TIDMMT

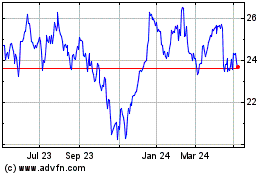

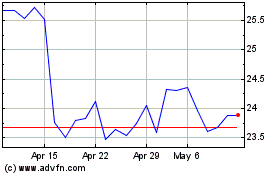

Luxembourg, August 1, 2019 - ArcelorMittal (referred to as

"ArcelorMittal" or the "Company") (MT (New York, Amsterdam, Paris,

Luxembourg), MTS (Madrid)), the world's leading integrated steel and

mining company, today announced results(1) for the three-month and

six-month periods ended June 30, 2019.

Highlights:

-- Health and safety: LTIF rate2 of 1.26x in 2Q 2019 and 1.19x in 1H 2019

-- Operating loss of $0.2bn in 2Q 2019 including $0.9bn of impairments

($0.3bn related to the remedy asset sales for the ArcelorMittal Italia

acquisition and $0.6bn impairment of the fixed assets of ArcelorMittal

USA following a sharp decline in steel prices and high raw material

costs); 1H 2019 operating income of $0.6bn including $1.1bn of

impairments3

-- EBITDA of $1.6bn in 2Q 2019; 1H 2019 EBITDA of $3.2bn, -42.6% lower YoY

reflecting a negative price-cost effect

-- Net loss of $0.4bn in 2Q 2019 (including $0.9bn of impairments3); 1H 2019

net loss of $33 million (including $1.1bn of impairments3)

-- Steel shipments of 22.8Mt in 2Q 2019, up 4.3% vs. 1Q 2019 and up 4.8% vs.

2Q 2018; 1H 2019 steel shipments of 44.6Mt, up 3.5% YoY largely

reflecting the impact of the ArcelorMittal Italia acquisition

-- 2Q 2019 iron ore shipments of 15.5Mt (+6.1% YoY), of which 9.9Mt shipped

at market prices (-1.0% YoY); 1H 2019 iron ore shipments of 29.3Mt (+3.0%

YoY), of which 19.1Mt shipped at market prices (-0.4% YoY)

-- Gross debt of $13.8bn as of June 30, 2019 as compared to $13.4bn as of

March 31, 2019. Net debt decreased by $1.0bn during the quarter to

$10.2bn as of June 30, 2019, due in part to M&A proceeds and working

capital release ($0.4bn) (despite higher raw materials costs and higher

steel shipments). Excluding IFRS 16 impact4, net debt as of June 30, 2019

was $1.5bn lower YoY

Strategic actions:

-- Given weak demand and high import levels in Europe, the Company has taken

steps to align its European production levels to the current market

demand. As a result of previously announced European production

curtailments, approximately 4.2Mt of annualized production curtailment is

scheduled for 2H 2019

-- Further temporary cost initiatives undertaken to navigate the current

weak market backdrop

-- Excluding IFRS 16 impact, net debt at the end of June 30, 2019 was the

lowest level achieved since the ArcelorMittal merger. Deleveraging

remains the Group's priority.

-- Cash needs of the business for 2019 have been reduced by $1.0bn to $5.4bn,

due to lower expected capex and tax and others

-- To complement the expected deleveraging through FCF generation, the

Company has identified opportunities to unlock up to $2bn of value from

its asset portfolio over the next two years

Outlook:

-- The Company now expects global steel demand in 2019 to grow +0.5% to

+1.5% (ex-China steel demand growth of +0.5% to +1.0%; US +0% to +1.0%;

and Europe to contract by between -2.0% to -1.0%)

-- Against this backdrop and considering scope changes (ArcelorMittal Italia

acquisition, remedy asset sales and European production curtailments)

steel shipments are still expected to increase YoY, which should provide

support for the Group's Action 2020 program

Financial highlights (on the basis of IFRS(1) ):

(USDm) unless otherwise shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

----------------------------------- ------- ------ ------ ------- --------

Sales 19,279 19,188 19,998 38,467 39,184

Operating (loss)/income (158) 769 2,361 611 3,930

Net (loss)/income attributable

to equity holders of the parent (447) 414 1,865 (33) 3,057

Basic (loss) / earnings per common

share (US$) (0.44) 0.41 1.84 (0.03) 3.01

Operating (loss) / income/ tonne

(US$/t) (7) 35 109 14 91

EBITDA 1,555 1,652 3,073 3,207 5,585

EBITDA/ tonne (US$/t) 68 76 141 72 130

Steel-only EBITDA/ tonne (US$/t) 43 56 127 50 114

Crude steel production (Mt) 23.8 24.1 23.2 47.8 46.5

Steel shipments (Mt) 22.8 21.8 21.8 44.6 43.1

Own iron ore production (Mt) 14.6 14.1 14.5 28.7 29.1

Iron ore shipped at market price

(Mt) 9.9 9.2 10.0 19.1 19.1

----------------------------------- ------- ------ ------ ------- --------

Commenting, Mr. Lakshmi N. Mittal, ArcelorMittal Chairman and CEO, said:

"After a strong 2018, market conditions in the first half of 2019 have

been very tough, with the profitability of our steel segments suffering

due to lower steel prices combined with higher raw material costs. This

has been only partially offset by improved profitability from our mining

segment, but I am pleased that we have generated healthy free cash flow

demonstrating the improved robustness of the business thanks to our

Action 2020 plan.

Global overcapacity remains a clear challenge. We have reduced capacity

in Europe in response to the current weak demand environment, which has

also impacted the turnaround of the ex-Ilva facilities in Italy. Further

action needs to be taken to address the increasing level of imports

entering the continent due to ineffective safeguard measures and we

continue to engage with the European Commission to create a level

playing field for the sector. A supportive regulatory and funding

environment is also crucial to our ambition to significantly reduce our

emissions as announced in our recent Climate Action report.

We are taking further actions to adapt and strengthen the Company,

ensuring we make continued progress towards our net debt target and

increase returns to shareholders. Despite the current challenges, the

Company is well positioned to benefit from any improvement in market

conditions and the current very low spread environment".

Sustainable development and safety performance

Health and safety - Own personnel and contractors lost time injury

frequency rate

Health and safety performance (inclusive of ArcelorMittal Italia

(previously known as Ilva)), based on own personnel figures and

contractors lost time injury frequency (LTIF) rate was 1.26x in second

quarter of 2019 ("2Q 2019") as compared to 1.14x in the first quarter of

2019 ("1Q 2019"). Health and safety performance (inclusive of

ArcelorMittal Italia) in the first six months of 2019 ("1H 2019") was

1.19x.

Excluding the impact of ArcelorMittal Italia, the LTIF was 0.68x for 2Q

2019 as compared to 0.66x for 1Q 2019 and 0.71x for the second quarter

of 2018 ("2Q 2018"). Health and safety performance (excluding the

impact of ArcelorMittal Italia) improved to 0.66x in 1H 2019 as compared

to 0.67x for the first six months of 2018 ("1H 2018").

The Company's efforts to improve its Health and Safety record remain

focused on both further reducing the rate of severe injuries and

preventing fatalities.

Own personnel and contractors - Frequency rate

Lost time injury frequency rate 2Q 19 1Q 19 2Q 18 1H 19 1H 18

----------------------------------- ----- ----- ----- ----- -------

Mining 0.64 0.38 0.62 0.51 0.53

NAFTA 0.46 0.58 0.64 0.50 0.52

Brazil 0.43 0.48 0.35 0.45 0.36

Europe 1.00 0.85 1.02 0.91 0.92

ACIS 0.58 0.75 0.52 0.66 0.64

Total Steel 0.69 0.71 0.72 0.69 0.69

Total (Steel and Mining) 0.68 0.66 0.71 0.66 0.67

-----------------------------------

ArcelorMittal Italia 13.73 11.05 - 12.35 -

Total (Steel and Mining) including

ArcelorMittal Italia 1.26 1.14 - 1.19 -

----- ----- ----- ----- -------

Key sustainable development highlights for 2Q 2019:

-- ArcelorMittal published its first Climate Action report with a stated

ambition to significantly reduce its carbon footprint by 2050;

ArcelorMittal's European business specifically targets to be carbon

neutral by 2050.

-- ArcelorMittal has become a member of the Energy Transition Commission.

-- ArcelorMittal hosted a consultation at the ArcelorMittal Orbit in London

on the draft ResponsibleSteel(TM) standard - the steel industry's first,

multi-stakeholder standard for the entire 'mine-to-metal' steel value

chain. The standard is due to launch to the market at the end of 2019.

-- ArcelorMittal won Fiat Chrysler Automobiles' best raw material supplier

award, recognizing our commitment to deliver value through innovation,

quality and competitiveness.

-- ArcelorMittal was named Steel Sustainability Champion by the World Steel

Association for the second consecutive year.

