior year period.

- Institutional research services revenue was $2.1 million, down

$0.1 million from the prior year period.

Incentive fees are not recognized until the measurement period

ends and the fee is crystalized, typically annually on December 31.

If the measurement period had ended on June 30, we would have

recognized $3.2 million for the six months ended June 30, 2019, a

$0.9 million increase over the unrealized incentive fees for the

six months ended June 30, 2018.

Investment and other non-operating income/(expense),

net

During the quarter, investment and other non-operating

income/(expense), net resulted in a profit of $3.0 million compared

to a profit of $19.7 million in the prior year quarter. Portfolio

mark-to-market changes were a loss of $(0.2) million and a gain of

$16.7 million in the 2019 and 2018 quarters, respectively. This was

driven by investment mark-to-market declines in portfolio values in

the 2019 quarter, including $4.0 million of the decline

attributable to the 3 million GAMCO shares held largely offset by

increases in valuations of other securities. Interest and dividend

income increased to $3.2 million in the second quarter of 2019 from

$2.8 million in the prior quarter.

Business and Investment Highlights

Alternative Investment Management

- Event-Driven Asset Management

The alternative investment strategies focus on fundamental,

active, event driven special situations and arbitrage. It is led by

merger arbitrage portfolios, the “Associates Funds” which returned

an unleveraged +2.2% return net of fees (+3.26% gross) for the

first half of 2019. This strategy benefits from corporate merger

and acquisitions (“M&A”) activity which reached $2.0 trillion

globally in the first half of 2019. Healthcare, E&P and

technology were the most active sectors for deals. Our arbitrage

team expects dealmaking to remain vibrant as the drivers for

M&A are unchanged. The strategy is offered domestically through

partnerships and separately managed accounts. Internationally, the

strategy is offered through corporations and EU regulated UCITS

structures. The team continues to build new channel partnerships

including managing the Gabelli Merger Plus Trust (“GMP”), an

LSE-listed investment company. While these initiatives serve to

deepen and lengthen the franchise, they also broaden the client

base globally.

- Direct Investing Business

We launched our direct private equity and merchant banking

activities. Our objective is to partner with management teams to

identify and surface value through strategic direction, operational

improvements and financial structuring. In this effort, we seek to

collaborate with the management of target companies, establish

common goals, support the restructuring and growth process, and

more importantly, add value by bringing in creative capital

solutions and our accumulated and compounded knowledge in selected

industries.

Our direct investment business is developing along three core

pillars; Gabelli Private Equity Partners, LLC (“GPEP”), formed in

August 2017 with $150 million of authorized capital as a

“fund-less” sponsor; the formation of Gabelli special purpose

acquisition vehicles, the SPAC business (“SPAC”), with the initial

vehicle launched and listed on the Italian Borsa in April 2018;

and, the formation of Gabelli Principal Strategies Group, LLC.

(“GPS”) to pursue strategic operating initiatives. These businesses

are organized to directly invest with a focus on leveraged buyouts

and restructurings of small and mid-sized companies. GPEP has the

flexibility to form partnerships with former executives of global

industrial conglomerates to create long-term value with no

pre-determined exit timetable. The Gabelli SPAC business allows us

to leverage our capital markets expertise through a direct

investing vehicle.

Institutional Research Services

In May, our Board formed a special committee to negotiate a

transaction between our institutional research services business,

G.research and Morgan Group Holding Co., an affiliated entity. As a

result of such potential combination, a portion of the

institutional research business could trade separately from A.C.

The transaction remains subject to regulatory approvals and

finalizing other conditions for closing. We cannot assure that a

transaction will be consummated.

G.research Institutional Services

Through G.research, we provide institutional research services

and act as an underwriter. G.research is regulated by FINRA.

G.research’s revenues are derived primarily from revenue generating

institutional research services, underwriting fees and selling

concessions.

During the past quarter, G.research, in coordination with

Gabelli Funds, Co. hosted the 13th annual Omaha Research Symposium

on May 3-4 and the 11th annual Entertainment & Broadcasting

Conference on June 6, 2019. On July 11, we co-hosted a conference

on Rule 852(b)(6), the Dynamics and Implications for the Fund

Industry. Industry participants and members from the academic

community covered a number of topics including “heartbeat trades”

and innovations in the active ETF market.

