Expected Oil Supply Surge Sustains Bear Market -- 2nd Update

August 01 2019 - 2:17PM

Dow Jones News

By Amrith Ramkumar

Growth in oil supply is forecast to accelerate next year in a

global wave of production, keeping crude prices mired in a bear

market and possibly lowering fuel prices for consumers.

The U.S. is expected to continue driving much of the surge in

output, and increases by smaller producers such as Brazil and

Norway will contribute to excess supply, investors say. Citigroup

and JPMorgan Chase analysts currently project supply will grow

roughly one million barrels a day more than demand in 2020,

resulting in a surplus each quarter of next year.

Oil fell about 6.5% to $54.80 a barrel Thursday, heading for its

largest one-day drop of the year and extending losses after

President Trump announced 10% tariffs on some Chinese imports

starting Sept. 1. Anxiety about trade tensions weakening demand has

bolstered worries about a supply glut in recent months, investors

say.

Plentiful supply has been a boon for U.S. consumers, who are on

average paying less for gasoline at the pump this summer than they

were a year ago and continue to drive economic growth even as

business investment slows. Companies including railroad operator

Union Pacific Corp. have also cited lower fuel costs as a positive

for second-quarter profits, though worries about economic

uncertainty and demand continue to hurt transportation firms.

The expected oversupply is also the latest threat to the

Organization of the Petroleum Exporting Countries and other

producers, many of which are curbing output to try to balance the

market.

Investors will be monitoring quarterly results from Exxon Mobil

Corp. and Chevron Corp. on Friday after most of the large energy

companies reported underwhelming figures for the first three months

of the year. Royal Dutch Shell PLC became the latest energy giant

to report a drop in second-quarter profits from a year earlier

Thursday.

Many investors have long expected a surge in U.S. shale

production to continue as new pipelines from the prolific Permian

Basin of Texas and New Mexico ease bottlenecks in the region. But

analysts said the addition of barrels from ancillary producers

threatens to make the expected surpluses bigger, particularly as

concern about a slowing world economy triggers fears about

crumbling demand.

Analysts estimate output from offshore projects in Brazil, a

Norwegian oil field in the North Sea and easing production

curtailments in Canada could produce several hundred thousand

barrels a day of crude next year. That figure is still relatively

small, but growth from those projects is bolstering bets output

will exceed consumption.

"Those are very relevant in tipping the scales," said Rebecca

Babin, a senior energy trader at CIBC Private Wealth Management.

"It's very hard for people to look at the 2020 supply-demand

imbalances and want to get long," referring to bullish

positions.

The projections for oversupply explain in part why oil prices

have barely moved in response to recent attacks in and near the

Strait of Hormuz, a critical shipping area near the Persian

Gulf.

U.S. crude prices have generally stayed in a range of $55 to $60

a barrel during the past six weeks, remaining well below their 2019

peak above $66. Oil would need to close at or above $61.37 to exit

its current bear market, which began in early June when crude

closed 20% below its April high.

Prices are up sharply in 2019, though they are still down about

15% in the past year. The moves have encouraged hedge funds and

other speculative investors to boost bets prices will fall. The

ratio of bullish bets to bearish wagers by the group on U.S. crude

has fallen to just over 3, down from last year's peak of 26 in July

2018. The most recent figures showed speculators increased bearish

bets by nearly 50% from a week earlier.

"There's a greater appreciation now that we're not in a

supply-constrained world," said Noah Barrett, an energy research

analyst at Janus Henderson Investors.

Inventories have already been rising. Oil stockpiles in

Organization for Economic Cooperation and Development countries

rose in each of the first five months of the year, the

International Energy Agency estimates. The group projects that the

world's requirement for OPEC crude is set to fall next year to its

lowest level in 16 1/2 years as supply outside the cartel

rises.

Oil has barely budged, with global supply disruptions at their

highest level in three decades. That means any shifts in sanctions

policies affecting Iran and Venezuela or other political

developments could add to bearish momentum.

"Some of the constraints on capacity could come off if

geopolitical events change, on top of the potential growth," said

Darwei Kung, a portfolio manager of the $2.8 billion DWS Enhanced

Commodity Strategy Fund. "That's one of the reasons we're a little

bit concerned about what the increase might mean to the global

balance."

Still, some analysts are hopeful that OPEC will continue curbing

output and that demand will exceed low expectations, supporting

crude and beaten-down shares of producers. Investors are also

demanding discipline from U.S. oil companies, many of which are

limiting production activity.

And with the S&P 500 energy sector down 19% in the past

year, some say companies with lower costs and higher shareholder

returns look attractive, even if oil stays in its current

range.

"The way to play it is to be cautious and select the quality

names," said David Yepez, a portfolio manager at Exencial Wealth

Advisors, which has been increasing positions in Exxon and Pioneer

Natural Resources Co. recently.

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

August 01, 2019 14:02 ET (18:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

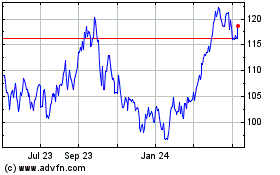

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

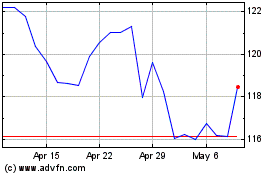

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024