Analysis of results for the six months ended June 30, 2019 versus

results for the six months ended June 30, 2018

Total steel shipments for 1H 2019 were 44.6 million metric tonnes

representing an increase of 3.5% as compared to 1H 2018,

primarily due to higher steel shipments in Europe (+10.1%) due to the

impact of ArcelorMittal Italia (following its consolidation from

November 1, 2018) and in Brazil (+6.6%), offset in part by lower

shipments in ACIS (-4.0%) and NAFTA (-5.3%). Excluding the impact of

ArcelorMittal Italia and Votorantim, steel shipments in 1H 2019 were

1.9% lower as compared to 1H 2018.

Sales for 1H 2019 decreased by 1.8% to $38.5 billion as compared with

$39.2 billion for 1H 2018, primarily due to lower average steel selling

prices (-6.1%) offset in part by higher steel shipments (+3.5%).

Depreciation of $1.5 billion for 1H 2019 was higher as compared with

$1.4 billion in 1H 2018. Depreciation charges for 2019 include the

depreciation of right-of-use assets recognized in property, plant and

equipment under IFRS 16 lease accounting, which were previously recorded

in cost of sales and selling, general and administrative expenses. FY

2019 depreciation is expected to be approximately $3.1 billion (based on

current exchange rates).

Impairment charges for 1H 2019 were $1.1 billion related to the remedy

asset sales for the ArcelorMittal Italia acquisition ($0.5 billion) and

impairment of the fixed assets of ArcelorMittal USA ($0.6 billion)

following a sharp decline in steel prices and high raw material costs.

Impairment charges for 1H 2018 were $86 million related to the agreed

remedy package required for the approval of the Votorantim

acquisition(5) .

Exceptional items for 1H 2019 were nil. Exceptional charges for 1H 2018

were $146 million related to a provision taken in respect of a case that

has been settled(6) .

Operating income for 1H 2019 was lower at $0.6 billion as compared to

$3.9 billion in 1H 2018 primarily driven by impairments as discussed

above, as well as weaker operating conditions (negative price-cost

effect in steel segments) reflecting both the impact of the decline in

steel prices since 4Q 2018 and higher raw material costs offset in part

by improved mining segment performance.

Income from associates, joint ventures and other investments for 1H 2019

was higher at $302 million as compared to $242 million for 1H 2018.

Performance of Calvert and Chinese investee weakened in 1H 2019 as

compared to 1H 2018, whilst 1H 2018 was negatively impacted by $132

million impairment of ArcelorMittal's investment in Macsteel (South

Africa) following the announced sale of its 50% stake in May 2018.

Income from investments in associates, joint ventures and other

investments in 1H 2019 and 1H 2018 include the annual dividend income

from Erdemir of $93 million and $87 million, respectively.

Net interest expense in 1H 2019 was slightly lower at $315 million as

compared to $323 million in 1H 2018. The Company expects full year 2019

net interest expense to be approximately $650 million.

Foreign exchange and other net financing losses were $404 million for 1H

2019 as compared to $564 million for 1H 2018. Foreign exchange losses

for 1H 2019 were $14 million as compared to foreign exchange losses of

$237 million in 1H 2018.

ArcelorMittal recorded an income tax expense of $149 million for 1H 2019

as compared to $184 million for 1H 2018. The deferred tax benefit of

$340 million in 1H 2018 is the result of recording a deferred tax asset

primarily due to the expectation of higher future profits mainly in

Luxembourg, following the share capital conversion.

ArcelorMittal's net loss for 1H 2019 was $33 million, or $0.03 basic

loss per common share, as compared to a net income in 1H 2018 of $3.1

billion, or $3.01 basic earnings per common share.

Analysis of results for 2Q 2019 versus 1Q 2019 and 2Q 2018

Total steel shipments in 2Q 2019 were 4.3% higher at 22.8Mt as compared

with 21.8Mt for 1Q 2019 primarily due to higher steel shipments in ACIS

(+19.5%) due to normalization of production in Temirtau (Kazakhstan),

seasonally higher shipments in Europe (+2.2%), higher shipments in NAFTA

(+2.2%), primarily due to ramp up of the blast furnace in Mexico, offset

by lower shipments in Brazil (-3.3%) due to weaker export conditions.

Total steel shipments in 2Q 2019 were 4.8% higher as compared with

21.8Mt for 2Q 2018 primarily due to higher steel shipments in Europe

(+12.3%) due to the acquisition of ArcelorMittal Italia, ACIS (+4.1%)

due to operational issues in Ukraine last year offset by lower steel

shipments in NAFTA (-6.3%) and in Brazil (-1.6%). Excluding the impact

of the ArcelorMittal Italia acquisition, steel shipments were -0.7%

lower as compared to 2Q 2018.

Sales in 2Q 2019 were 0.5% higher at $19.3 billion as compared to $19.2

billion for 1Q 2019 primarily due to higher steel shipments (+4.3%)

offset in part by lower average steel selling prices (-3.9%). Sales in

2Q 2019 were 3.6% lower as compared to $20 billion for 2Q 2018 primarily

due to lower average steel selling prices (-8.8%), partially offset by

higher steel shipments (+4.8%).

Depreciation for 2Q 2019 was higher at $766 million as compared to $733

million for 1Q 2019. 2Q 2019 depreciation expense was higher than $712

million in 2Q 2018 primarily due to the impact of IFRS 16.

Impairment charges for 2Q 2019 were $947 million related to the remedy

asset sales for the ArcelorMittal Italia acquisition ($347 million) and

impairment of the fixed assets of ArcelorMittal USA ($600 million)

following a sharp decline in steel prices and high raw material costs.

Impairment charges for 1Q 2019 of $150 million related to the remedy

asset sales for the ArcelorMittal Italia acquisition. Impairment charges

for 2Q 2018 were nil.

Operating loss for 2Q 2019 was $0.2 billion as compared to an operating

income of $0.8 billion in 1Q 2019 and an operating income of $2.4

billion in 2Q 2018 primarily driven by impairments as discussed above,

as well as weaker operating conditions (negative price-cost effect in

the steel segments) reflecting both the impact of the decline in steel

prices since 1Q 2019 and higher raw material prices, offset in part by

the impact of higher seaborne iron ore reference prices.

Income from associates, joint ventures and other investments for 2Q 2019

was $94 million as compared to $208 million for 1Q 2019 and $30 million

for 2Q 2018. 2Q 2019 was impacted by weaker Chinese and Calvert investee

performances. 1Q 2019 was positively impacted by the annual dividend

declared by Erdemir ($93 million). 2Q 2018 was impacted by $132 million

impairment of ArcelorMittal's investment in Macsteel (South Africa)

following the announced sale of its 50% stake in May 2018.

Net interest expense in 2Q 2019 was $154 million as compared to $161

million in 1Q 2019 and lower than $159 million in 2Q 2018.

Foreign exchange and other net financing losses in 2Q 2019 were $173

million as compared to $231 million for 1Q 2019 and $390 million in 2Q

2018. Foreign exchange gain for 2Q 2019 was $34 million as compared to

foreign exchange losses of $48 million and $309 million, in 1Q 2019 and

2Q 2018, respectively. 2Q 2019 includes non-cash mark-to-market losses

of $55 million related to the mandatory convertible bonds call option as

compared to losses of $6 million in 1Q 2019 and gains of $91 million in

2Q 2018.

ArcelorMittal recorded an income tax expense of $14 million in 2Q 2019

as compared to an income tax expense of $135 million for 1Q 2019 and an

income tax benefit of $19 million for 2Q 2018.

Income attributable to non-controlling interests was $42 million for 2Q

2019 as compared to $36 million for 1Q 2019 and losses attributable to

non-controlling interests of $4 million in 2Q 2018.

ArcelorMittal recorded a net loss for 2Q 2019 of $0.4 billion, or $0.44

basic loss per common share, as compared to net income for 1Q 2019 of

$0.4 billion, or $0.41 basic earnings per common share, and a net income

for 2Q 2018 of $1.9 billion, or $1.84 basic earnings per common share.

Analysis of segment operations

NAFTA

(USDm) unless otherwise

shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

Sales 5,055 5,085 5,356 10,140 10,108

Operating (loss) / income (539) 216 660 (323) 968

Depreciation (137) (134) (131) (271) (263)

Impairments (600) -- -- (600) --

EBITDA 198 350 791 548 1,231

Crude steel production

(kt) 5,590 5,388 5,946 10,978 11,810

Steel shipments (kt) 5,438 5,319 5,803 10,757 11,362

Average steel selling

price (US$/t) 836 874 853 855 817

-------------------------- ----- ----- ----- ------ ------

NAFTA segment crude steel production increased by 3.7% to 5.6Mt in 2Q

2019 as compared to 5.4Mt in 1Q 2019. This increase was primarily due to

ramp up of the blast furnace in Mexico (which had suffered delays

following scheduled maintenance in 3Q 2018).