The schedule of upcoming conferences for the balance of the year

include:

- the 25th Aerospace and Defense Conference in New York on

September 5th

- the 43rd Annual Gabelli Automotive Aftermarket Conference on

November 4th – 6th

- The Gabelli – Columbia Business School Healthcare Symposium on

November 22nd.

In addition, G.research continues to sponsor non-deal roadshows

providing corporate management access to our institutional

clients.

For frequent, real-time updates from our research team on social

media platforms, we invite you to visit GabelliTV, our

jointly-operated online portal, at YouTube

(www.youtube.com/GabelliTV) or Facebook

(www.facebook.com/GabelliTV).

Shareholder Compensation

During the second quarter, AC repurchased approximately 43,000

Class A shares at an average cost of $38.23 per share for a total

outlay of $1.6 million.

Since the spin-off from GBL we have returned approximately $104

million to shareholders through share repurchases and exchange

offers representing approximately 3.0 million shares. In addition

to dividends of approximately $16 million.

At June 30, 2019, there were 3.5 million Class A shares and 19.0

million Class B shares outstanding. Of these, GGCP, a private

company, owns approximately 15.5 thousand and 18.4 million Class A

and Class B shares, respectively.

About Associated Capital Group, Inc.

The Company operates its investment management business via

Gabelli & Company Investment Advisers, Inc. (“GCIA” f/k/a

Gabelli Securities, Inc.), its 100% owned subsidiary. GCIA and its

wholly-owned subsidiary, Gabelli & Partners, collectively serve

as general partners or investment managers to investment funds

including limited partnerships, offshore companies and separate

accounts. The Company primarily manages assets in equity

event-driven strategies, across a range of risk and event arbitrage

portfolios and earns management and incentive fees from its

advisory activities. GCIA is registered with the Securities and

Exchange Commission as an investment advisor under the Investment

Advisers Act of 1940, as amended.

The Company operates its institutional research services

business through G.research, LLC, an indirect wholly-owned

subsidiary of the Company. G.research is a broker-dealer registered

under the Securities Exchange Act of 1934, as amended, that

provides institutional research services and acts as an

underwriter.

The Company also derives investment income/(loss) from

proprietary trading of assets awaiting deployment in its operating

businesses.

NOTES ON NON-GAAP FINANCIAL MEASURES

Operating Loss Before Management Fee

Operating loss before management fee expense represents a

non-GAAP financial measure used by management to evaluate its

business operations. We believe this measure is useful in

illustrating the operating results of the Company as management fee

expense is based on pre-tax income before management fee expense,

which includes non-operating items including investment gains and

losses from the Company’s proprietary investment portfolio and

interest expense. The management fee is calculated based on the

year to date income before management fee and income taxes. For the

quarter ending June 2018, the losses from the first quarter were

not recaptured during the six month period and therefore, no

management fee is recognized.

The reconciliation of operating loss to operating loss before

management fee expense (non-GAAP) is provided below.

Year-to-date

(In thousands)

2019

2018

Operating loss

$(11,027)

$(7,696)

Add: management fee expense

3,126

-

Operating loss before management fee

$(7,901)

$(7,696)

Table I ASSOCIATED CAPITAL GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION (Dollars in thousands) June

30, December 31, June 30,

2019

2018

2018

ASSETS Cash and cash equivalents

$

361,564

$

409,564

$

273,770

Investments

544,886

439,876

595,689

Investment in GAMCO stock (3,016,501, 3,016,501 and 3,726,250

shares, respectively)

57,826

50,949

99,714

Receivable from brokers

24,163

24,629

21,105

Other assets

10,838

4,568

4,298

Deferred tax assets

2,998

9,422

Other receivables

1,885

15,425

4,352

Total assets

$

1,004,160

$

954,433

$

998,928

LIABILITIES AND EQUITY Payable to

brokers

$

9,347

$

5,511

$

13,034

Income taxes payable

872

3,577

1,685

Compensation payable

9,457

11,388

4,829

Securities sold short, not yet purchased

46,010

9,574

13,332

Accrued expenses and other liabilities

4,618

8,335

2,805

Sub-total

70,304

38,385

35,685

Redeemable noncontrolling interests (a)

49,668

49,800

51,307

Equity

884,188

866,248

931,936

4% PIK Note due from GAMCO

-

-

(20,000

)

Total equity

884,188

866,248

911,936

Total liabilities and equity

$

1,004,160

$

954,433

$

998,928

- Represents third-party capital balances in consolidated

investment funds.

