French car company seeks Fiat deal revival

By Sean McLain and Nick Kostov

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 3, 2019).

Top executives at Nissan Motor Co. and Renault SA are trying to

hash out a deal to reshape their global alliance, a step top

executives at the French car company hope will pave the way for

merger talks with Fiat Chrysler Automobiles NV to resume, according

to emails reviewed by The Wall Street Journal and people briefed on

the discussions.

Nissan wants Renault to reduce its 43.4% stake in the Japanese

auto company, the emails show, a move one of the people said is

aimed at resolving longstanding tensions between the two car

companies over the structure of their globe-spanning alliance.

Nissan is the larger company of the two, but only owns a 15%

nonvoting stake in Renault. The uneven shareholding agreement that

binds the alliance partners has long been a point of contention.

Concerns within Nissan that Renault's merger with Fiat Chrysler

could weaken the Japanese car maker's influence in the alliance led

it to withhold support for the deal, ultimately leading to the

deal's collapse.

Top executives at Renault are hoping changes to the shareholding

structure will allay Nissan's concerns and clear the way to restart

merger talks with Fiat Chrysler, according to the emails. The

merger proposal fell apart in June after Nissan said it wouldn't

back a tie-up and the French government asked to delay a board vote

on the matter. Fiat Chrysler Chairman John Elkann got frustrated

and walked away, ending discussions.

Renault and Nissan declined to comment for this article.

Talks to change the alliance's structure began soon after the

possible Renault-Fiat Chrysler deal collapsed and have been limited

to a small circle of top executives, board members and lawyers for

the companies, in part to prevent leaks, according to the emails

and one of the people involved.

The people briefed on the discussions cautioned the negotiations

are at an early stage, including talks on the potential reduction

in Renault's stake in Nissan. The talks could result in an initial

memorandum of understanding on the restructuring as early as

September, according to one of the emails, which is dated July 12.

Another person briefed on the discussions warned that talks could

stretch until the end of the year.

Even if the companies agree that Renault should sell shares in

Nissan, they will need the blessing of the French state, which has

expressed resistance to changing the structure without also

strengthening the alliance between the two car companies.

Renault and Fiat Chrysler have said that they continue to see

the merits of the merger, but no talks are currently happening.

Fiat Chrysler has said previously it can thrive as a stand-alone

company but still believes the merger proposal with Renault could

add value. On Wednesday, its CEO Mike Manley echoed that sentiment

in an earnings call with analysts, calling it "a great opportunity

for us. And we believe it's a very good opportunity for

Renault."

A Fiat Chrysler spokesman declined to comment.

According to a July 12 email from a Nissan lawyer, Renault asked

for a written proposal from Nissan on reshaping the alliance and

the conditions under which the Japanese car maker "would consider

that an agreement with FCA would be acceptable."

The email from the Nissan lawyer was sent to Hari Nada, a senior

Nissan executive. Mr. Nada also was one of the whistleblowers who

flagged alleged financial misconduct by former chairman Carlos

Ghosn. Mr. Ghosn has denied wrongdoing and says he will defend

himself in a trial slated to begin next year.

The timing of the emails is significant, because they occurred

after the French government, Renault's largest shareholder,

indicated it wasn't interested in changes to the alliance's

cross-shareholding agreement.

The government's support is considered crucial to getting an

alliance deal done.

In late June, French President Emmanuel Macron signaled support

wasn't forthcoming. Speaking in Osaka during the G-20 meeting, Mr.

Macron said Renault and Nissan should focus on the car business and

said any talk of changing the shareholding structure was

"off-topic."

On the Renault side, the discussions are being led by Chairman

Jean-Dominique Senard, CEO Thierry Bolloré and independent board

member Pierre Fleuriot, a former Credit Suisse Group AG executive,

according to the email exchanges and one of the people briefed on

the discussions.

Nissan's team includes CEO Hiroto Saikawa, Mr. Nada and

independent board member Masakazu Toyoda, who is a former Japanese

bureaucrat at the Ministry for Economy, Trade and Investment, the

emails show. Outside lawyers were tapped to provide advice to both

sides.

On July 14, Mr. Nada wrote to other members of the Nissan team

that he had discussed the Japanese car maker's potential list of

demands with Mr. Toyoda.

Mr. Toyoda told Mr. Nada that Renault must sell down its stake

in Nissan to around 5%-10%, according to Mr. Nada's email.

"The cross shareholding is a burden for both Red and Navy and it

is both companies interest to liquidate the holding and invest in

new ventures," Mr. Nada wrote in the email following his

conversation with Mr. Toyoda, using code names for Renault and

Nissan.

The French state has made it clear in the past that it wouldn't

support Renault selling its stake in Nissan without a deal to

strengthen the alliance between the two car makers.

Mr. Toyoda said Nissan should combine any stake sell down with

the creation of a new joint-venture entity controlled by Renault

and Nissan "in order to show that despite the capital adjustments

the alliance is not dead," Mr. Nada wrote. "Otherwise, Senard may

not be able to move."

Reviving the Fiat Chrysler deal remains a key goal of Renault's

Mr. Senard, who has said the merger remains attractive to both

Renault and the alliance. "Everyone has the right to dream," Mr.

Senard told reporters last month in response to a question about

his desire to revive a merger between Renault and Fiat

Chrysler.

Still, his main priority is strengthening the alliance and

resolving any tensions between the two partners first, said one of

the people briefed on the discussions.

Write to Sean McLain at sean.mclain@wsj.com and Nick Kostov at

Nick.Kostov@wsj.com

(END) Dow Jones Newswires

August 03, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

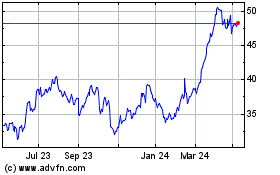

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

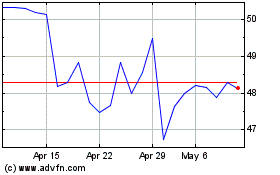

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024