Steel shipments in 2Q 2019 increased by 2.2% to 5.4Mt as compared to

5.3Mt in 1Q 2019 primarily due to a 21.1% improvement in the long

product shipments (mainly in Mexico as discussed above).

Sales in 2Q 2019 were stable at $5.1 billion as compared to 1Q 2019,

primarily due to higher steel shipments (+2.2%) offset by a 4.3% decline

in average steel selling prices (with both flat and long products down

3.6% and 5.7%, respectively). US prices have deteriorated through 2Q

2019 reflecting weaker demand exacerbated by prolonged customer

destocking and increased domestic supply with prices well below import

parity.

Impairment charges for 2Q 2019 were $600 million related to impairment

of the fixed assets of ArcelorMittal USA following a sharp decline in

steel prices and high raw material costs. As a result, there was an

operating loss in 2Q 2019 of $539 million as compared to operating

income of $216 million in 1Q 2019 and $660 million in 2Q 2018.

EBITDA in 2Q 2019 decreased by 43.4% to $198 million as compared to $350

million in 1Q 2019 primarily due to negative price-cost effect offset in

part by higher steel shipment volumes. EBITDA in 2Q 2019 decreased by

75.0% as compared to $791 million in 2Q 2018 primarily due to a negative

price-cost effect and lower steel shipments (-6.3%).

Brazil

(USDm) unless otherwise

shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

---------------------------- ------ ------ ------ ------ --------

Sales 2,126 2,156 2,191 4,282 4,179

Operating income 234 239 369 473 584

Depreciation (79) (70) (74) (149) (143)

Impairment -- -- -- -- (86)

EBITDA 313 309 443 622 813

-----

Crude steel production (kt) 2,830 3,013 3,114 5,843 5,915

Steel shipments (kt) 2,785 2,880 2,831 5,665 5,314

Average steel selling price

(US$/t) 705 704 728 705 739

---------------------------- ----- ----- ----- ----- -----

Brazil segment crude steel production decreased by 6.1% to 2.8Mt in 2Q

2019 as compared to 3.0Mt for 1Q 2019, due in part to the decision to

stop ArcelorMittal Tubarão's blast furnace #2 in June, two months

earlier than its initial maintenance schedule due to deteriorating

export market conditions, as well as lower production in the long

business.

Steel shipments in 2Q 2019 decreased by 3.3% to 2.8Mt as compared to

2.9Mt in 1Q 2019, due to a decrease in flat products (-8.0%) primarily

due to lower exports.

Sales in 2Q 2019 decreased by 1.4% to $2.1 billion as compared to $2.2

billion in 1Q 2019, primarily due to lower steel shipments as discussed

above. Average steel selling prices remained stable as increases in

local currency sales prices were offset by currency depreciation.

Operating income in 2Q 2019 marginally declined to $234 million as

compared to $239 million in 1Q 2019 and was lower than $369 million in

2Q 2018.

EBITDA in 2Q 2019 increased by 1.2% to $313 million as compared to $309

million in 1Q 2019. EBITDA in 2Q 2019 was 29.3% lower as compared to

$443 million in 2Q 2018 primarily due to negative price-cost effect and

foreign exchange translation impact.

Europe

(USDm) unless otherwise

shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

----------------------- ------- ------- ------- ------- ---------

Sales 10,396 10,494 10,527 20,890 21,168

Operating (loss) /

income (301) 11 853 (290) 1,433

Depreciation (313) (309) (292) (622) (610)

Impairment (347) (150) -- (497) --

Exceptional charges -- -- -- -- (146)

EBITDA 359 470 1,145 829 2,189

Crude steel production

(kt) 12,079 12,372 11,026 24,451 22,272

Steel shipments (kt) 11,811 11,553 10,516 23,364 21,213

Average steel selling

price (US$/t) 704 729 800 716 800

----------------------- ------ ------ ------ ------ ------

Europe segment crude steel production decreased by 2.4% to 12.1Mt in 2Q

2019 as compared to 12.4Mt in 1Q 2019, primarily due to weaker than

expected market conditions.

Steel shipments in 2Q 2019 seasonally increased by 2.2% to 11.8Mt as

compared to 11.6Mt in 1Q 2019, whilst they were 12.3% higher than 2Q

2018 (due to the scope impact from the ArcelorMittal Italia acquisition

which was consolidated from November 1, 2018), the impact of floods in

Asturias, Spain and the impact of rail strikes in France in 2Q 2018.

Sales in 2Q 2019 were $10.4 billion, -0.9% lower as compared to $10.5

billion in 1Q 2019, with lower average steel selling prices -3.5% (with

both flat and long products declining 3.5% and 3.7%, respectively)

offset in part by higher steel shipments, as discussed above.

Impairment charges for 2Q 2019 and 1Q 2019 were $347 million and $150

million, respectively, related to remedy asset sales related to

ArcelorMittal Italia. Impairment charges for 2Q 2018 were nil.

Operating loss in 2Q 2019 was $301 million as compared to operating

income of $11 million in 1Q 2019 and $853 million in 2Q 2018. Operating

results were impacted by impairment charges as discussed above.

Despite seasonally higher steel shipments, EBITDA in 2Q 2019 decreased

by -23.7% to $359 million as compared to $470 million in 1Q 2019

primarily due to a negative price-cost effect. EBITDA in 2Q 2019

decreased by -68.7% as compared to $1,145 million in 2Q 2018, primarily

due to negative price-cost effect, foreign exchange impact, and

continued losses of ArcelorMittal Italia. Assuming existing market

conditions and no ongoing license to operate issues, an accelerated

action plan has been implemented to significantly reduce ArcelorMittal

Italia losses by 4Q 2019.

ACIS

(USDm) unless otherwise

shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

---------------------------- ------ ------ ------ ------ --------

Sales 1,906 1,645 2,129 3,551 4,209

Operating income 114 64 312 178 602

Depreciation (85) (81) (85) (166) (158)

EBITDA 199 145 397 344 760

Crude steel production (kt) 3,252 3,323 3,087 6,575 6,487

Steel shipments (kt) 3,182 2,662 3,057 5,844 6,086

Average steel selling price

(US$/t) 536 541 621 538 616

---------------------------- ----- ----- ----- ----- -----

ACIS segment crude steel production in 2Q 2019 was broadly stable at

3.3Mt as compared to 1Q 2019 primarily due to normalization of

production in Temirtau (Kazakhstan) following an explosion at a gas

pipeline in 4Q 2018 offset by lower production in Ukraine due to planned

blast furnace repair and in South Africa following a scheduled

maintenance.

Steel shipments in 2Q 2019 increased by 19.5% to 3.2Mt as compared to

2.7Mt as at 1Q 2019, primarily due to the improved shipments in all

three regions particularly in Kazakhstan.

Sales in 2Q 2019 increased by 15.8% to $1.9 billion as compared to $1.6

billion in 1Q 2019 primarily due to higher steel shipments.

Operating income in 2Q 2019 was higher at $114 million as compared to

$64 million in 1Q 2019 and lower as compared to $312 million in 2Q 2018.

EBITDA in 2Q 2019 increased by 37.5% to $199 million as compared to $145

million in 1Q 2019 primarily due to higher steel shipment volumes.

EBITDA in 2Q 2019 was 49.7% lower as compared to $397 million in 2Q

2018, primarily due to negative price-cost effect partially offset by

higher shipments.

Mining

(USDm) unless otherwise shown 2Q 19 1Q 19 2Q 18 1H 19 1H 18

--------------------------------------- ------ ------ ------ ------ --------

Sales 1,423 1,127 1,065 2,550 2,089

Operating income 457 313 198 770 440

Depreciation (113) (107) (107) (220) (214)

EBITDA 570 420 305 990 654

Own iron ore production (Mt) 14.6 14.1 14.5 28.7 29.1

Iron ore shipped externally and

internally at market price (a)

(Mt) 9.9 9.2 10.0 19.1 19.1

Iron ore shipment - cost plus

basis (Mt) 5.6 4.6 4.6 10.2 9.3

Own coal production (Mt) 1.5 1.2 1.6 2.7 3.1

Coal shipped externally and internally

at market price (a) (Mt) 0.7 0.7 0.7 1.4 1.1

Coal shipment - cost plus basis

(Mt) 0.7 0.7 0.9 1.4 1.8

--------------------------------------- ----- ----- ----- ----- -----

(a) Iron ore and coal shipments of market-priced based materials include

the Company's own mines and share of production at other mines

Own iron ore production in 2Q 2019 increased by 4.0% to 14.6Mt as

compared to 14.1Mt in 1Q 2019, primarily due to seasonally higher

production in ArcelorMittal Mines Canada(7) (AMMC). Own iron ore

production in 2Q 2019 increased by 1.2% as compared to 2Q 2018 primarily

due to higher AMMC and Ukraine production offset in part by lower

production in Liberia and Kazakhstan and the Volcan mine in Mexico which

reached end of life in May 2019.