Table II ASSOCIATED CAPITAL GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share data)

Three months ended June 30, Six months ended June 30,

2019

2018

2019

2018

Investment advisory and incentive fees

$

2,713

$

2,615

$

5,446

$

5,144

Institutional research services

2,076

2,172

3,989

4,324

Other revenues

32

9

38

31

Total revenues

4,821

4,796

9,473

9,499

Compensation costs

5,584

5,870

$

11,480

$

12,194

Stock-based compensation

284

-

699

72

Other operating expenses

2,238

2,372

5,195

4,929

Total expenses

8,106

8,242

17,374

17,195

Operating loss before management fee

(3,285

)

(3,446

)

(7,901

)

(7,696

)

Investment gain/(loss)

(234

)

16,571

34,745

(10,959

)

Interest and dividend income from GAMCO

60

345

121

935

Interest and dividend income, net

3,200

2,781

6,881

4,865

Investment and other non-operating income/(expense), net

3,026

19,697

41,747

(5,159

)

Income/(loss) before management fee and income taxes

(259

)

16,251

33,846

(12,855

)

Management fee

(134

)

-

3,126

-

Income/(loss) before income taxes

(125

)

16,251

30,720

(12,855

)

Income tax expense/(benefit)

(277

)

3,388

5,914

(3,346

)

Net income/(loss)

152

12,863

24,806

(9,509

)

Net income attributable to noncontrolling interests

1,084

1,039

2,591

896

Net income/(loss) attributable to Associated Capital Group, Inc.

$

(932

)

$

11,824

$

22,215

$

(10,405

)

Net income/(loss) per share attributable to Associated

Capital Group, Inc.: Basic

$

(0.04

)

$

0.51

$

0.98

$

(0.45

)

Diluted

(0.04

)

0.51

0.98

(0.45

)

Weighted average shares outstanding: Basic

22,552

23,080

22,568

23,293

Diluted

22,552

23,080

22,568

23,293

Actual shares outstanding - end of period

22,533

22,991

22,533

22,991

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

The financial results set forth in this press release are

preliminary. Our disclosure and analysis in this press release,

which do not present historical information, contain

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements convey our current expectations or forecasts of future

events. You can identify these statements because they do not

relate strictly to historical or current facts. They use words such

as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” and other words and terms of similar meaning. They also

appear in any discussion of future operating or financial

performance. In particular, these include statements relating to

future actions, future performance of our products, expenses, the

outcome of any legal proceedings, and financial results. Although

we believe that we are basing our expectations and beliefs on

reasonable assumptions within the bounds of what we currently know

about our business and operations, the economy and other

conditions, there can be no assurance that our actual results will

not differ materially from what we expect or believe. Therefore,

you should proceed with caution in relying on any of these

forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future

performance.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors, some of which are

listed below, that are difficult to predict and could cause actual

results and outcomes to differ materially from any future results

or outcomes expressed or implied by such forward-looking

statements. Some of the factors that could cause our actual results

to differ from our expectations or beliefs include a decline in the

securities markets that adversely affect our assets under

management, negative performance of our products, the failure to

perform as required under our investment management agreements, and

a general downturn in the economy that negatively impacts our

operations. We also direct your attention to the more specific

discussions of these and other risks, uncertainties and other

important factors contained in our Form 10 and other public

filings. Other factors that could cause our actual results to

differ may emerge from time to time, and it is not possible for us

to predict all of them. We do not undertake to update publicly any

forward-looking statements if we subsequently learn that we are

unlikely to achieve our expectations whether as a result of new

information, future developments or otherwise, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190807005897/en/

Kenneth D. Masiello Chief Accounting Officer (203) 629-2726

Associated-Capital-Group.com

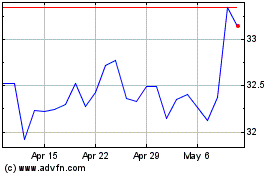

Associated Capital (NYSE:AC)

Historical Stock Chart

From Mar 2024 to Apr 2024

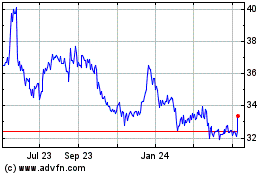

Associated Capital (NYSE:AC)

Historical Stock Chart

From Apr 2023 to Apr 2024