Renault Sputters as Auto-Alliance Partner Nissan Stalls Out -- WSJ

July 27 2019 - 3:02AM

Dow Jones News

By Nick Kostov

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 27, 2019).

PARIS -- Renault SA cut its revenue target and posted sharply

lower first-half earnings, saying it was "heavily penalized" by the

declining fortunes of alliance partner Nissan Motor Co.

The French auto maker reported a day after Nissan disclosed a

plunge in profitability and said it would cut 9% of its global

workforce. Renault owns 43.4% of Nissan, while Nissan owns 15% of

Renault as part of an auto-making alliance stretching back two

decades.

The two partners have clashed publicly in recent months after

long-simmering tensions between them exploded. The trigger was the

arrest of Carlos Ghosn, the man who forged the alliance and served

as chairman of both companies before his detention in Japan last

year.

The financial strain at Nissan has only heightened that tension

as Renault relies heavily on its Japanese partner to pad its bottom

line. Last year, Nissan's contributed EUR1.51 billion, or more than

40% of Renault's profit, following a EUR2.79 billion contribution

in 2017.

Renault management, which has sought to bring the two partners

closer together, believes Nissan's struggles support the argument

for tighter bonds, according to people familiar with their

thinking. Nissan executives, meanwhile, have resisted the idea,

saying the talk of integration is an unhelpful distraction from

their turnaround efforts.

"We are really making sure that we are going to support, help,

make everything possible to make it such that Nissan gets back on

track. This is our priority," Thierry Bolloré, Renault's chief

executive, said Friday.

In May, Renault management pushed for a merger with Fiat

Chrysler Automobiles NV as a way to add bulk to tackle the myriad

challenges facing the auto industry. The deal ultimately fell apart

after Renault failed to get full backing from the French state and

Nissan.

Renault and Fiat executives have said they would like to

reengage in talks at some point, but Mr. Bolloré acknowledged that

the deal is dead for now. "We have no talks any longer with FCA,"

Mr. Bolloré said. "That's a pity because the fundamentals of the

quality of the deal for us are still totally vivid."

Renault has struggled to steady itself after a chaotic period

that included the arrest of Mr. Ghosn. The former Renault CEO has

been charged with financial misconduct in Japan, allegations he

denies and intends to fight in court.

Like other auto makers, Renault is grappling with a slowdown in

sales and an increase in investment to develop electric and

self-driving cars. European regulators are establishing some of the

strictest emissions regimes in the world and, combined with high

labor costs, that is pressuring the bottom line of regional auto

makers.

The French car maker said its net profit fell to EUR970 million

in the six months to the end of June, from EUR1.95 billion the same

period last year. Nissan's contribution swung to a EUR21 million

loss from a EUR805 million profit.

Renault's revenue fell 6.4% to EUR28.05 billion, hit by falling

sales in France, Turkey and Argentina as well as the decline in

demand for diesel engines in Europe and the closure of the Iranian

market.

The company cut its 2019 revenue outlook and now expects sales

to be close to last year's.

Renault's operating income -- a closely watched figure used by

analysts to judge underlying performance -- dropped 12% to EUR1.52

billion.

The company backed its guidance for an operating margin of about

6% and positive operational free cash flow in its core auto

business.

The car maker said Friday that it expects the global auto market

to contract by 3% in 2019, with the European market holding steady

as long as the U.K. doesn't leave the European Union without a

deal. The Russian market is expected to fall by as much as 3%,

while Brazil's could grow by 8%.

-- Max Bernhard in Barcelona contributed to this article.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

July 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

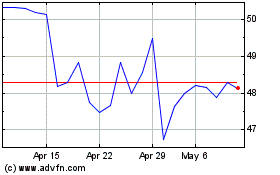

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

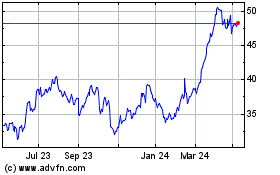

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024