Market-priced iron ore shipments in 2Q 2019 increased by 7.7% to 9.9Mt

as compared to 9.2Mt in 1Q 2019, primarily driven by seasonally higher

market-priced iron ore shipments in AMMC offset in part by lower

shipments in Liberia and at the Volcan mine in Mexico (as discussed

above). Market-priced iron ore shipments in 2Q 2019 were largely stable

as compared to 2Q 2018 driven by higher shipments in AMMC and Serra Azul

offset by lower shipments in Ukraine. Market-priced iron ore shipments

for FY 2019 are expected to be stable as compared to FY 2018 with

increases in Liberia and AMMC to be offset by lower volume at the Volcan

mine.

Own coal production in 2Q 2019 increased by 18.1% to 1.5Mt as compared

to 1.2Mt in 1Q 2019 primarily due to higher production at Princeton (US)

and Temirtau (Kazakhstan). Own coal production in 2Q 2019 decreased by

9.0% as compared to 1.6Mt in 2Q 2018 due to lower production at Temirtau

(Kazakhstan).

Market-priced coal shipments in 2Q 2019 were stable at 0.7Mt as compared

to 1Q 2019 and 2Q 2018.

Operating income in 2Q 2019 increased by 46.2% to $457 million as

compared to $313 million in 1Q 2019 and $198 million in 2Q 2018.

EBITDA in 2Q 2019 increased by 35.8% to $570 million as compared to $420

million in 1Q 2019, primarily due to the impact of higher seaborne iron

ore reference prices (+22.5%) and higher market-priced iron ore

shipments (+7.7%). EBITDA in 2Q 2019 was 86.7% higher as compared to

$305 million in 2Q 2018, primarily due to higher seaborne iron ore

reference prices (+53.0%).

Liquidity and Capital Resources

For 2Q 2019 net cash provided by operating activities was $1,786 million

as compared to $971 million in 1Q 2019 and $1,232 million in 2Q 2018.

The cash provided by operating activities during 2Q 2019 reflects in

part a working capital release of $353 million as compared to a working

capital investment of $553 million in 1Q 2019 and a working capital

investment of $1,232 million in 2Q 2018.

Due to a smaller than anticipated release in 4Q 2018, the Group invested

more in working capital than expected in 2018 ($4.4 billion versus

guidance of $3.0-3.5 billion). The Group expects this additional

investment of approximately $1 billion to be released in full over the

course of 2019. The 1H 2019 working capital investment of $0.2 billion

was significantly less pronounced than in previous years despite

seasonally higher shipments and higher raw material prices reflecting

the Company's focus on the structural release of the excess working

capital. Given the 1H 2019 working capital investment of $0.2 billion

this implies a release of $1.2 billion in 2H 2019.

Net cash used in investing activities during 2Q 2019 was $564 million as

compared to $693 million during 1Q 2019 and $556 million in 2Q 2018.

Capex decreased to $869 million in 2Q 2019 as compared to $947 million

in 1Q 2019 and increased as compared to $616 million in 2Q 2018. Whilst

no significant delays to growth investments are expected, the Company

has reduced overall expected capex across all segments in FY 2019 by

$0.5 billion and now expects FY 2019 capex to be $3.8 billion versus

previous guidance of $4.3 billion.

Net cash provided by other investing activities in 2Q 2019 of $305

million primarily includes net proceeds from remedy asset sales for the

ArcelorMittal Italia acquisition of $0.5 billion, offset by $0.1 billion

partial reversal of the Indian rupee rolling hedge (see below) and by

the quarterly lease payment for the ArcelorMittal Italia acquisition

($51 million). Net cash provided by other investing activities in 1Q

2019 of $254 million primarily includes $0.3 billion due to the rollover

of the Indian rupee hedge at market price which protects the dollar

funds needed for the Essar transaction as per the resolution plan

approved by the Committee of Creditors and the National Company Law

Tribunal in Ahmedabad, offset in part by the quarterly lease payment for

the ArcelorMittal Italia acquisition ($51 million).

Net cash provided by financing activities in 2Q 2019 was $180 million as

compared to net cash used in financing activities of $344 million in 1Q

2019 and net cash provided by financing activities in 2Q 2018 of $352

million.

In 2Q 2019, net cash provided by financing activities included a net

inflow of $0.5 billion for new bank financing. In 1Q 2019, net outflow

of debt repayments and issuances of $136 million includes $1 billion

repayment of amounts borrowed in connection with the purchase of the

Uttam Galva and KSS Petron debts, $0.9 billion repayment of the EUR750

million 5-year, 3% bond at maturity; and offset in part by $1.6 billion

cash received from the issuance of two new bonds (EUR750 million 2.25%

notes due 2024 and $750 million 4.55% notes due 2026) and $0.2 billion

commercial paper issuance. Net cash provided by financing activities in

2Q 2018 of $352 million primarily includes proceeds from a $1 billion

short-term loan facility entered into on May 14, 2018 offset by

repayment of a EUR400 million ($491 million) bond at maturity on April

9, 2018.

During 2Q 2019, the Company paid dividends of $204 million mainly to

ArcelorMittal shareholders. During 1Q 2019, the Company paid dividends

of $46 million to minority shareholders in AMMC (Canada). During 2Q

2018, the Company paid dividends of $101 million to ArcelorMittal

shareholders. During 1Q 2019, the Company completed its share buyback

programme having repurchased 4 million shares for a total value of $90

million (EUR80 million) at an approximate average price per share of

$22.42 (EUR19.89 per share).

Outflows from lease principal payments and other financing activities

(net) were $84 million in 2Q 2019 as compared $72 million in 1Q 2019 and

$21 million in 2Q 2018. The increase is as a result of the first-time

application of IFRS 16 effective from January 1, 2019, as the repayments

of the principal portion of the operating leases are presented under

financing activities (previously reported under operating activities).

As of June 30, 2019, the Company's cash and cash equivalents amounted to

$3.7 billion as compared to $2.2 billion at March 31, 2019 and $2.4

billion at December 31, 2018.

Gross debt increased to $13.8 billion as of June 30, 2019, as compared

to $13.4 billion at March 31, 2019 and $12.6 billion in December 31,

2018. As of June 30, 2019, net debt decreased by $1.0 billion to $10.2

billion as compared to $11.2 billion as of March 31, 2019. Net debt as

of December 31, 2018, was $10.2 billion.

As of June 30, 2019, the Company had liquidity of $9.2 billion,

consisting of cash and cash equivalents of $3.7 billion and $5.5 billion

of available credit lines(8) . The $5.5 billion credit facility contains

a financial covenant not to exceed 4.25x Net debt / LTM EBITDA (as

defined in the facility). As of June 30, 2019, the average debt maturity

was 4.7 years.

Key recent developments

-- On May 6, 2019, ArcelorMittal announced its intention to temporarily

reduce annualized European primary steelmaking production by 3Mt in the

2H 2019. These measures included temporarily idling production at its

steelmaking facilities in Kraków, Poland and reduce production in

Asturias, Spain as well as the slow down at ArcelorMittal Italia

following a decision to optimise cost and quality over volume in this

environment. Furthermore, on May 29, 2019, the Company announced

additional steps to adjust its European production levels to the current

market demand by a further 1.2Mt to take total annualized productions

cuts to 4.2Mt in 2H 2019. These include:

1. Reduce primary steelmaking production at its facilities in Dunkirk,

France and Eisenhüttenstadt, Germany;

2. Reduce primary steelmaking production at its facility in Bremen,

Germany in the fourth quarter of this year, where a planned blast

furnace stoppage for repair works will be extended;

3. Extend the stoppage planned in the fourth quarter of this year to

repair a blast furnace at its plant in Asturias, Spain.

ArcelorMittal stated that these actions were taken in light of difficult

operating conditions in Europe with a combination of weakening demand,

rising imports, high energy costs and rising carbon costs.

-- On May 29, 2019, ArcelorMittal published its first Climate Action report

in which it announced its ambition to significantly reduce CO2 emissions

globally and be carbon neutral in Europe by 2050. To achieve this goal

the Company is building a strategic roadmap linked to the evolution of

public policy and developments in low-emissions steelmaking technologies.

A target to 2030 will be launched in 2020, replacing the Company's

current target of an 8% carbon footprint reduction by 2020, against a

2007 baseline. The report explains in greater detail the future

challenges and opportunities for the steel industry, the plausible

technology pathways the Company is exploring as well as its views on the

policy environment required for the steel industry to succeed in meeting

the targets of the Paris Agreement.

