Ray-Ban Maker EssilorLuxottica Strikes $6.1 Billion Deal for European Rival

July 31 2019 - 11:13AM

Dow Jones News

By Ben Dummett

EssilorLuxottica SA agreed Wednesday to buy control of European

rival GrandVision NV for about EUR5.49 billion ($6.1 billion), in a

move that would further cement the Ray-Ban maker's global position

as the leading manufacturer and retailer of eyewear and lenses.

The deal comes after EssilorLuxottica disclosed earlier in July

its talks to acquire the almost 77% stake from HAL Holding NV, a

holding company. EssilorLuxottica said that after completing the

HAL transaction it would seek to buy out the rest of GrandVision,

which could ultimately value the Dutch company at more than EUR7.15

billion.

EssilorLuxottica, based in Paris, was created last year from the

EUR46.3 billion merger between Italian sunglasses maker Luxottica

and French lens manufacturer Essilor. That tie-up allowed the two

companies to access each other's markets of frames and lenses

without competing.

It didn't, however, address the competitive shortcomings of the

combined company's network of stores that offer optical services

and products ranging from eye testing to contact lenses. An

acquisition of GrandVision, a big optical retailer, is meant to

help fill that gap.

EssilorLuxottica operates more than 9,000 stores, with a large

presence in North America through brands like LenCrafters and

Pearle Vision, as well as in parts of Asia and Latin America.

However, with the exception of Italy, the company's retail network

in Europe is relatively small.

The acquisition of Grandvision would give EssilorLuxottica

access to about 5,300 stores across Europe that the Dutch company

operates as part of a global network of more than 7,200 outlets.

GrandVision oversees 30 retail banners including Vision Express in

the U.K. and Apollo in Germany.

GrandVision, meanwhile, could benefit from accessing

EssilorLuxottica's bigger retail network in the U.S. to reach a

broader customer base. The greater scale would also allow the

companies to pool their e-commerce offerings as they seek to

address growing consumer demand to shop online.

In European trading, GrandVision's stock was up 5.2% at EUR26.68

following news of the deal.

The acquisition is dependent on meeting various conditions

including antitrust clearance. EssilorLuxottica agreed to increase

its per-share offering by 1.5% to EUR28.42 from the current offer

of EUR28 if the deal with HAL doesn't close within 12 months. That

increase is recognition of the strong retail presence

EssilorLuxottica and GrandVision have in different countries and

the greater time regulators are taking to review transactions.

The deal comes at a tricky time for EssilorLuxottica, which

could raise questions among investors. The company is searching for

a new chief executive and is still integrating operations to wring

out the promised cost savings from the merger of Essilor and

Luxottica. In addition, analysts have questioned the fit between

GrandVision and EssilorLuxottica, as the latter has had a greater

focus on offering premium products.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

July 31, 2019 10:58 ET (14:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

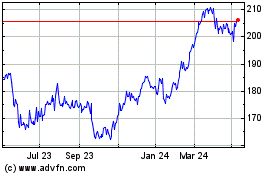

Essilorluxottica (EU:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

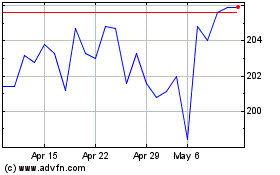

Essilorluxottica (EU:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024