Euro Lower As ECB Stimulus Hopes Rise After Soft Eurozone Data

July 31 2019 - 2:49AM

RTTF2

The euro came under pressure against its major counterparts in

the European session on Wednesday, as a slowdown in Euro zone

economic growth in the second quarter and inflation in July

intensified hopes that the European Central Bank will announce

stimulus measures in September.

Flash estimate from Eurostat showed that the euro area economy

expanded at a slower pace as expected in the second quarter.

Gross domestic product grew 0.2 percent sequentially, following

the first quarter's 0.4 percent expansion. The rate came in line

with expectations.

On a yearly basis, economic growth eased to 1.1 percent from 1.2

percent. Nonetheless, the rate of growth exceeded the expected 1

percent.

Separate data showed that Eurozone consumer price inflation

slowed in July, after rising in the previous month.

Headline inflation eased to 1.1 percent from 1.3 percent in

June. The slowing was in line with economists' expectations.

Core inflation, which strips out the volatile energy, food,

alcohol & tobacco prices, slowed to 0.9 percent from 1.1

percent. Economists had forecast 1 percent.

Another report showed that the unemployment rate reached its

lowest level in almost 11 years in June.

The jobless rate dropped to 7.5 percent in June, as expected,

from 7.6 percent in May. This was the lowest since July 2008.

Unemployment decreased by 45,000 from May to 12.377 million in

June.

European stocks were mixed as investors digested mixed earnings

and looked ahead to the latest monetary policy decision from the

Federal Reserve for clues on the policy path. It will be up to

Chair Powell to steer market expectations for more rate cuts via

the press conference.

The currency was trading mixed against its major counterparts in

the Asian session. While it held steady against the greenback and

the pound, it fell against the yen. Against the franc, it

advanced.

The euro was trading at 1.1144 against the greenback, down from

a 6-day high of 1.1162 hit at 2:15 am ET. The pair had closed

Tuesday's deals at 1.1155. The currency is likely to find support

around the 1.09 level.

The European currency ticked down to 120.98 against the yen from

yesterday's closing value of 121.12. The euro is seen finding

support around the 118.00 level.

Data from the Cabinet Office showed that Japan's consumer

confidence weakened to the lowest level in five-and-a-half years in

June.

The consumer confidence index for households with two or more

persons fell to a seasonally adjusted 37.8 in July from 38.7 in

June. Economists had expected a score of 38.5.

After a 5-day rise to 1.1062 against the Swiss franc at 1:30 am

ET, the euro pulled back to 1.1040. On the downside, 1.07 is

possibly seen as the next support level for the euro.

The euro edged down to 0.9157 against the pound, following an

advance to 0.9181 at 5:30 pm ET. If the euro declines further, it

may find support around the 0.885 level.

Data from the Nationwide Building Society showed that UK house

prices increased for the second straight month in July.

House prices grew 0.3 percent month-on-month, faster than the

0.1 percent rise in June and the expected 0.2 percent increase.

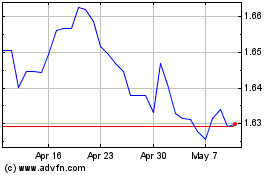

The euro fell to 1.6852 against the kiwi and 1.6161 against the

aussie, from its early near a 3-week high of 1.6930 and more than a

4-week high of 1.6248, respectively. The next possible support

levels for the euro are seen around 1.66 against the kiwi and 1.59

against the aussie.

On the flip side, the euro held steady against the loonie, after

having declined to a 2-day low of 1.4648 at 9:15 pm ET. At

yesterday's close, the pair was worth 1.4669.

Looking ahead, U.S. ADP private payrolls data for July will be

published at 8:15 am ET.

In the New York session, Canada GDP data for May and industrial

product price index for June will be out.

At 2:00 pm ET, the Federal Reserve's interest rate decision is

slated for release. Economists widely expect the central bank to

cut rates to 2.00 percent - 2.25 percent.

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024