-- In June 2017, ArcelorMittal signed an agreement for the lease (for a

period up to August 2023) and subsequent acquisition of Ilva's business

assets, providing for total maximum payments of EUR 1.8 billion. The

lease period started on November 1, 2018. According to the legal

framework in force at the time of signing and closing of the lease

agreement, Ilva's insolvency trustees, as well as the lessee and

purchaser of Ilva's assets, were granted protection from criminal

liability related to environmental, health and safety, and workplace

security issues at Ilva's Taranto plant, pending the timely

implementation of the EUR 1.15 billion environmental investment program

approved by the Italian Government in September 2017. In September 2017

and then August 2018 the Italian State Solicitor-General issued an

opinion confirming that the term of the protection coincided with the

term of the Company's environmental plan, namely to August 23, 2023. On

June 28, 2019, however, the Italian Parliament ratified a law decree

enacted by the Government, which has removed the protection for criminal

liability related to public health and safety, and workplace security

matters and, as from September 7, 2019, will also remove such protection

as it relates to environmental matters. ArcelorMittal considers that the

removal of this protection could impair any operator's ability to operate

the Taranto plant while implementing the environmental plan.

ArcelorMittal remains in discussions with the Italian authorities on this

matter, in view of reaching before September 7, 2019 an appropriate

solution compatible with the continued operation of the Taranto plant. No

assurance can be given at this stage as to the outcome of such

discussions.In addition, on July 9, 2019 the public prosecutor of Taranto

ordered the shutdown of blast furnace No. 2 of the Taranto plant. The

order was in the context of a procedure dating from a fatality in 2015,

as a result of which the blast furnace was put under seizure and

improvements were required to be undertaken by the Special Commissioners

as a condition to the continued operation of the blast furnace. The

timeline of the shutdown of blast furnace No. 2 remains to be determined

and will be set forth in a plan the judicial custodian appointed by the

public prosecutor of Taranto is currently preparing and whose

implementation would take 60 days. ArcelorMittal Italia is assessing

technical aspects and is working with the relevant authorities towards an

acceptable solution so that the blast furnace (which has an annual

production target of 1.5 million tonnes) may remain operational.

-- On July 1, 2019, ArcelorMittal announced the completion of the sale to

Liberty House Group ('Liberty') of several steelmaking assets that form

the divestment package the Company agreed with the European Commission

('EC') during its merger control investigation into the Company's

acquisition of Ilva S.p.A. The assets included in the divestment package

are: ArcelorMittal Ostrava (Czech Republic), ArcelorMittal Galati

(Romania), ArcelorMittal Skopje (Macedonia), ArcelorMittal Piombino

(Italy), ArcelorMittal Dudelange (Luxembourg) and several finishing lines

at ArcelorMittal Liège (Belgium). The total net consideration

(consisting of amounts payable upon closing and subsequently in part

contingent upon certain criteria, net of EUR 110 million placed in

escrow) for the assets payable to ArcelorMittal is EUR740 million subject

to customary closing adjustments. Of this total amount, EUR610 million

was received on June 28, 2019. The Company has deposited EUR110 million

in escrow to be used by Liberty for certain capital expenditure projects

to satisfy commitments given in the EC approval process.

-- On July 4, 2019, ArcelorMittal announced the completion of an issuance of

EUR250 million of its 2.250% notes due January 17, 2024 (the "Notes"),

which will be consolidated and form a single series with the existing

EUR750 million 2.250 per cent. notes due January 17, 2024, originally

issued on January 17, 2019. At the time of pricing the "tap" issuance,

the yield to maturity (representing the actual annual cost of the

issuance for ArcelorMittal) was 0.984%. The issuance closed on July 4,

2019. The Notes were issued under ArcelorMittal's EUR10 billion wholesale

Euro Medium Term Notes Programme. The proceeds of the issuance will be

used for general corporate purposes.

-- On July 4, 2019, the National Company Law Appellate Tribunal ("NCLAT") of

India disposed of the various appeals pending before it while approving

the Company's resolution plan for the acquisition of Essar Steel India

Limited ("ESIL"). Several appeals have been filed before India's Supreme

Court challenging the NCLAT's order and on July 22, 2019, India's Supreme

Court further stayed the implementation of the NCLAT's order pending a

hearing of the appeals on August 7, 2019. The transaction closing is now

expected 3Q 2019.

-- On July 11, 2019, ArcelorMittal completed the pricing of its offering of

US$750 million aggregate principal amount of its 3.600% notes due 2024

(the "Series 2024 Notes") and US$500 million aggregate principal amount

of its 4.250% notes due 2029 (the "Series 2029 Notes"). The proceeds to

ArcelorMittal (before expenses), amounting to approximately $1.2 billion,

will be used for general corporate purposes including future repayment of

existing indebtedness and to partially pre-fund commitments under the

Essar acquisition financing facility. The issuance closed on July 16,

2019.

-- On July 30, 2019, ArcelorMittal announced that it has given notice that

it will redeem all of the outstanding 5.125% Notes due June 1, 2020 and

5.250% Notes due August 5, 2020 on August 30, 2019. Following prior

tender offers, there is currently the following outstanding principal

amount of 5.125% Notes and 5.250% Notes, respectively: US$324,229,000

(original issuance of US$500,000,000) and US$625,630,000 (original

issuance of US$1,000,000,000).

Outlook and guidance

Based on year-to-date growth and the current economic outlook,

ArcelorMittal expects global apparent steel consumption ("ASC") to grow

further in 2019 by between +0.5% to +1.5% (slightly revised down from

previous expectation of +1.0% to +1.5% growth). By region:

ASC in US is expected to grow marginally by between +0.0% to +1.0% in

2019, with healthy non-residential construction demand offset by ongoing

weakness in automotive demand and a slowdown in machinery demand (a

moderation of growth versus +0.5% to +1.5% previous estimate). In Europe,

ASC is expected to contract by between -2.0% to -1.0% with ongoing

automotive demand weakness primarily due to lower exports (versus -1.0%

to 0.0% previous estimate). In Brazil, ASC growth in 2019 is forecasted

in the range of +1.5% to +2.5% (a moderation of growth versus +3.0% to

4.0% previous estimate) as domestic GDP has slowed, as well as impacts

of Argentinian recession and delayed growth in infrastructure spend

until pension reform is passed. In the CIS, expected ASC growth is

unchanged at +1.0% to +2.0% in 2019. Overall, World ex-China ASC is

expected to grow by approximately +0.5% to +1.0% in 2019 (a moderation

versus previous estimate of +1.0% to +2.0%).

In China, ASC growth forecast has increased to between +0.5% to +1.5% in

2019 (versus previous estimate of +0.0% to +1.0%) as real estate demand

remains resilient.

The Group's steel shipments are expected to increase in 2019 versus 2018

due to these demand expectations, the positive scope effect of the

ArcelorMittal Italia and Votorantim acquisition (net of the remedy

assets sales for the ArcelorMittal Italia acquisition now complete), the

expectation that 2018 operational disruptions (both controllable and

uncontrollable) will not recur, offset in part by European production

curtailments.

Market-priced iron ore shipments for FY 2019 are expected to be broadly

stable as compared to FY 2018 with increases in Liberia and AMMC to be

offset by lower volume in Mexico (in part due to the end of life of the

Volcan mine).

The Company expects certain cash needs of the business (including capex,

interest, cash taxes, pensions and certain other cash costs but

excluding working capital movements) to be approximately $5.4 billion in

2019 versus $6.4 billion previous guidance. Whilst no significant delays

to growth investments are expected, the Company has reduced overall

expected capex across all segments in FY 2019 by $0.5 billion and now

expects FY 2019 capex to be $3.8 billion (versus previous guidance of

$4.3 billion). Interest expense in 2019 is expected to be $0.65 billion

(no change) while cash taxes, pensions and other cash costs are now

expected to be $1.0 billion (versus previous guidance of $1.5 billion).

As announced with the full year 2018 results in February 2019, the $1

billion excess working capital accumulated in 2018 is expected to be

released in full over the course of 2019. Given the 1H 2019 working

capital investment of $0.2 billion this implies a release of $1.2

billion in 2H 2019.

The Company will continue to prioritize deleveraging and believes that

$7 billion (including impact of IFRS 16) is an appropriate net debt

target that will sustain investment grade metrics even at the low point

of the cycle.

ArcelorMittal intends to progressively increase the base dividend paid

to its shareholders, and, on attainment of the net debt target, the

Company is committed to returning a portion of annual FCF to

shareholders.

ArcelorMittal Condensed Consolidated Statement of Financial Position(1)

Jun 30, Mar 31, Dec 31,

In millions of U.S. dollars 2019 2019 2018

------------------------------------------------- ------- ------- ---------

ASSETS

Cash and cash equivalents 3,656 2,246 2,354

Trade accounts receivable and other 5,048 5,131 4,432

Inventories 20,550 20,583 20,744

Prepaid expenses and other current assets 3,123 3,000 2,834

Assets held for sale(9) 122 1,950 2,111

Total Current Assets 32,499 32,910 32,475

Goodwill and intangible assets 5,480 5,549 5,728

Property, plant and equipment 36,725 36,647 35,638

Investments in associates and joint ventures 5,026 5,000 4,906

Deferred tax assets 8,412 8,318 8,287

Other assets 4,224 4,236 4,215

Total Assets 92,366 92,660 91,249

LIABILITIES AND SHAREHOLDERS' EQUITY

Short-term debt and current portion of long-term

debt 3,107 2,739 3,167

Trade accounts payable and other 14,418 14,232 13,981

Accrued expenses and other current liabilities 5,549 5,699 5,486

Liabilities held for sale(9) 35 828 821

Total Current Liabilities 23,109 23,498 23,455

------- ------- -------

Long-term debt, net of current portion 10,723 10,591 9,316

Deferred tax liabilities 2,284 2,337 2,374

Other long-term liabilities 12,139 11,945 11,996

Total Liabilities 48,255 48,371 47,141

Equity attributable to the equity holders of

the parent 42,033 42,286 42,086

Non-controlling interests 2,078 2,003 2,022

Total Equity 44,111 44,289 44,108

Total Liabilities and Shareholders' Equity 92,366 92,660 91,249

------------------------------------------------- ------- ------- -------

ArcelorMittal Condensed Consolidated Statement of Operations(1)

Three months ended Six months ended

------------------------------------------

In millions of U.S. dollars unless Jun 30, Mar 31, Jun 30, Jun 30, Jun 30,

otherwise shown 2019 2019 2018 2019 2018

---------- ---------- ---------- ---------- ----------

Sales 19,279 19,188 19,998 38,467 39,184

Depreciation (B) (766) (733) (712) (1,499) (1,423)

Impairments (B) (947) (150) -- (1,097) (86)

Exceptional items(6) (B) -- -- -- -- (146)

------ ------ ------ ------ ------

Operating (loss) / income (A) (158) 769 2,361 611 3,930

Operating margin % (0.8)% 4.0% 11.8% 1.6% 10.0%

Income from associates, joint

ventures and other investments 94 208 30 302 242

Net interest expense (154) (161) (159) (315) (323)

Foreign exchange and other net

financing loss (173) (231) (390) (404) (564)

(Loss) / income before taxes

and non-controlling interests (391) 585 1,842 194 3,285

Current tax expense (225) (180) (240) (405) (524)

Deferred tax benefit 211 45 259 256 340

Income tax (expense) / benefit (14) (135) 19 (149) (184)

(Loss) / income including non-controlling

interests (405) 450 1,861 45 3,101

Non-controlling interests (income)

/ loss (42) (36) 4 (78) (44)

Net (loss) / income attributable

to equity holders of the parent (447) 414 1,865 (33) 3,057

Basic (loss) / earnings per common

share ($) (0.44) 0.41 1.84 (0.03) 3.01

Diluted (loss) / earnings per

common share ($) (0.44) 0.41 1.83 (0.03) 2.99

Weighted average common shares

outstanding (in millions) 1,014 1,014 1,013 1,013 1,016

Diluted weighted average common

shares outstanding (in millions) 1,014 1,017 1,018 1,013 1,021

OTHER INFORMATION

EBITDA (C = A-B) 1,555 1,652 3,073 3,207 5,585

EBITDA Margin % 8.1% 8.6% 15.4% 8.3% 14.3%

Own iron ore production (Mt) 14.6 14.1 14.5 28.7 29.1

------ ------ ------ ------ ------

Crude steel production (Mt) 23.8 24.1 23.2 47.8 46.5

------ ------ ------ ------ ------

Steel shipments (Mt) 22.8 21.8 21.8 44.6 43.1

------------------------------------------ ------ ------ ------ ------ ------

ArcelorMittal Condensed Consolidated Statement of Cash flows(1)

Three months ended Six months ended

Jun 30, Mar 31, Jun 30, Jun 30, Jun 30,

In millions of U.S. dollars 2019 2019 2018 2019 2018

-------------------------------------- ------- --------- ------- ---------- ---------

Operating activities:

(Loss)/income attributable to

equity holders of the parent (447) 414 1,865 (33) 3,057

Adjustments to reconcile net income

to net cash provided by operations:

Non-controlling interests income/

(loss) 42 36 (4) 78 44

Depreciation and impairments 1,713 883 712 2,596 1,509

Exceptional items(6) -- -- -- -- 146

Income from associates, joint

ventures and other investments (94) (208) (30) (302) (242)

Deferred tax benefit (211) (45) (259) (256) (340)

Change in working capital 353 (553) (1,232) (200) (3,101)

Other operating activities (net) 430 444 180 874 319

Net cash provided by operating

activities (A) 1,786 971 1,232 2,757 1,392

Investing activities:

Purchase of property, plant and

equipment and intangibles (B) (869) (947) (616) (1,816) (1,368)

Other investing activities (net) 305 254 60 559 136

Net cash used in investing activities (564) (693) (556) (1,257) (1,232)

Financing activities:

Net proceeds / (payments) relating

to payable to banks and long-term

debt 468 (136) 474 332 737

Dividends paid (204) (46) (101) (250) (151)

Share buyback -- (90) -- (90) (226)

Lease payments and other financing

activities (net) (84) (72) (21) (156) (41)

Net cash provided by / (used in)

financing activities 180 (344) 352 (164) 319

Net increase / (decrease) in cash

and cash equivalents 1,402 (66) 1,028 1,336 479

------ ----- ------ ------ ------

Cash and cash equivalents transferred

from/(to) assets held for sale 21 (11) (23) 10 (23)

------ ----- ------ ------ ------

Effect of exchange rate changes

on cash 17 (15) (104) 2 (87)

--------------------------------------

Change in cash and cash equivalents 1,440 (92) 901 1,348 369

Free cash flow (C=A+B) 917 24 616 941 24

-------------------------------------- ------ ----- ------ ------ ------

Appendix 1: Product shipments by region

(000'kt) 2Q 19 1Q 19 2Q 18 1H 19 1H 18

--------- ------ ------ ------ ------ --------

Flat 4,732 4,750 5,011 9,482 9,822

Long 873 721 969 1,594 1,890

NAFTA 5,438 5,319 5,803 10,757 11,362

Flat 1,563 1,699 1,494 3,262 2,894

Long 1,236 1,194 1,345 2,430 2,440

Brazil 2,785 2,880 2,831 5,665 5,314

Flat 8,824 8,647 7,553 17,471 15,257

Long 2,883 2,821 2,942 5,704 5,903

Europe 11,811 11,553 10,516 23,364 21,213

CIS 2,064 1,617 1,861 3,681 3,727

Africa 1,113 1,049 1,199 2,162 2,366

ACIS 3,182 2,662 3,057 5,844 6,086

--------- ------ ------ ------ ------ ------

Note: "Others and eliminations" are not presented in the table

Appendix 2a: Capital expenditures

(USDm) 2Q 19 1Q 19 2Q 18 1H 19 1H 18

------- ----- ----- ----- ----- -------

NAFTA 144 182 110 326 270

Brazil 80 84 36 164 83

Europe 337 353 226 690 539

ACIS 115 137 117 252 234

Mining 125 115 119 240 226

Total 869 947 616 1,816 1,368

------- ----- ----- ----- ----- -----

Note: "Others" are not presented in the table

Appendix 2b: Capital expenditure projects

The following tables summarize the Company's principal growth and

optimization projects involving significant capex.

Completed projects in most recent quarter

Segment Site / Project Capacity / details Actual

unit completion

NAFTA Indiana Indiana Harbor "footprint Restoration of 80" HSM and 4Q 2018

Harbor optimization project" upgrades at Indiana Harbor (a)

(US) finishing

------- ------- ------------------------- --------------------------- -----------

Ongoing projects

Segment Site / unit Project Capacity / details Forecasted

completion

------- --------------------- ------------------- --------------------------------- -----------

ACIS ArcelorMittal Kryvyi New LF&CC 2&3 Facilities upgrade to switch 2019

Rih (Ukraine) from ingot to continuous

caster route. Additional

billets of up to 290kt over

ingot route through yield

increase

Europe Sosnowiec (Poland) Modernization of Upgrade rolling technology 2019

Wire Rod Mill improving the mix of HAV

products and increase volume

by 90kt

NAFTA Mexico New Hot strip mill Production capacity of 2.5Mt/year 2020(b)

NAFTA ArcelorMittal Dofasco Hot Strip Mill Replace existing three end 2021(c)

(Canada) Modernization of life coilers with two

states of the art coilers

and new runout tables

NAFTA Burns Harbor (US) New Walking Beam Two new walking beam reheat 2021

Furnaces furnaces bringing benefits

on productivity, quality

and operational cost

Brazil ArcelorMittal Vega Expansion project Increase hot dipped / cold 2021(d)

Do Sul rolled coil capacity and

construction of a new 700kt

continuous annealing line

(CAL) and continuous galvanising

line (CGL) combiline

Brazil Juiz de Fora Melt shop expansion Increase in meltshop capacity On hold(e)

by 0.2Mt/year

Brazil Monlevade Sinter plant, blast Increase in liquid steel On hold(e)

furnace and melt capacity by 1.2Mt/year;

shop Sinter feed capacity of

2.3Mt/year

------- --------------------- ------------------- --------------------------------- -----------

Mining Liberia Phase 2 expansion Increase production capacity Under

project to 15Mt/year review(f)

1. In support of the Company's Action 2020 program, the footprint

optimization project at ArcelorMittal Indiana Harbor is now complete,

which has resulted in structural changes required to improve asset and

cost optimization. The plan involved idling redundant operations

including the #1 aluminize line, 84" hot strip mill (HSM), and #5

continuous galvanizing line (CGL) and No.2 steel shop (idled in 2Q 2017)

whilst making further planned investments totalling approximately $200

million including a new caster at No.3 steel shop (completed in 4Q 2016),

restoration of the 80" hot strip mill and Indiana Harbor finishing. The

full project scope was completed in 4Q 2018.

2. On September 28, 2017, ArcelorMittal announced a major US$1 billion,

three-year investment programme at its Mexican operations, which is

focussed on building ArcelorMittal Mexico's downstream capabilities,

sustaining the competitiveness of its mining operations and modernising

its existing asset base. The programme is designed to enable

ArcelorMittal Mexico to meet the anticipated increased demand

requirements from domestic customers, realise in full ArcelorMittal

Mexico's production capacity of 5.3 million tonnes and significantly

enhance the proportion of higher added-value products in its product mix,

in-line with the Company's Action 2020 plan. The main investment will be

the construction of a new hot strip mill. Upon completion, the project

will enable ArcelorMittal Mexico to produce c. 2.5 million tonnes of flat

rolled steel, long steel c. 1.8 million tonnes and the remainder made up

of semi-finished slabs. Coils from the new hot strip mill will be

supplied to domestic, non-auto, general industry customers. The project

commenced late 4Q 2017 and is expected to be completed in 2020. Deep

foundation essentially complete. Building erection ongoing. Working with

EPC consortium on productivity improvements.

3. Investment in ArcelorMittal Dofasco (Canada) to modernise the hot strip

mill. The project is to install two new state of the art coilers and

runout tables to replace three end of life coilers. The strip cooling

system will be upgraded and include innovative power cooling technology

to improve product capability. Engineering and equipment manufacturing is

complete. Construction activities for coiler are on track. Runout table

installation work originally scheduled for April 2019 will be effectively

carried out during April 2020 shut down due to change in design and delay

in manufacturing. The project is expected to be completed in 2021.

4. In August 2018, ArcelorMittal announced the resumption of the Vega Do Sul

expansion to provide an additional 700kt of cold-rolled annealed and

galvanised capacity to serve the growing domestic market. The three-year

$0.3 billion investment programme to increase rolling capacity with

construction of a new continuous annealing line and CGL combiline (and

the option to add a ca. 100kt organic coating line to serve construction

and appliance segments), and upon completion, will strengthen

ArcelorMittal's position in the fast growing automotive and industry

markets through Advanced High Strength Steel products. The investments

will look to facilitate a wide range of products and applications whilst

further optimizing current ArcelorMittal Vega facilities to maximize site

capacity and its competitiveness, considering comprehensive digital and

automation technology.

5. Although the Monlevade wire rod expansion project and Juiz de Fora rebar

expansion were completed in 2015, both projects are currently on hold and

are expected to be completed upon Brazil domestic market recovery.

6. ArcelorMittal had previously announced a Phase 2 project that envisaged

the construction of 15 million tonnes of concentrate sinter fines

capacity and associated infrastructure. The Phase 2 project was initially

delayed due to the declaration of force majeure by contractors in August

2014 due to the Ebola virus outbreak in West Africa, and then reassessed

following rapid iron ore price declines over the ensuing period.

ArcelorMittal Liberia is currently conducting detailed engineering

following the feasibility study in order to be ready to progress to the

next stage of the project. The investment case will be assessed in 2H

2019.

Appendix 3: Debt repayment schedule as of June 30, 2019

(USD billion) 2019 2020 2021 2022 2023 >=2024 Total

Bonds -- 1.8 1.3 1.5 0.6 3.3 8.5

Commercial paper 1.3 0.2 -- -- -- -- 1.5

Other loans 0.6 1.0 0.7 0.5 0.4 0.6 3.8

Total gross debt 1.9 3.0 2.0 2.0 1.0 3.9 13.8

----------------- ---- ---- ---- ---- ---- ------ -----

Appendix 4: Reconciliation of gross debt to net debt

Jun 30, Mar 31, Dec 31,

(USD million) 2019 2019 2018

------------------------------------------------ ------- ------- ---------

Gross debt (excluding that held as part of the

liabilities held for sale) 13,830 13,330 12,483

Gross debt held as part of the liabilities held

for sale -- 96 77

Gross debt 13,830 13,426 12,560

Less:

Cash and cash equivalents (3,656) (2,246) (2,354)

Cash and cash equivalents held as part of the

assets held for sale -- (21) (10)

------

Net debt (including that held as part of the

assets and the liabilities held for sale) 10,174 11,159 10,196

------------------------------------------------ ------

Net debt / LTM EBITDA -- -- 1.0

------ ------ ------

Appendix 5: Terms and definitions

Unless indicated otherwise, or the context otherwise requires,

references in this earnings release report to the following terms have

the meanings set out next to them below:

Apparent steel consumption: calculated as the sum of production plus

imports minus exports.

Average steel selling prices: calculated as steel sales divided by steel

shipments.

Cash and cash equivalents: represents cash and cash equivalents,

restricted cash and short-term investments.

Capex: represents the purchase of property, plant and equipment and

intangibles.

Crude steel production: steel in the first solid state after melting,

suitable for further processing or for sale.

EBITDA: operating income plus depreciation, impairment expenses and

exceptional income/ (charges).

EBITDA/tonne: calculated as EBITDA divided by total steel shipments.

Exceptional items (income / (charges)): relate to transactions that are

significant, infrequent or unusual and are not representative of the

normal course of business of the period.

Foreign exchange and other net financing (loss) / gain: include foreign

currency exchange impact, bank fees, interest on pensions, impairments

of financial assets, revaluation of derivative instruments and other

charges that cannot be directly linked to operating results.

Free cash flow (FCF): refers to net cash provided by operating

activities less capex.

Gross debt: long-term debt, plus short-term debt and IFRS 16 liabilities

impact (including that held as part of the liabilities held for sale).

Liquidity: cash and cash equivalents plus available credit lines

excluding back-up lines for the commercial paper program.

LTIF: lost time injury frequency rate equals lost time injuries per

1,000,000 worked hours, based on own personnel and contractors.

MT: refers to million metric tonnes

Market-priced tonnes: represent amounts of iron ore and coal from

ArcelorMittal mines that could be sold to third parties on the open

market. Market-priced tonnes that are not sold to third parties are

transferred from the Mining segment to the Company's steel producing

segments and reported at the prevailing market price. Shipments of raw

materials that do not constitute market-priced tonnes are transferred

internally and reported on a cost-plus basis.

Mining segment sales: i) "External sales": mined product sold to third

parties at market price; ii) "Market-priced tonnes": internal sales of

mined product to ArcelorMittal facilities and reported at prevailing

market prices; iii) "Cost-plus tonnes" - internal sales of mined product

to ArcelorMittal facilities on a cost-plus basis. The determinant of

whether internal sales are reported at market price or cost-plus is

whether the raw material could practically be sold to third parties

(i.e. there is a potential market for the product and logistics exist to

access that market).

Net debt: long-term debt, plus short-term debt and IFRS 16 liabilities

impact less cash and cash equivalents (including those held as part of

assets and liabilities held for sale).

Net debt/LTM EBITDA: refers to Net debt divided by last twelve months

(LTM) EBITDA calculation.

Net interest expense: includes interest expense less interest income

On-going projects: refer to projects for which construction has begun

(excluding various projects that are under development), even if such

projects have been placed on hold pending improved operating conditions.

Operating results: refers to operating income/(loss).

Operating segments: NAFTA segment includes the Flat, Long and Tubular

operations of USA, Canada and Mexico. The Brazil segment includes the

Flat, Long and Tubular operations of Brazil and its neighbouring

countries including Argentina, Costa Rica and Venezuela. The Europe

segment comprises the Flat, Long and Tubular operations of the European

business, as well as Downstream Solutions. The ACIS segment includes the

Flat, Long and Tubular operations of Kazakhstan, Ukraine and South

Africa. Mining segment includes iron ore and coal operations.

Own iron ore production: includes total of all finished production of

fines, concentrate, pellets and lumps and includes share of production.

PMI: refers to purchasing managers index (based on ArcelorMittal

estimates)

Seaborne iron ore reference prices: refers to iron ore prices for 62% Fe

CFR China

Shipments: information at segment and group level eliminates

intra-segment shipments (which are primarily between Flat/Long plants

and Tubular plants) and inter-segment shipments respectively. Shipments

of Downstream Solutions are excluded.

Steel-only EBITDA: calculated as Group EBITDA less Mining segment

EBITDA.

Steel-only EBITDA/tonne: calculated as steel-only EBITDA divided by

total steel shipments.

Working capital change (working capital investment / release): Movement

of change in working capital - trade accounts receivable plus

inventories less trade and other accounts payable.

YoY: refers to year-on-year.

Footnotes

1. The financial information in this press release has been prepared

consistently with International Financial Reporting Standards ("IFRS")

as issued by the International Accounting Standards Board ("IASB") and

as adopted by the European Union. The interim financial information

included in this announcement has also been also prepared in accordance

with IFRS applicable to interim periods, however this announcement does

not contain sufficient information to constitute an interim financial

report as defined in International Accounting Standard 34, "Interim

Financial Reporting". The numbers in this press release have not been

audited. The financial information and certain other information

presented in a number of tables in this press release have been rounded

to the nearest whole number or the nearest decimal. Therefore, the sum

of the numbers in a column may not conform exactly to the total figure

given for that column. In addition, certain percentages presented in the

tables in this press release reflect calculations based upon the

underlying information prior to rounding and, accordingly, may not

conform exactly to the percentages that would be derived if the relevant

calculations were based upon the rounded numbers. This press release

also includes certain non-GAAP financial/alternative performance

measures. ArcelorMittal presents EBITDA, and EBITDA/tonne, which are

non-GAAP financial/alternative performance measures and calculated as

shown in the Condensed Consolidated Statement of Operations, as

additional measures to enhance the understanding of operating

performance. ArcelorMittal believes such indicators are relevant to

describe trends relating to cash generating activity and provides

management and investors with additional information for comparison of

the Company's operating results to the operating results of other

companies. ArcelorMittal also presents net debt and change in working

capital as additional measures to enhance the understanding of its

financial position, changes to its capital structure and its credit

assessment. ArcelorMittal also presents free cash flow (FCF), which is a

non-GAAP financial/alternative performance measure calculated as shown

in the Condensed Consolidated Statement of Cash flows, because it

believes it is a useful supplemental measure for evaluating the strength

of its cash generating capacity. The Company also presents the ratio of

net debt to EBITDA for the twelve months ended December 31, 2018, which

investors may find useful in understanding the company's ability to

service its debt. Non-GAAP financial/alternative performance measures

should be read in conjunction with, and not as an alternative for,

ArcelorMittal's financial information prepared in accordance with IFRS.

Such non-GAAP/alternative performance measures may not be comparable to

similarly titled measures applied by other companies.

2. Health and safety performance inclusive of ArcelorMittal Italia

and related facilities ("ArcelorMittal Italia") (consolidated as from

November 1, 2018) was 1.26x for 2Q 2019 and 1.14x for 1Q 2019. Health

and safety figures excluding ArcelorMittal Italia were 0.68x for 2Q 2019

as compared to 0.66x for 1Q 2019. From 1Q 2019 onwards, the methodology

and metrics used to calculate health and safety figures for

ArcelorMittal Italia have been harmonized with those of ArcelorMittal.

3. Management performed its quarterly analysis of impairment

indicators, and a downward revision of cash flow projections for

ArcelorMittal USA resulted from the weaker than anticipated operating

environment in the US, including lower than expected steel prices, lower

ASC and high raw material costs. Impairment charges for 2Q 2019 were

$947 million related to the remedy asset sales for the ArcelorMittal

Italia acquisition ($347 million) and impairment of the fixed assets of

ArcelorMittal USA ($600 million) following a sharp decline in steel

prices and high raw material costs. Impairment charges for 1H 2019 were

$1.1 billion related to the remedy asset sales for the ArcelorMittal

Italia acquisition ($0.5 billion) and impairment of the fixed assets of

ArcelorMittal USA ($0.6 billion) following a sharp decline in steel

prices and high raw material costs.

4. ArcelorMittal has applied IFRS 16 Leases as of January 1, 2019.

Due to the transition option selected, the prior-period data has not

been restated. IFRS 16 Leases provides a single lessee accounting model

requiring lessees to recognize right-of-use assets and lease liabilities

for all non-cancellable leases except for short-term leases and low

value assets. The right-of-use assets are recognized as property, plant

and equipment and measured on January 1, 2019 at an amount equal to the

lease liability recognized as debt (short term $0.3 billion and long

term $0.9 billion impact as of January 1, 2019) and measured on the

basis of the net present value of remaining lease payments. On January

1, 2019 net debt increased accordingly by $1.2 billion following the

adoption of IFRS 16 lease standard. The recognition of the lease expense

in EBITDA for leases previously accounted for as operating leases is

replaced by a depreciation expense related to the right-of-use assets

and an interest expense reflecting the amortization of the lease

liability. In addition, cash payments relating to the repayment of the

principal amount of the lease liability are presented in the

consolidated statements of cash flows as outflows from financing

activities while lease payments for operating leases were previously

recognized as outflows from operating activities.

5. On April 20, 2018, following the approval by the Brazilian

antitrust authority - CADE of the combination of ArcelorMittal Brasil's

and Votorantim's long steel businesses in Brazil subject to the

fulfilment of divestment commitments, ArcelorMittal Brasil agreed to

dispose of its two production sites of Cariacica and Itaúna, as

well as some wire drawing equipment of ArcelorMittal Brasil and

ArcelorMittal Sul-Fluminense. The sale was completed early May 2018 to

the Mexican Group Simec S.A.B. de CV. A second package of some wire

drawing equipment of ArcelorMittal Brasil and ArcelorMittal

Sul-Fluminense was sold to the company Aço Verde do Brasil as part

of CADE's conditional approval.

6. In July 2018, as a result of a settlement process, the Company

and the German Federal Cartel Office agreed to a EUR118 million ($146

million) fine to be paid by ArcelorMittal Commercial Long Deutschland

GmbH ending an investigation that began in the first half of 2016 into

antitrust violations concerning the ArcelorMittal entities that were

under investigation. The payment was made in August 2018.

7. ArcelorMittal Mines Canada, otherwise known as ArcelorMittal

Mines and Infrastructure Canada.

8. On December 19, 2018, ArcelorMittal signed a $5,500,000,000

Revolving Credit Facility, with a five-year maturity plus two one-year

extension options (i.e. the options to extend are in the first and

second years, so at end 2019 and at end 2020). The facility replaced the

$5,500,000,000 revolving credit facility agreement signed April 30, 2015

and amended December 21, 2016 and will be used for the general corporate

purposes of the ArcelorMittal group. The facility gives ArcelorMittal

considerably improved terms over the former facility, and extends the

average maturity date by approximately three years. As of June 30, 2019,

the $5.5 billion revolving credit facility was fully available.

9. Assets and liabilities held for sale, as of June 30, 2019 are

related to the carrying value of the USA long product facilities at

Steelton ("Steelton"). Assets and liabilities held for sale, as of March

31, 2019 and December 31, 2018, include the ArcelorMittal Italia remedy

package assets (as previously disclosed in the 1Q 2018 earnings release),

and the USA long product facilities at Steelton.

Second quarter 2019 earnings analyst conference call

ArcelorMittal will hold a conference call hosted by Mr. Lakshmi Mittal,

Chairman and CEO and Aditya Mittal, President and CFO to discuss the

three month and six-month period ended June 30, 2019 on: Thursday August

1, 2019 at 9.30am US Eastern time; 14.30pm London time and 15.30pm CET.

The dial in numbers are:

Toll free dial in Local dial in

Location numbers numbers Participant

UK local: 0800 0515 931 +44 (0)203 364 5807 81958122#

US local: 1 86 6719 2729 +1 24 0645 0345 81958122#

-----------------

France: 0800 914780 +33 1 7071 2916 81958122#

Germany: 0800 965 6288 +49 692 7134 0801 81958122#

Spain: 90 099 4930 +34 911 143436 81958122#

Luxembourg: 800 26908 +352 27 86 05 07 81958122#

------------------ ---------------------

A replay of the conference call will be available for one week by dialling:

+49 (0) 1805 2047 088; Access code 2524123#

Forward-Looking Statements

This document may contain forward-looking information and statements

about ArcelorMittal and its subsidiaries. These statements include

financial projections and estimates and their underlying assumptions,

statements regarding plans, objectives and expectations with respect to

future operations, products and services, and statements regarding

future performance. Forward-looking statements may be identified by the

words "believe", "expect", "anticipate", "target" or similar

expressions. Although ArcelorMittal's management believes that the

expectations reflected in such forward-looking statements are reasonable,

investors and holders of ArcelorMittal's securities are cautioned that